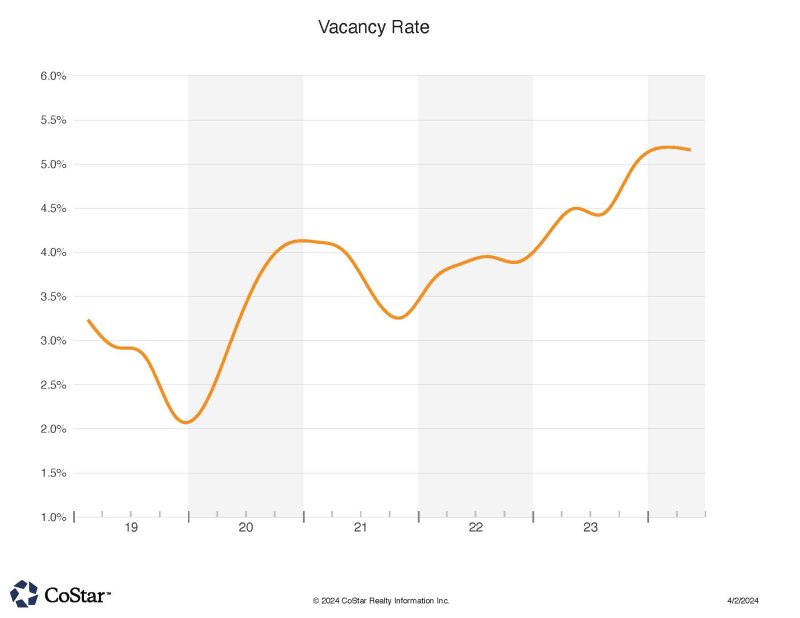

Tri county industrial vacancy

Trending up, but still only about 5%

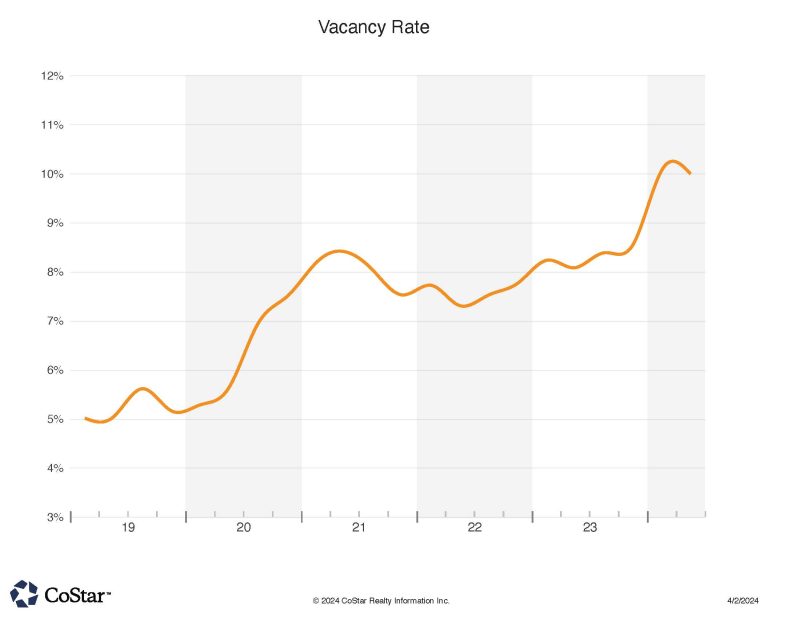

Tri county office vacancy

Trending up, and at twice the vacancy rate of the industrial sector

Healthcare related real estate is one of the more stable and higher demand CRE investment property types. NoCO featured a few larger sales which demonstrate this demand. In #NoCOCRE March 2024 transactions, the Post Acute Medical building on 10th St. in Greeley sold for $36.3 million, or just over $700 per square foot. Buyer was an investor who owns other properties with this same tenant across the United States, (MedProperties Realty Advisers out of Dallas TX). This is a 51,500 SF inpatient rehabilitation center. In the healthcare industry, another property sold for $9.85 million. In this case Mental Health Center of Boulder County bought the former Flatirons Health Rehabilitation Center in Louisville. The property sale calculates to approximately $230 PSF, and will be occupied by the new Buyer. The third major health-care type property that sold in March was the Legacy at Lafayette, an assisted living facility. This sale was for $7.6 million to a buyer headquartered in Pasadena CA. The Seller had acquired the property ten years ago for $7.4 million. Price per square foot was about $150 PSF.

The second highest sale amount in March was the $13.1 million transaction of the former Louisville CO Lowe’s home improvement center to a group which is converting the 134,000 SF facility into a R&D/Bio-science property. Buyer is a consortium, including Ventria out of Dallas, Koelbel out of Denver, and DRA out of New York. The facility conversion will try to attract tenants in the growing life-sciences industries in the Boulder area.

Standard Commercial out of Honolulu Hawaii purchased a 56,000 SF warehouse in Mead CO for $7.65 million or about $135 PSF. The property was fully occupied at time of sale, and was bought for investment by the Buyer. This property is near I-25 and Highway 66, and was sold for $4.3 million in 2022 to the current seller, related to local developer Schuman Companies.

An office building in the Niwot/Gunbarrel area sold for $7.6 million or about $200 PSF. In this trade, the buyer is actually the Mountain View Fire Protection District. Seller is a Boulder developer (Chrisman properties) who owned the property for 25 years.

The old Windsor Mill property in Windsor CO sold to a local investor for $5.7 million, at a reported 7.11% cap rate. The renovated historic property is occupied by several retail, food and beverage, and office tenants. The sale price calculates to about $235 PSF.

A couple restaurant building investment sales were of note last month. The Red Robin Gourmet Burgers store in Greeley’s centerplace development sold for $3.5 million to a New Jersey investment group which arranged a portfolio sale-leaseback with Red Robin on 10 stores, including Greeley, across the United States. Terms of the leaseback include a 15 year base term by the restaurant chain. Buyer is a public REIT, and is working with Red Robin on a 35 store deal extending over three tranches of transactions representing over $50 million in value back to the restaurant group from their real estate holdings. A two-tenant retail property, this one with Voodoo Donuts and Taco Bell, in Boulder, sold for $3.2 million. The transaction calculates to $1068 PSF, and was reported to yield a 5.5% cap rate for the buyer out of Huntington Beach CA. Seller is out of Denver CO.

A Loveland-based private investor bought a Fort Collins bank building which will be partially occupied by Blue Federal Credit Union for $2.25 million, or about $150 PSF. The credit union will occupy about 5,000 SF of the 14,000 SF office building going forward. Seller was the credit union, which is headquartered in Cheyenne WY.

In all, the tri-county region saw 49 sales during March, which is showing slightly more activity than the previous few months.