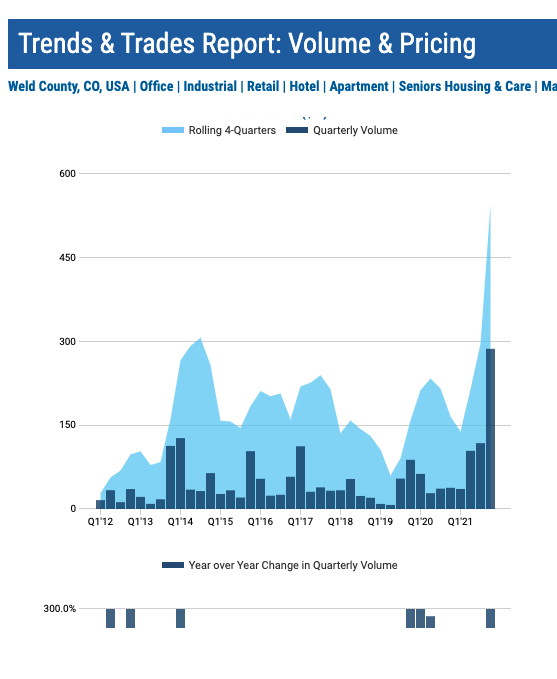

Record in the works…

Three Billion dollar CRE market combined in all three NoCO counties based on trailing 12 mos. sales activity

Out of state institutional buyers made a big splash in Fort Collins in October, recording the four largest purchases of the month. Fort Collins continues to attract capital investment with higher and higher prices, showing investor confidence in future rental rate increases and strong demand from student and other demographics.

ColRich out of San Diego CA expanded its Fort Collins holdings with the purchase of the 300 unit Habitat apartments in Fort Collins for $66.5 million. With only 3% reported vacancy, the property sold at $222,000 per unit and at a 4.58% cap rate. About 40% of Habitat’s occupants are students. Most recent renovations were completed in 2016 on the property, and it last sold for $47.5 million, so the Seller took a $19 million gain over a 5 year holding period.

Then Coastal Ridge out of Columbus OH purchased the 220 bed Outpost apartments in Fort Collins for $60 million, $300,000 per unit, and at a reported 0% vacancy. This property was built in 2014 and is largely occupied by students.

Jones Lang LaSalle Income Trust from Chicago IL purchased two apartment complexes in Fort Collins in October as well. 210 unit MIramont apartments sold for $57.3 million, $273,000 per unit, and was part of a two property sale. Added to this sale, the same buyer purchased the 195 unit Pinecone apartments in Fort Collins for $51.6 million or $275,000 per unit. Both properties combined garnered a 4.19% cap rate based on 97% occupancy.

Continuing the multi-family theme was a $15 million trade of the 125 unit Heatherway apartments in Greeley. In this case, a Denver investor purchased the property which reported no vacancy. Apparently $15 million is now the demarcation between private and institutional purchases of multi-family in the NoCO region.

The fifth largest sale was from a property class (manufactured home park) that is not very deep compared to multi-family in terms of market presence. In this case, the 204 unit Hickory Village in Fort Collins sold to a Utah investment group for $114,000 per slot. There were no park-owned manufactured home units included in the sale, so the sale was based on ground rentals obtained by the park owner. Sale price was $23.35 million. Seller had owned the park for over 20 years prior to sale.

Continuing the residential demand driving big deals in our region was a $14 million sale of a 150 acre raw land parcel in west Loveland. LGI Homes out of Woodland TX purchased the land at $3 PSF. At a projected 4 to 5 single family homes per acre, the builder could well fit in up to 750 homes at the site.

Finally, Boulder shows up in the top 10 sales with a $11 million Pollard Auto dealership property sale to an Oklahoma investor. The sale calculates to just over $450 PSF for the five year old property on east Pearl St.

Two industrial properties also made the top 10 sales list for NoCO. A 100,000 SF industrial building on Diamond Valley rd. in Windsor was sold for $16.8 million ($168 PSF). Archer Daniels Midland out of Chicago IL bought the newly constructed building for its own occupancy. The 33,000 SF Rice’s Honey building in Greeley sold to a Greeley buyer for $252 PSF or $8.4 million. The investment was likely a sale-leaseback arrangement between the now tenant and the buyer.