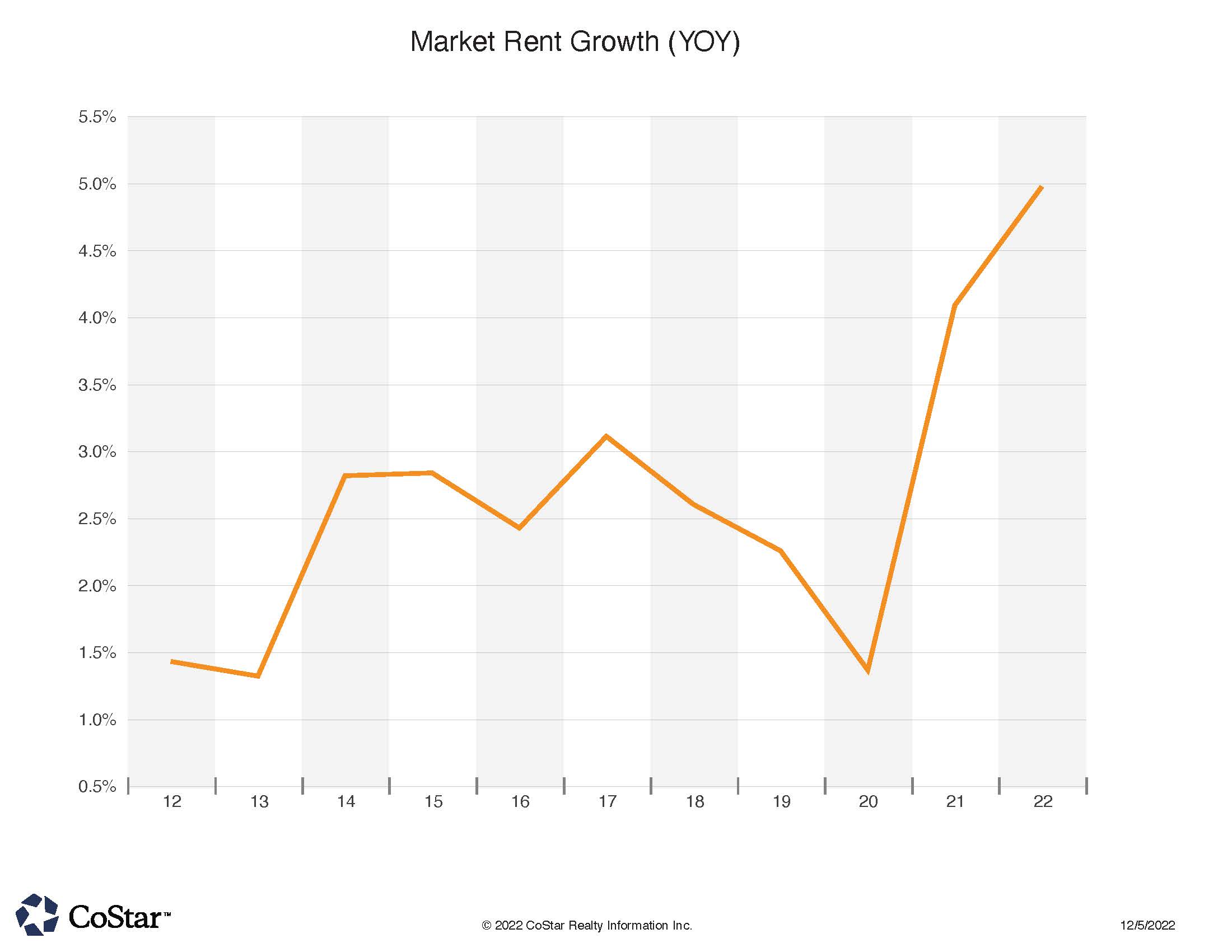

Retail Rent Growth Strong in NoCO

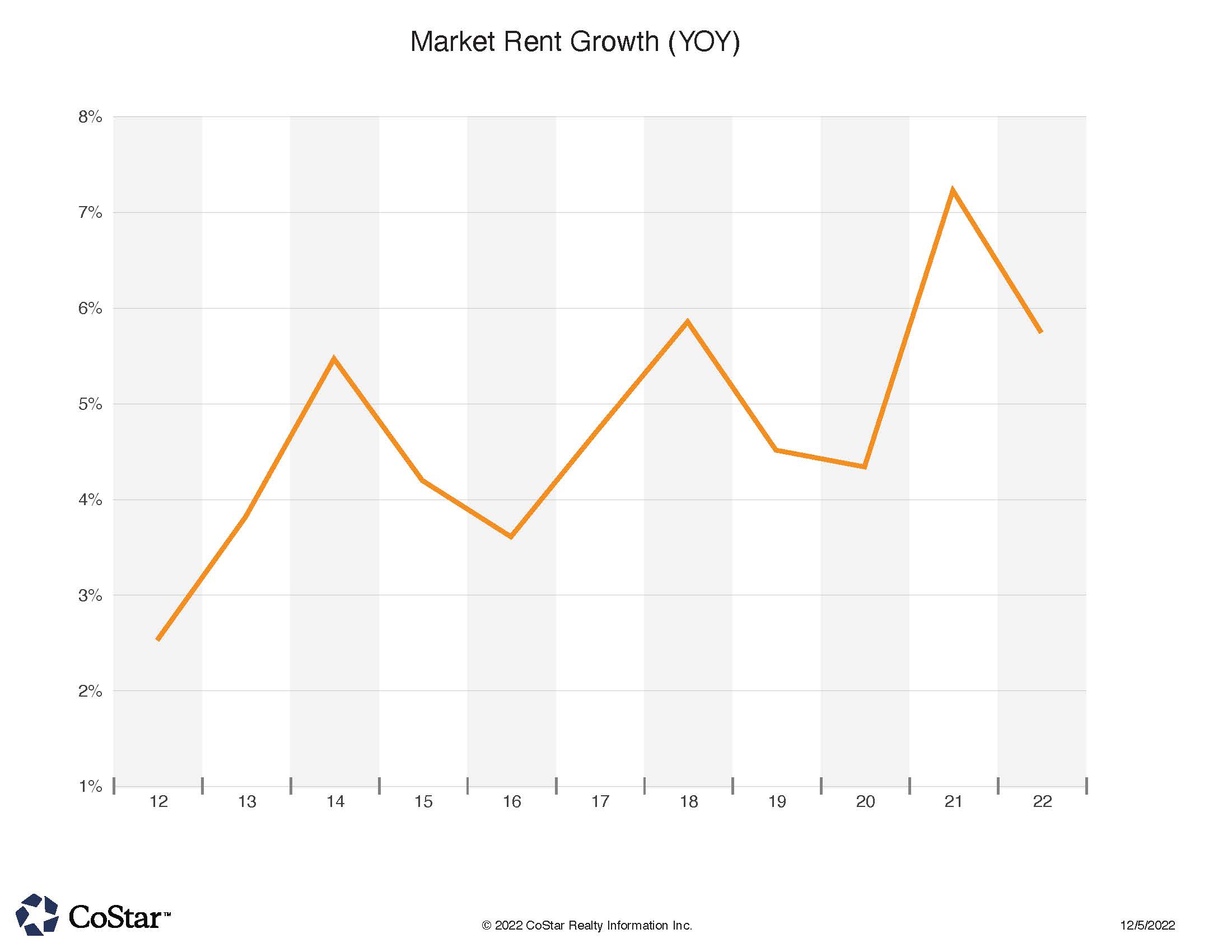

Industrial Rent Growth Continues 10 year Rise in NoCO

The tri-county (Boulder, Larimer & Weld counties) “NoCOCRE market had the slowest month in a long time in terms of sales transactions. Only about 50 transactions were noted, which is 50% of the typical month in our region. Buyers and Sellers are in a “hold” mode while they figure out whether higher interest rates impact pricing and what they portend for the future. Perception may be more impactful than actual reality right now as most Colorado economists seem to believe any recession will be mild in Colorado. Stagnation is the current order of the day in the meantime.

Leading the region as the top sale, the Marriott Hotel in Fort Collins traded for $31.5 million. Colorado based developer McWhinney Companies bought the 241 room property for $136,000 per key approximately. An initial phase of remodeling had been conducted by the Seller, out of San Diego CA, prior to the sale. The Seller had owned the property since 2011, when they acquired it for about $45,000 per key. McWhinney purportedly plans additional renovation of the common areas and amenities of the hotel. McWhinney has developed and operated a portfolio of over 15 hotels across the nation, and has expertise in this arena.

A Frederick CO owner sold its 31,000 SF industrial property to a Lafayette California private investor for $11.1 million, or $327 per square foot. This purchase was reportedly at a 5.5% cap rate, for the multi-tenant property. Major tenants are Rexel USA, SNS Iron Works, and Dark Horse Nutrition. The property was built in 2019 and also features about 5 acres of yard space which is also leased out to tenants. The Buyer utilized a 1031 IRS tax exchange to purchase the property.

The 32 unit Parkside Apartments in Greeley sold for about $209,000 per unit, or $6.7 million. Seller was based in Greeley, and Buyer has not yet been disclosed. Parkside is mostly two bedroom units and is located near the University of Northern Colorado.

