With about one-quarter billion square feet of commercial space in the tri-county (Boulder, Larimer, Weld) Northern Colorado market, we seem to be settling into a multi-year pattern of 5% vacancy rates, and about 2 million square feet of annual absorption. Construction starts and properties under construction have fallen, though we still see plenty of cranes in the region. The market appears to be acting “sanely” in the basics of supply and demand!

For a change, no multi-family sale occurred in the Top 10 sales of the month.

A $21 million office sale led the single-property pack (out of 112 sales we tracked in the entire region). In this one, the 55,000 SF Arapahoe Center in Boulder was sold to a local Boulder private investor. The multi-tenant property sold for $385 PSF, and was previously owned by WW Reynolds Co. UC Health is the primary tenant. WW Reynolds had owned the property for about 2 years, and the sale price was the same as the previous sale in 2017. At that time, the cap rate was reported at 6.25%. No current cap rate was reported on the most recent sale.

McWhinney Companies bought a 184,000 square foot Hewlett Packard owned property on E. Harmony in Fort Collins for $21 million. This calculated to about $114 PSF. Primary tenants are Comcast and Madwire. The property is 100% occupied, and is substantially below replacement cost at the purchase price rate.

WW Reynolds also was a buyer in the Boulder market in April. The Table Mesa Shopping Center retail properties were bought for $14 million from a private individual, also in Boulder. The 8 buildings in the transaction amounted to about 250,000 SF in total. Tenants include Neptune Mountaineering, and Escoffier School of Culinary Arts. King Soopers grocery shadow-anchors the various properties acquired.

Two larger tenant-purchases featured in Fort Collins in April. A Colorado Springs based private educational organization bought a property on West Horsetooth in Fort Collins for $9.7 million, or $333 PSF. Global Village Academy had been the only tenant in the building, and purchased the property from the original developer. Fort Collins also featured a 33,000 LEED certified class A office building sale on Centre Ave. close to CSU. The University is the primary tenant in the property which was purchased by the Colorado State University Research Foundation.

Longmont featured the largest industrial deal as the former AstraZenica plant was sold to Novartis out of Basel, Switzerland. The entire portfolio of 7 properties spanning 692,000 SF sold for $30 million. The R&D flex and industrial properties were sold at a fraction of replacement cost to the firm using the dba AveXis, which is in the pharmaceutical industry researching gene therapy products. Obviously there are only a few buyers for such a property, and the plant had been on the market looking for such a Buyer who was also in medical and pharmaceutical research.

Finally on sales of note in the region, Tebo Properties in Boulder bought The Registry Office building for $6.5 million. The prominent 19,000 SF downtown office property sold for $342 PSF and was completely occupied, mostly by smaller office tenants.

On the leasing front, Quicksilver Scientific inked a 59,000 SF lease on Cherry St. in Louisville. The Tenant will occupy the entire Colorado Technology Center flex property, with Etkin Johnson as the Landlord.

With about one-quarter billion square feet of commercial space in the tri-county (Boulder, Larimer, Weld) Northern Colorado market, we seem to be settling into a multi-year pattern of 5% vacancy rates, and about 2 million square feet of annual absorption. Construction starts and properties under construction have fallen, though we still see plenty of cranes in the region. The market appears to be acting “sanely” in the basics of supply and demand!

For a change, no multi-family sale occured in the Top 10 sales of the month.

A $21 million office sale led the single-property pack (out of 112 sales we tracked in the entire region). In this one, the 55,000 SF Arapahoe Center in Boulder was sold to a local Boulder private investor. The multi-tenant property sold for $385 PSF, and was previously owned by WW Reynolds Co. UC Health is the primary tenant. WW Reynolds had owned the property for about 2 years, and the sale price was the same as the previous sale in 2017. At that time, the cap rate was reported at 6.25%. No current cap rate was reported on the most recent sale.

McWhinney Companies bought a 184,000 square foot Hewlett Packard owned property on E. Harmony in Fort Collins for $21 million. This calculated to about $114 PSF. Primary tenants are Comcast and Madwire. The property is 100% occupied, and is substantially below replacement cost at the purchase price rate.

WW Reynolds also was a buyer in the Boulder market in April. The Table Mesa Shopping Center retail properties were bought for $14 million from a private individual, also in Boulder. The 8 buildings in the transaction amounted to about 250,000 SF in total. Tenants include Neptune Mountaineering, and Escoffier School of Culinary Arts. King Soopers grocery shadow-anchors the various properties acquired.

