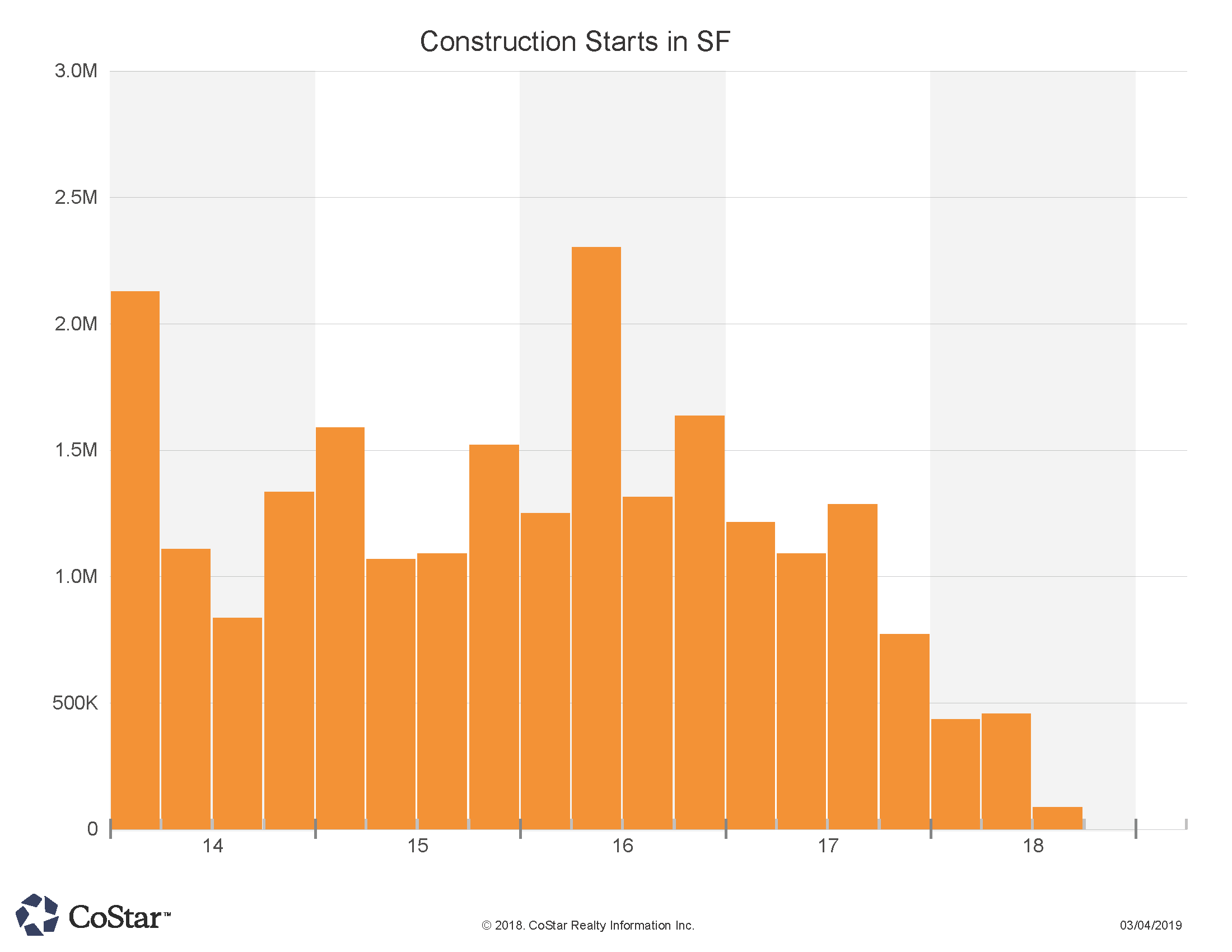

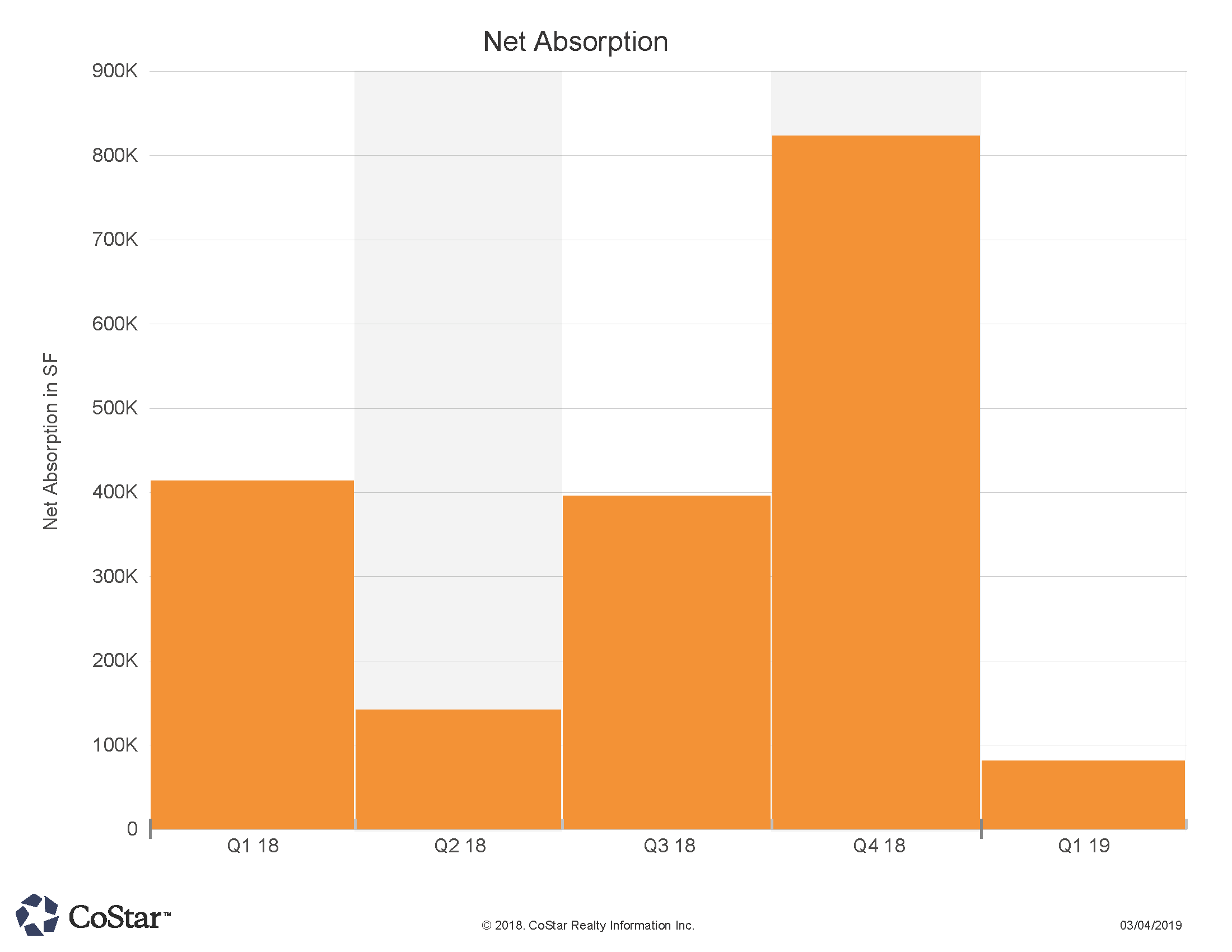

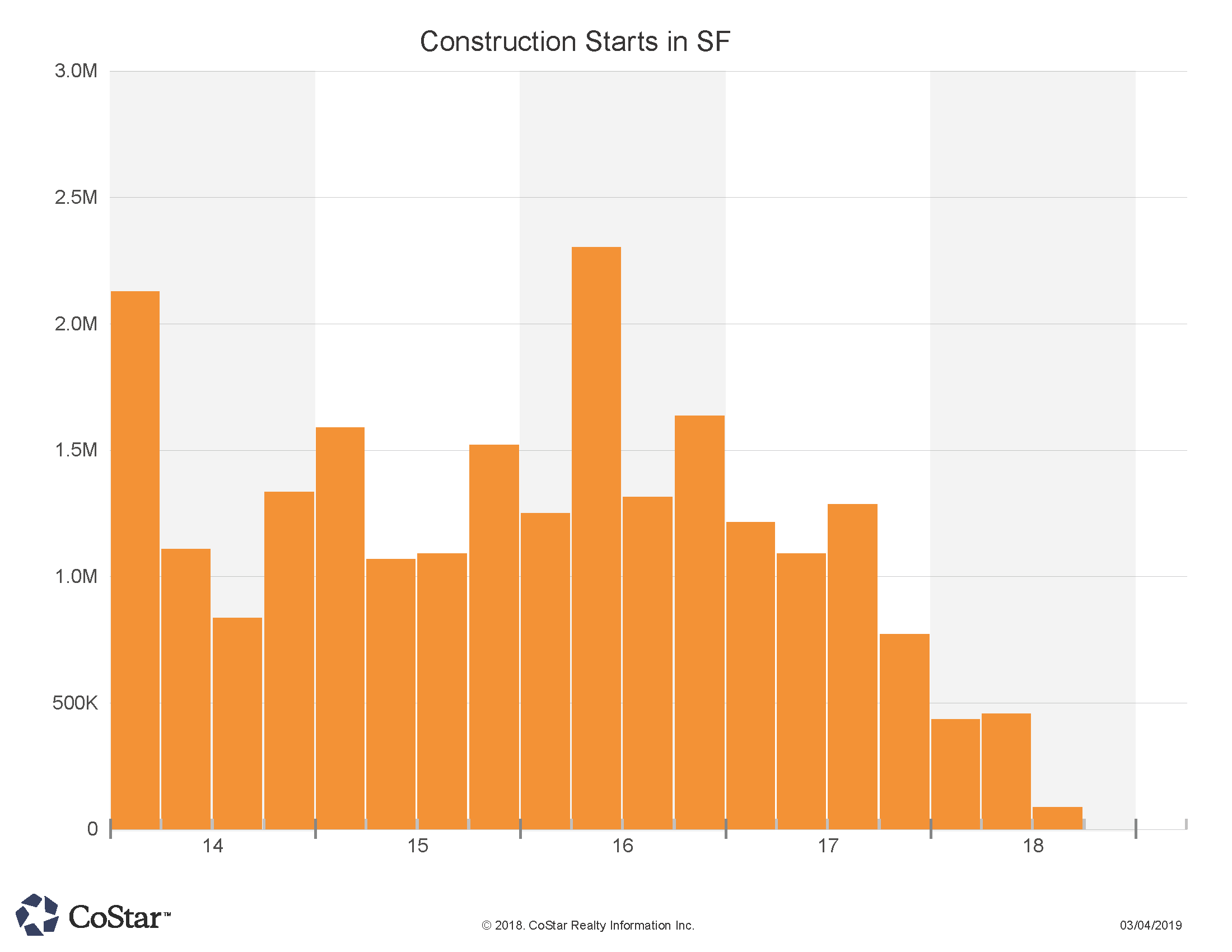