Greeley was also the site of a 9.4 acre sale of commercial land in City Center West. Local developer Hoover Investments sold the parcel for $8 per square foot, or $3.25 million. The property is most likely positioned for multi-family residential development. Another retail property in Greeley, the M&A Grocery, sold for $2.18 million. This 5000 square foot property sold for $435 per square foot from the local seller to another local buyer entity. The property dates back to 1929.

A Philadelphia PA buyer purchased a 13,000 square foot light industrial property in the Lafayette Industrial Park of Lafayette CO for $2.7 million or $209 per square foot. The multi-tenant property was 100% occupied at time of sale. The eight tenant mix includes bakeries, retailers, and light industrial uses. Seller had owned the property for 9 years prior to the sale.

The property housing Kid City USA, a daycare provider in Fort Collins CO sold for $2.5 million in an investment sale. The cap rate reported was 6% on the sale. Buyer and Seller were both reported to be from Littleton CO. The tenant has been operating for 20 years and has a lease until 2037 at the site.

Finally, the Murphy’s Tap House on McCaslin Blvd. in Louisville sold for $1.9 million / $317 per square foot to a Niwot CO individual buyer. Seller was located in San Francisco CA. The Buyer operates the Murphy’s Tap House restaurant at the 6000 square foot site, and was a tenant since 2015 before purchasing this property. Owner-occupants can readily obtain financing with high loan-to-value ratios. Interest rates on these loans are higher than the most recent years but still at historically reasonable rates.

On the leasing side, our charts show strength in both the retail and industrial sectors in terms of rent growth. Retail has come on strong in the last few years, while industrial has been strong over the last 10 years.