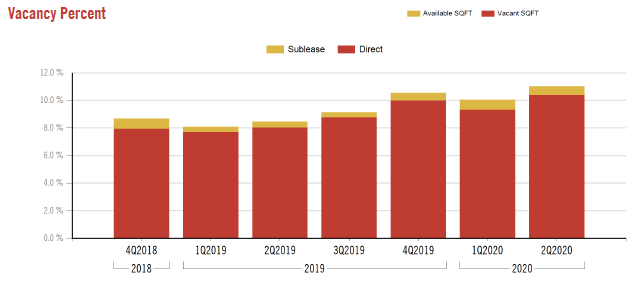

Boulder Office Vacancy

Boulder has managed to remain relatively stable in office vacancy and sublet space.

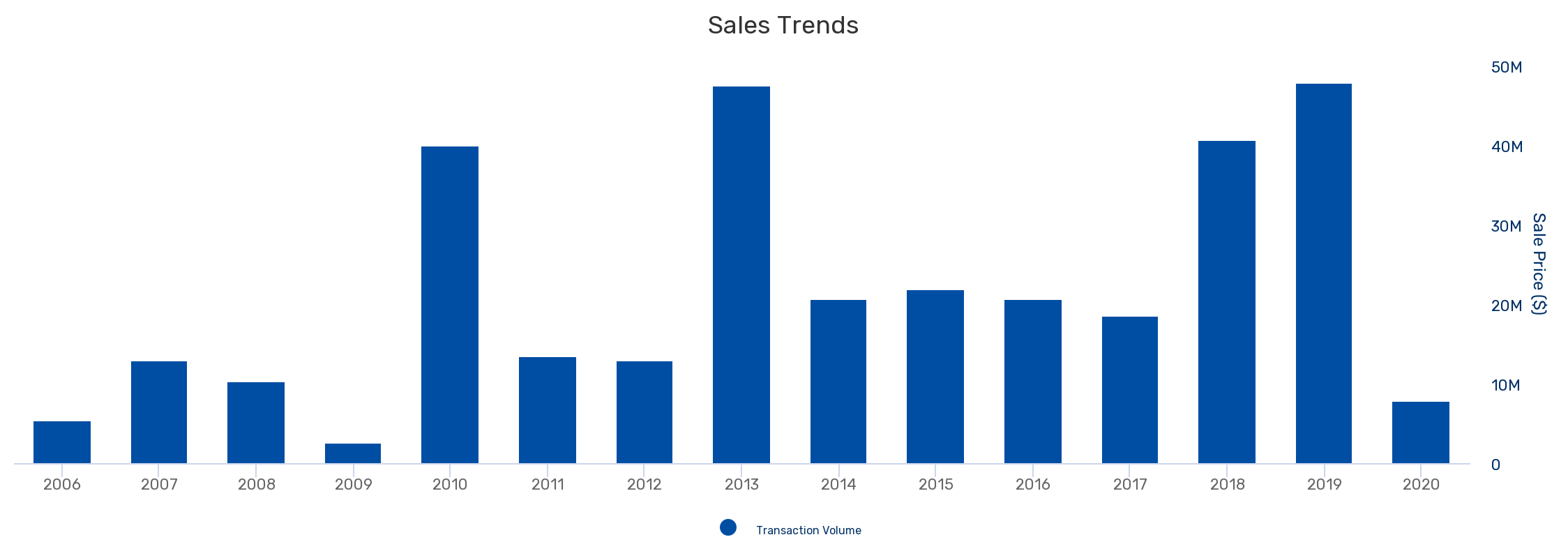

Fort Collins Office Sales

Fort Collins office sales have greatly slowed this year. The office market future demand structure has been in question during Covid era.

Perhaps NoCO CRE buyers hit the pause button again, as closings were atonly a quarter of pre-Covid velocity. Boulder, Larimer, and Weld counties did see some more diverse deals however. This was highlighted by the sale of a central Fort Collins cinema/theater building on Worthington St., which sold for $1.7 million, or about $95 PSF to a Longmont group. This will likely be re-purposed, as the price per square foot is below replacement cost. Theaters have been one of the casualties of the Covid era.

An investor bought a single tenant net leased industrial property in Greeley. Archrock, a large oil and gas service company with 1700 employees nationwide, had recently signed a 10 year lease at the site. The investor was likely drawn to the higher cap rate, in excess of 8%, based on the income generated by that lease. Sales price was $2.3 million, or $240 PSF. The property featured a large service yard, which is attractive to industrial tenants in the energy sector.

ENT Credit Union purchased the former Guadalajara restaurant building in Windsor. The $1,290,000 purchase amounted to about $300 PSF for the Main St. property. The property had been slated to become an urgent care center, but when that fell through, it was placed back on market. ENT will re-purpose the building to serve it’s financial services business offering.

A 20,000 SF self storage facility in Ault CO sold to a Wellington CO buyer for $1,025,000. The price calculated to just around $50 PSF, which is also below replacement cost. Ault has been growing with new residential areas, and demand for self storage usually follows residential growth patterns.

Leasing activity did pick up in the NoCO CRE region over past months of doldrums. 82 spaces were leased, which is similar to pre-Covid activity levels.

On the office side, 1401 Walnut in Boulder’s central business district featured three suites under lease during the month. Though the largest lease of office was also in Boulder for 14,000 SF at 1715 38th, most leasing activity for this property type has been small (under 2,500 SF). Smaller tenants have been much more active than larger tenants.

Similarly, the retail sector had reasonable activity, though most all for smaller space. 615 Briggs in downtown Erie CO featured the signing of 4 such retail tenants.

27 industrial leases were recorded in July. Of these, the largest were 113,000 SF in the Louisville corporate campus, and 57,000 SF on Spine road in the Boulder Gunbarrel district. Industrial developers and landlords have been able to maintain near-normal activity levels through the Covid era as many of their tenants are in essential industries less likely to have immediate slowdowns due to the current situation.