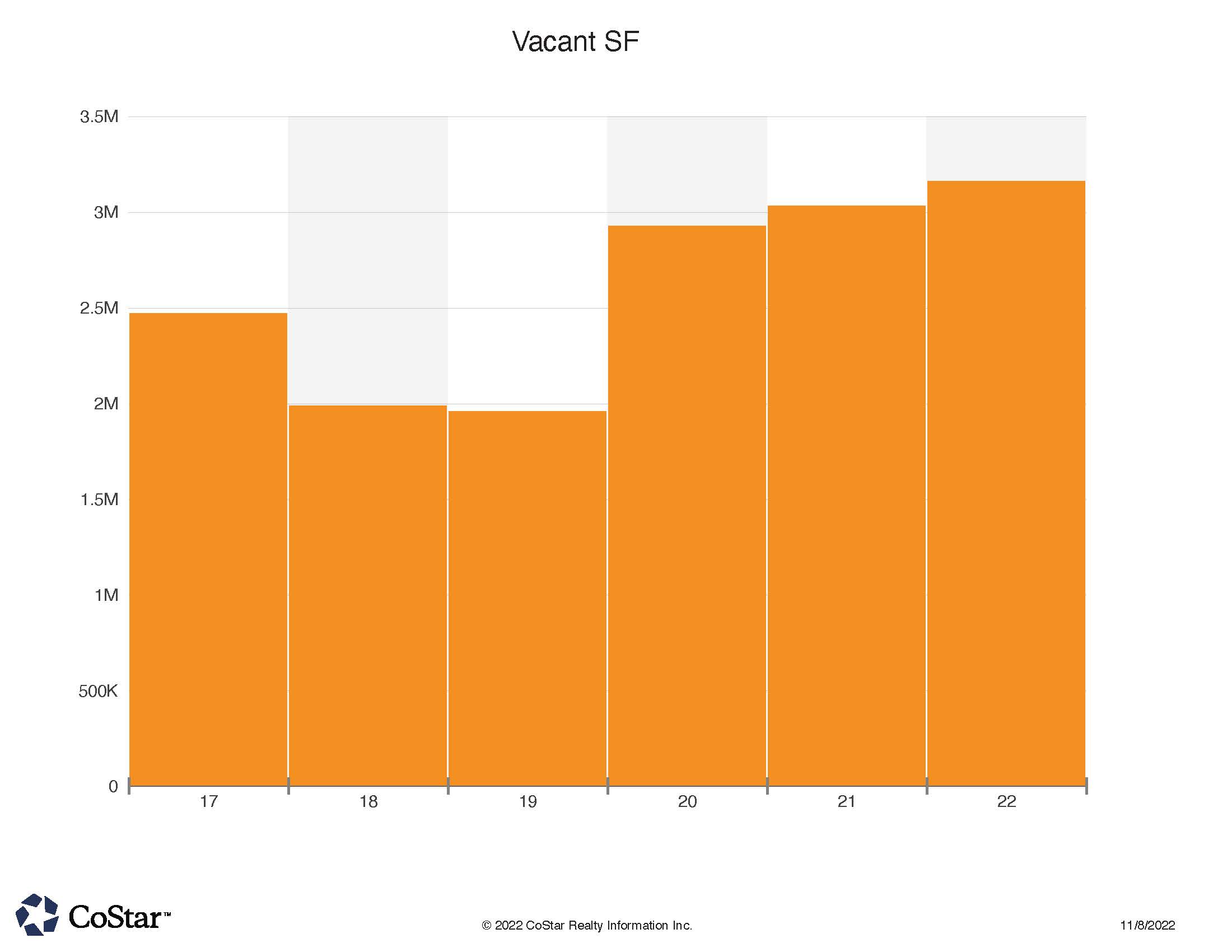

NoCO Vacancy Space Now at 3 Million Square Feet

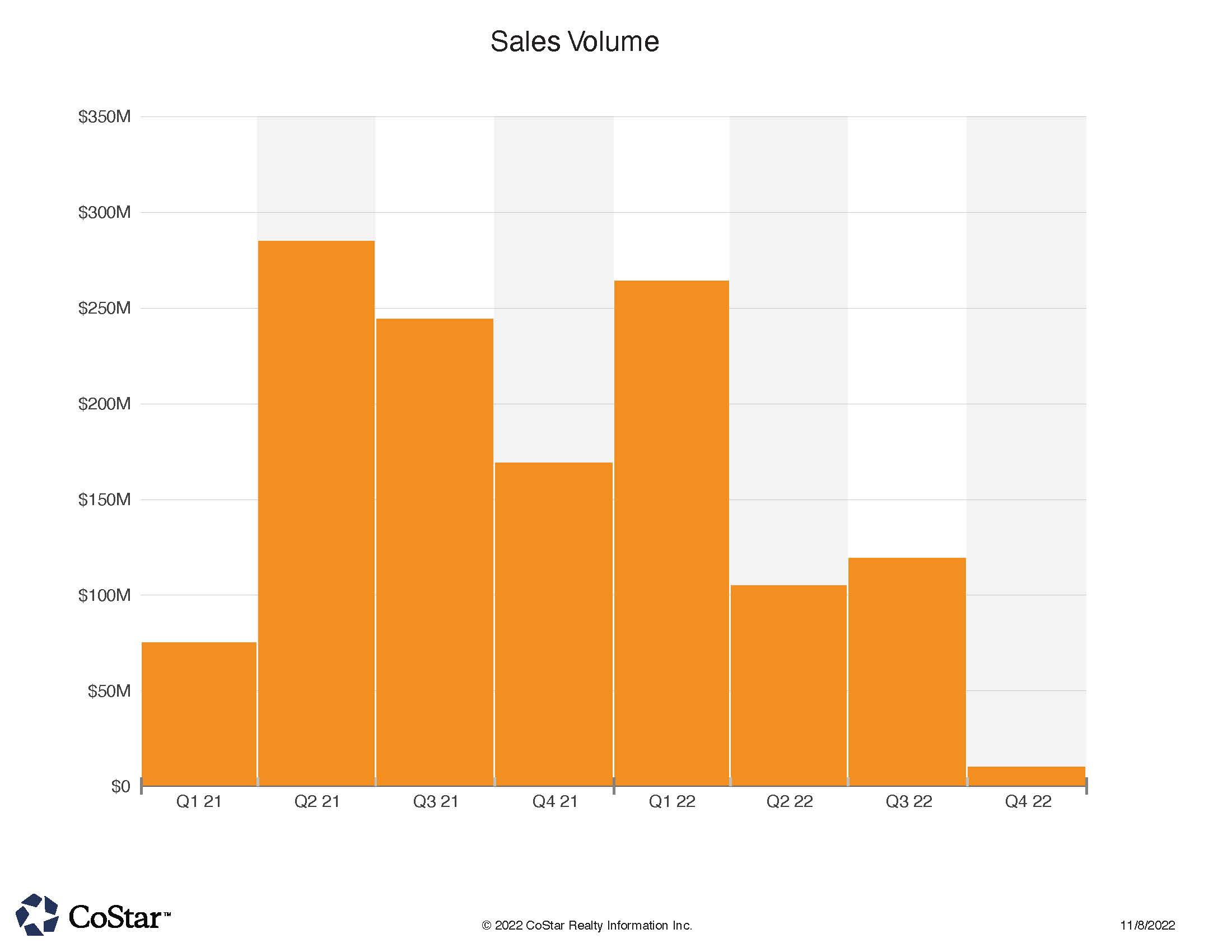

NoCO Sales Volume Slowing Down in Two Recent Quarters

Despite the definite cooling off in CRE sales volume in our area, we still see some market trends playing out. Two of the largest deals in our tri-county (Larimer, Weld & Boulder) NoCO region demonstrate the property types in favor with investors today.

The top sale in the region during October was a 314 unit apartment complex in Fort Collins, which was sold to an investment group out of Los Angeles CA. McWhinney sold the Trails at Timberline for $110 million / $350,000 per unit. Reported cap rate was 4.1%. The buyer financed $66 million of the purchase price. Approximately half of the units were one bedroom units.

Then, for $73.8 million, the 12 building Harvest Junction Shopping Center in Longmont was sold by Denver area developer Alberta Development Group, to Chicago area Pine Tree Company. The property sale calculates to $202 PSF. The buyer obtained 50% financing at a 5.9% interest rate. Tenant’s include Lowe’s, Best Buy and Marshalls. It was reported at 97% occupancy at time of sale. Retail shopping centers in prime locations are still operating at good sales levels and have put the pandemic behind them. Longmont has been growing to the east towards I-25 and Harvest Junction is well located to gain from this growth.

Fort Collins’ largest October sale was a four-property portfolio of flex buildings for almost $13 million / $178 PSF. Buyer is out of Denver, as was Seller. This 73,000 SF “Plum Tree Plaza” complex was reported to be 100% tenant occupied at time of sale.

Another active property type in NoCO has been development land. 32 acres of industrial land in Milliken. The property sold for $12.3 million / approx. $9 PSF. A rail switch on the property added value to the deal. Also, a 12.55 acre commercial land parcel in east Longmont off Ken Pratt blvd. sold for $4.9 million / $9 PSF.

Owner-occupants are always active in our market. The first case in point was a $5.4 million purchase of a flex building in the Gunbarrel region of Boulder by Watershed School. The 16,700 SF building sold for $320 PSF. 11,000 SF of that total are tenants on short term leases, so the school can take occupancy in near future. The buyer utilized $4.4 million in loan financing for the sale.

The second case in point was the sale of the World Beverage building and liquor store business off highway 287 in Loveland. It sold for $6.2 million / $399 PSF (though that price included the ongoing business assets as well). Seller and buyer were both from Loveland. Buyer utilized a $4.9 million loan in the purchase.