Two larger tenant-purchases featured in Fort Collins in April. A Colorado Springs based private educational organization bought a property on West Horsetooth in Fort Collins for $9.7 million, or $333 PSF. Global Village Academy had been the only tenant in the building, and purchased the property from the original developer. Fort Collins also featured a 33,000 LEED certified class A office building sale on Centre Ave. close to CSU. The University is the primary tenant in the property which was purchased by the Colorado State University Research Foundation.

Longmont featured the largest industrial deal as the former AstraZenica plant was sold to Novartis out of Basel, Switzerland. The entire portfolio of 7 properties spanning 692,000 SF sold for $30 million. The R&D flex and industrial properties were sold at a fraction of replacement cost to the firm using the dba AveXis, which is in the pharmaceutical industry researching gene therapy products. Obviously there are only a few buyers for such a property, and the plant had been on the market looking for such a Buyer who was also in medical and pharmaceutical research.

Finally on sales of note in the region, Tebo Properties in Boulder bought The Registry Office building for $6.5 million. The prominent 19,000 SF downtown office property sold for $342 PSF and was completely occupied, mostly by smaller office tenants.

On the leasing front, Quicksilver Scientific inked a 59,000 SF lease on Cherry St. in Louisville. The Tenant will occupy the entire Colorado Technology Center flex property, with Etkin Johnson as the Landlord.

