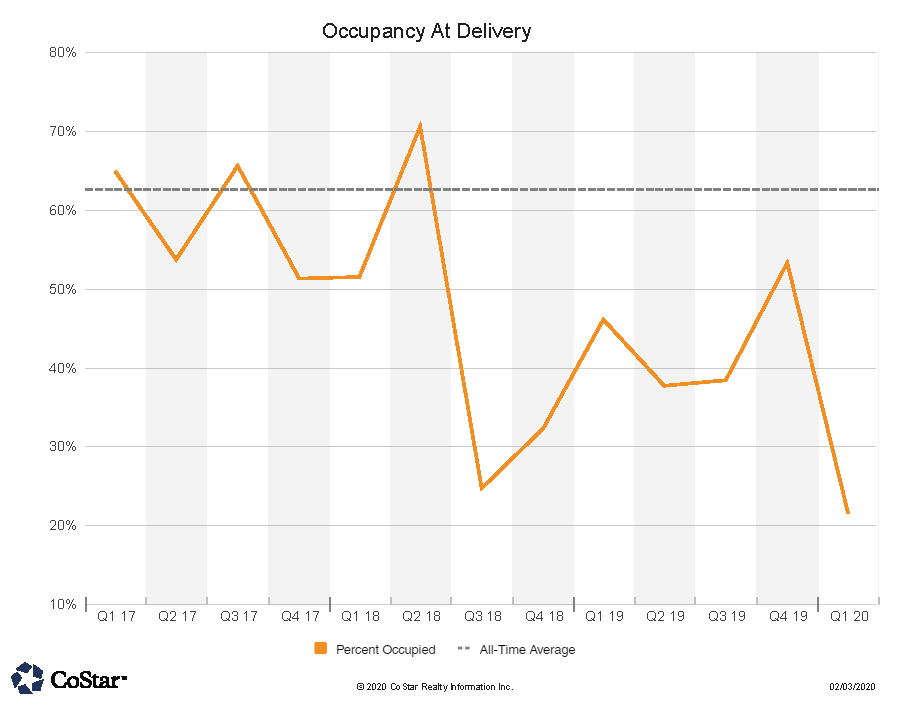

More Speculative Building Occurring?

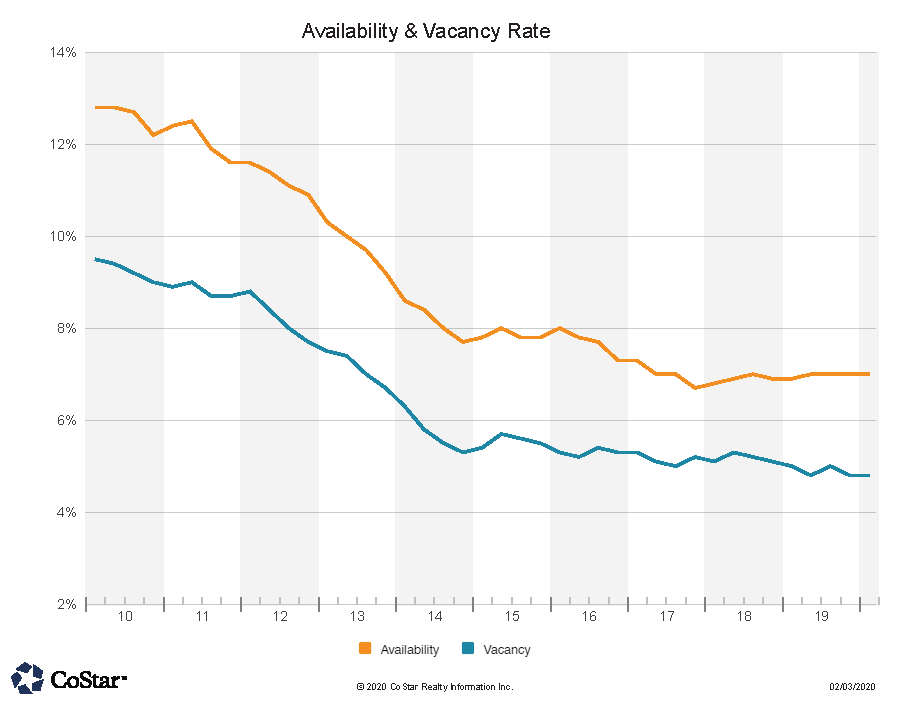

Availability Compared to Vacancy

Another industrial lease was signed on Diamond Valley Pkwy. in Windsor, where 22,000 SF leased at a reported $10.00 PSF plus triple net expenses (taxes, insurance and building maintenance). Local wind-energy giant Vestas was the tenant signing on. Reflecting the strong home construction market, Shake & Shingle Supply signed on for 12,000 SF on Air Park Dr. in Fort Collins. Rate was reported to be $10.50 PSF plus NNN’s.

On the sales front, a capital investment group out of Palm Beach FL purchased the Governer’s Park apartment complex in Fort Collins for $68 million. The 291 unit complex had some kitchen updates recently, and sold for approx. $240,000 per unit. A Beverly Hills CA seller held the property for 12 years prior to the sale.

An apartment portfolio of 98 units surrounding UNC in Greeley, sold for $10.6 million. These properties were sold as a value-add opportunity and were said to be renting significantly below market. Purchaser is from Aurora CO. On the tail of the aforementioned deal, a 32 unit Boulder complex sold for $10.5 million or about $300,000 per unit. This property on Walnut, in the Whittier neighborhood, was purchased by Clarion Partners out of New York, who have been active in acquiring Boulder properties as of recent.

The Rangeview One office building in Centerra, Loveland CO, sold for $14.6 million to a group out of Eugene Oregon. Developer McWhinney corporation is the primary tenant in the building and is joined by several others, including MLS provider IRES. The 54,000 SF building sold for $269 PSF to the investors.

A 20,000 SF flex property at The Campus at Longmont, sold for $7.4 million to a local investment entity. The four tenant property sold for $370 PSF, and had approximately 5,000 SF of vacancy at time of sale. The price per square foot set a high mark for flex properties in the region.

On the retail front, a relatively new multi-tenant retail center on McCaslin Blvd. in Superior CO, sold for $6 million or just over $800 PSF. Tenants include Starbucks, and Firehouse Subs. A group out of Englewood CO bought the property from Scottsdale AZ developers of the property.

For the first time in a while, we are seeing evidence of speculative building by measuring occupancy at time of new building delivery (see chart herein). This phenomenon is a sign of developer confidence in NoCO CRE.