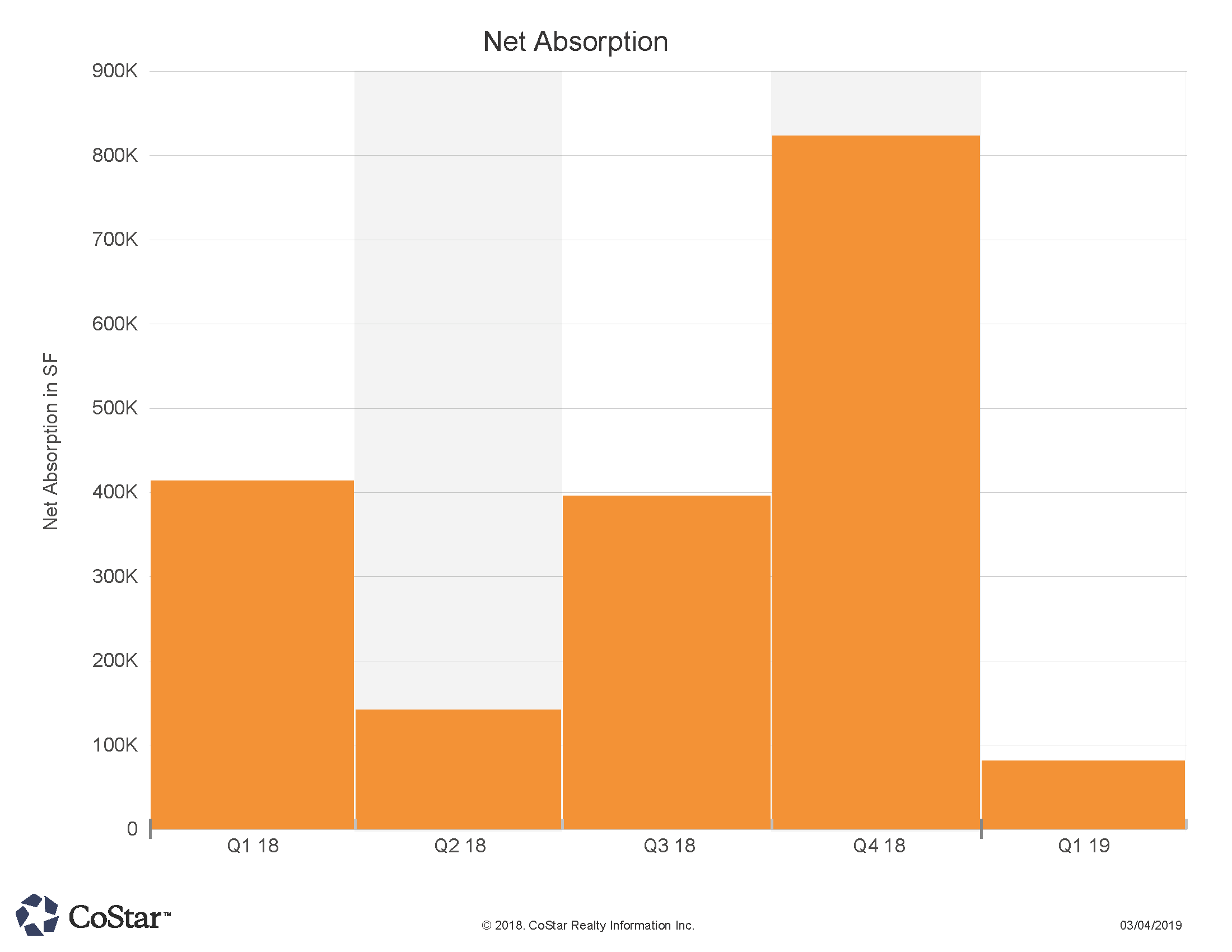

Absorption Matching Construction Starts

“After a few years of over 1 million square feet a quarter of commercial real estate absorption and matching construction starts, the tri-county region is showing declines to half those numbers in both categories. The market is reacting appropriately to the supply and demand curve.”