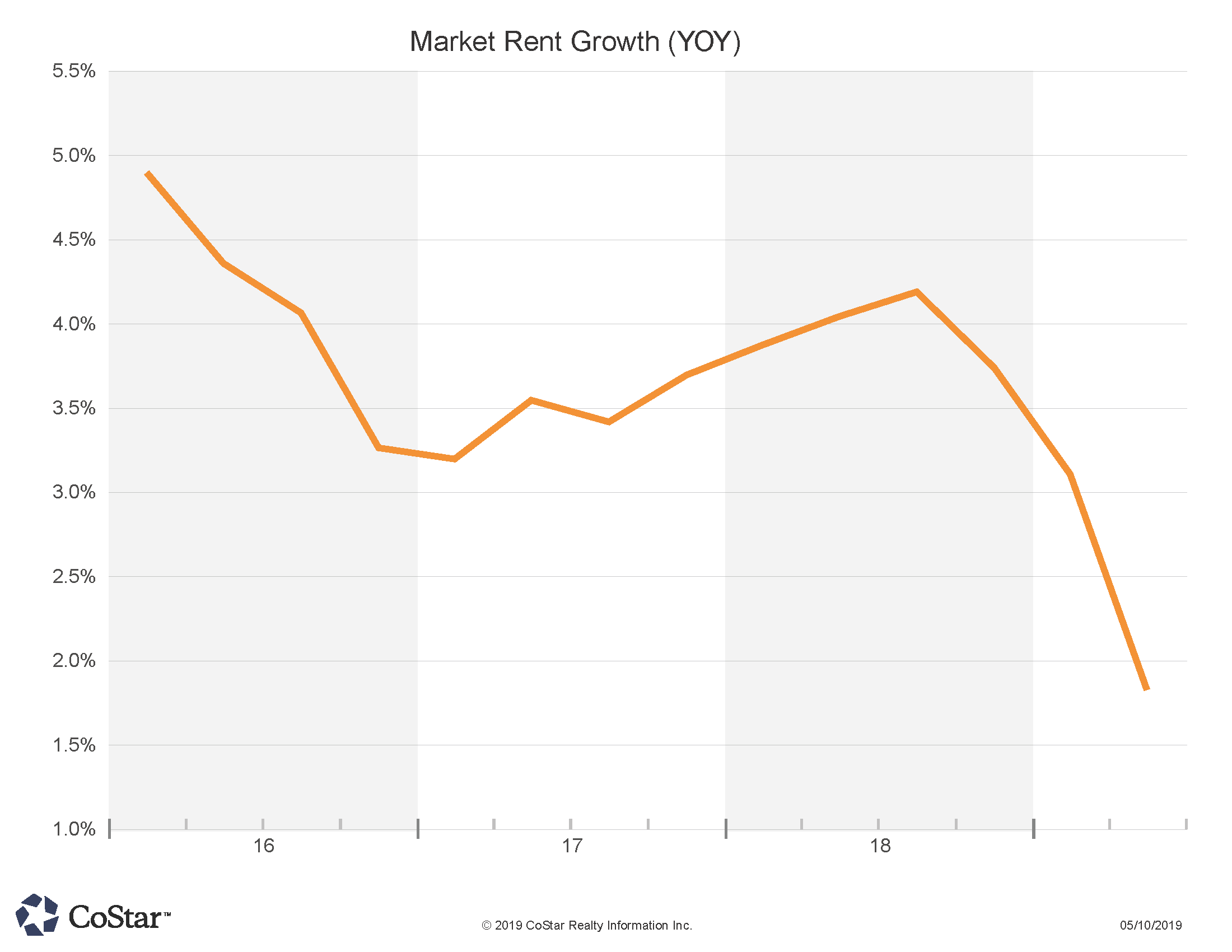

NoCO Market Rent Growth

Rent Increases in Region

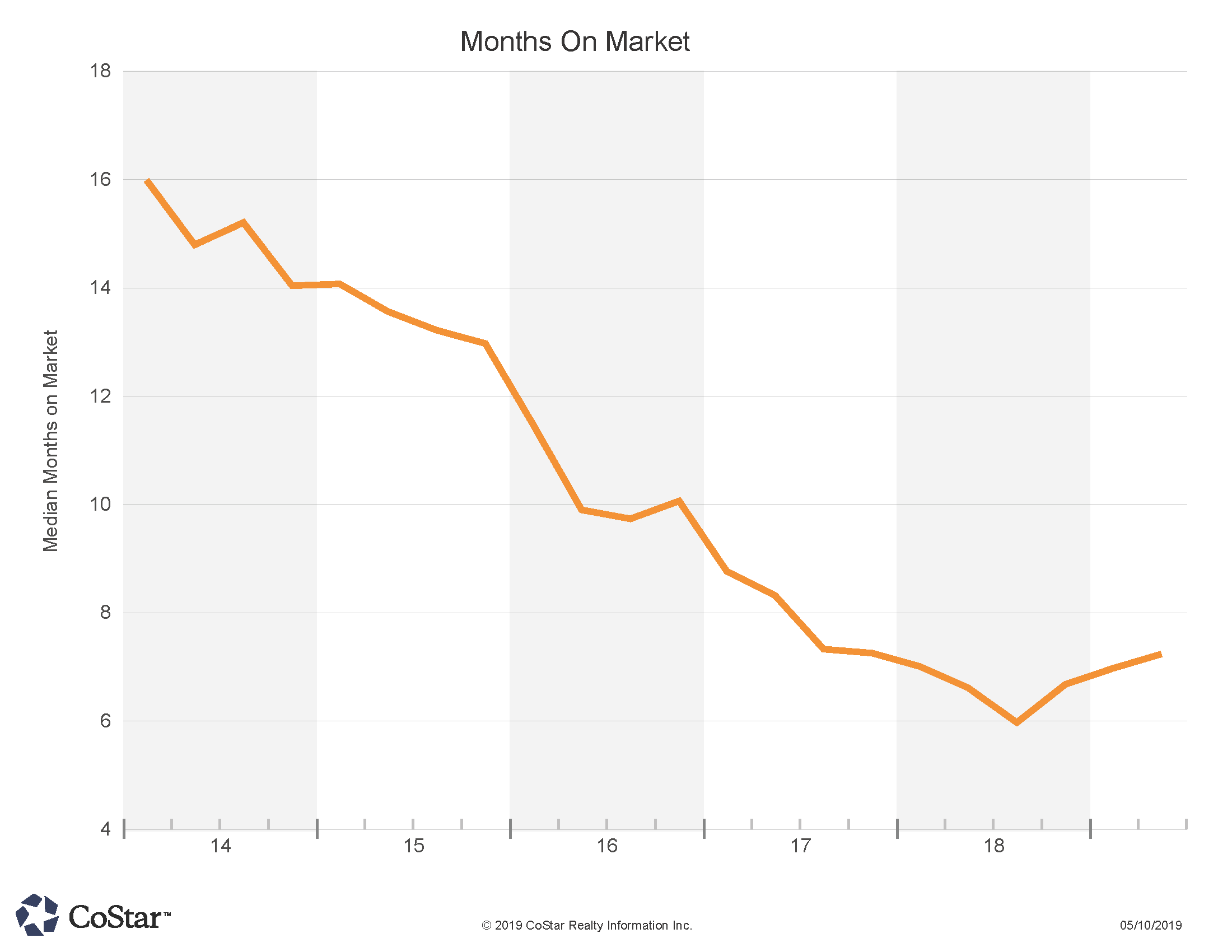

NoCO Months on Market

Properties Sell on Average Within about Six Months after Listing

Contact our advisors to see how they can help you with your property

Northern Colorado:

970.207.0700

2032 Lowe St. Suite 101

Fort Collins, CO 80525

Denver Metro:

303.632.8784

414 14th St. Suite 100

Denver, CO 80202