Contact our advisors to see how they can help you with your property

Northern Colorado:

970.207.0700

2032 Lowe St. Suite 101

Fort Collins, CO 80525

Denver Metro:

303.632.8784

414 14th St. Suite 100

Denver, CO 80202

Leading the way was a 150 acre land sale in Platteville. Usually there isn’t much activity in this small Weld county community, but a Weld county group made the purchase with plans for a mixed use residential development. Sellers were also local Weld county residents.

Flatiron Park in Boulder always seems to be in movement and February provided another transaction. This one was for $8 million, trading to a San Francisco group The sale calculated to $192 PSF for the property which was around 76% leased. Primary Tenant is SolarWinds, an IT management software group.

The Centennial Valley office campus in Louisville is another location that attracts larger investment deals. This month, Equus Capital from Pennsylvania purchased to buildings for $11.95 million or $135 PSF. The 89,000 SF multi-tenanted properties were sold to the investment group at a reported 7.4% cap rate.

A collection of retail and shop space just off the Boulder Pearl Street corridor at 2010 21st St., sold to Boulder based investors for $5.8 million, or $308 PSF. Retail properties and core city properties typically sell for more than our office park properties when measured on a price per square foot.

An educational group from Colorado Springs bought a Windsor I-25 interchange office property for $5.55 million to occupy and run a private school. This property sold for $160 PSF.

Though not quite making the $5 million cut, the Parco mobile home park in Louisville sold for $4.8 million. Purchaser and Seller were both in the Boulder/Louisville area.

On the leasing front, 88 deals were reported, with the average size being about 3,100 SF. The largest deal was just a couple blocks away from Flatiron Park, where a single tenant leased the industrial property at 1880 55th St. in Boulder.

The Colorado Technology Center in Louisville and a property in Brighton, in Weld county’s southern border, also featured with 12,000 SF leases each for the industrial properties. Summit Stone Health Partners leased the largest (medical) office suite for the month, as they took down 7,700 SF on the Timberline corridor in Fort Collins.

Perhaps it was the short month with a holiday in the middle, but our tri-county region of Larimer, Weld and Boulder slowed it’s pace from January’s start. While we had 66 sales transactions, that was far fewer than the 80 posted in January. Six of those 66 sales were reported in excess of $5 million.

Leading the way was a 150 acre land sale in Platteville. Usually there isn’t much activity in this small Weld county community, but a Weld county group made the purchase with plans for a mixed use residential development. Sellers were also local Weld county residents.

Flatiron Park in Boulder always seems to be in movement and February provided another transaction. This one was for $8 million, trading to a San Francisco group The sale calculated to $192 PSF for the property which was around 76% leased. Primary Tenant is SolarWinds, an IT management software group.

The Centennial Valley office campus in Louisville is another location that attracts larger investment deals. This month, Equus Capital from Pennsylvania purchased to buildings for $11.95 million or $135 PSF. The 89,000 SF multi-tenanted properties were sold to the investment group at a reported 7.4% cap rate.

A collection of retail and shop space just off the Boulder Pearl Street corridor at 2010 21st St., sold to Boulder based investors for $5.8 million, or $308 PSF. Retail properties and core city properties typically sell for more than our office park properties when measured on a price per square foot.

An educational group from Colorado Springs bought a Windsor I-25 interchange office property for $5.55 million to occupy and run a private school. This property sold for $160 PSF.

Though not quite making the $5 million cut, the Parco mobile home park in Louisville sold for $4.8 million. Purchaser and Seller were both in the Boulder/Louisville area.

On the leasing front, 88 deals were reported, with the average size being about 3,100 SF. The largest deal was just a couple blocks away from Flatiron Park, where a single tenant leased the industrial property at 1880 55th St. in Boulder.

The Colorado Technology Center in Louisville and a property in Brighton, in Weld county’s southern border, also featured with 12,000 SF leases each for the industrial properties. Summit Stone Health Partners leased the largest (medical) office suite for the month, as they took down 7,700 SF on the Timberline corridor in Fort Collins.