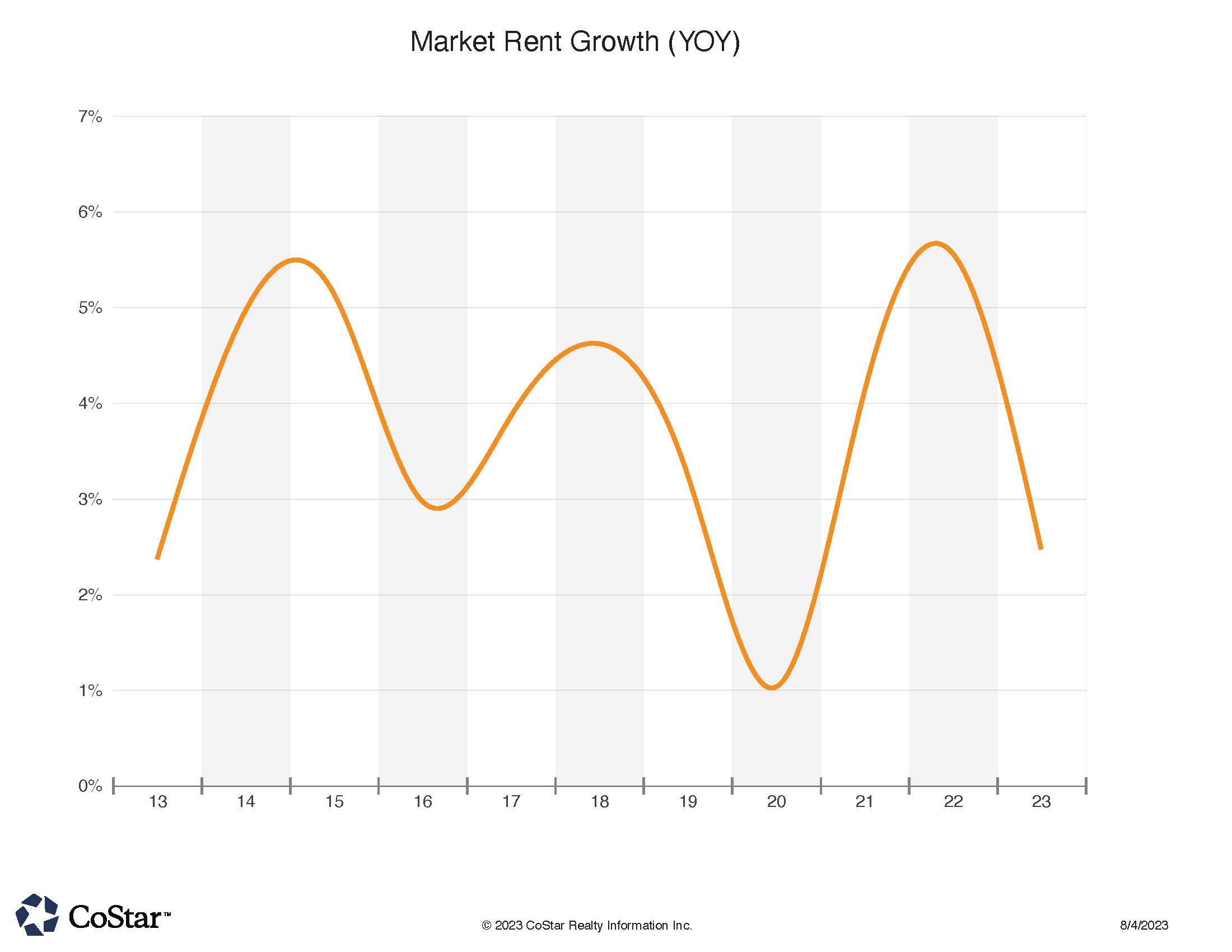

NoCO Market Rent Growth is Slowing to a 10 Year Low Outside of the Pandemic Era

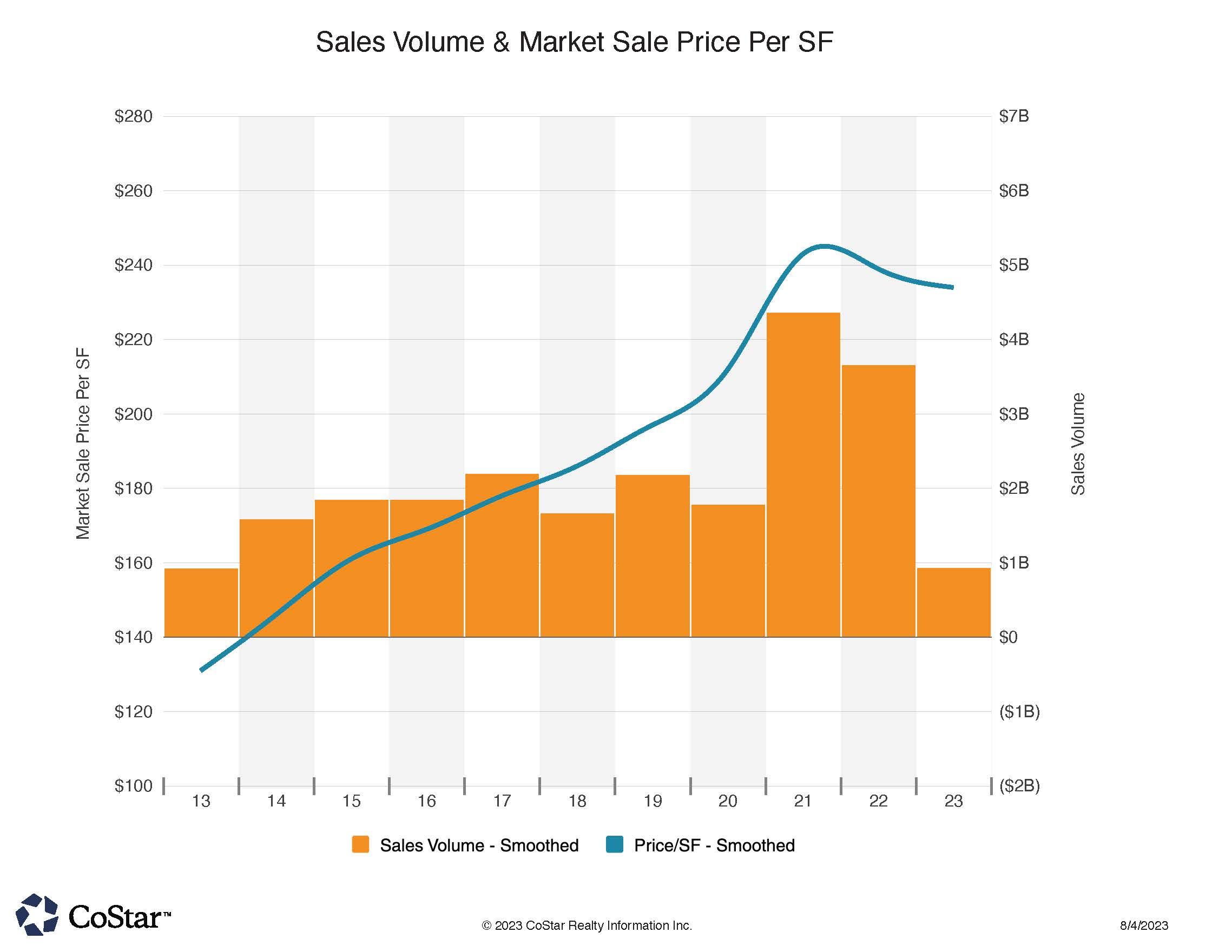

NoCO CRE Sales Prices have Tempered this Year as Sales Volume has Been Far Below Typical Volume for the Last 10 Years

In these uncertain times for the CRE industry, NoCO has shown the resilience of CRE in our tri-county (Boulder, Larimer and Weld) region. Leading this charge in July was the purchase of the Seagate Campus R&D/technology center in Longmont. This 533,000 SF campus was sold in a 10 year sales-leasebak arrangement to a private equity investment group located in nearby Boulder and having ties to Boston MA. Selling price was $101.5 million or $190 per square foot approximately. The sale symbolizes the strength of the region in terms of technology and associated research and development. The sales-leaseback strategy allows the operating firm (Tenant) to obtain capital funding for its business operations to deploy for future growth, rather than having it stay on the real estate side of their balance sheets. For owner-occupants, this can be a novel and alternative way to reposition their real estate capital when other forms of business financing are tight or not as favorable towards borrowers. Boulder county has led the way in the region for R&D firm growth, but the capital strategy applies to all industry types.

Another CRE strategy to increase value is a re-purposing of the real estate to a higher and better use. In Fort Collins, the Glick Brothers Business campus traded for $16.4 million, or $139 PSF. The property generated close to $1 million in net cash flow which translates to an approximate 6% cap rate yield for the Aurora buyers. The property’s origin was as a multi-tenant industrial distribution center, but the Sellers transformed it over the years to add retail components and enhance its value.

NoCO’s hospitality industry has had a lot of trading as the industry rebounds strongly after the pandemic era. Two trades featured in NoCO. First, a Salt Lake city hotel investor purchased the 83 room Candlewood Suites in Greeley for $13 million. This translates to about $157 per “key”. The Seller, local operator Spirit Hospitality, also sold the 92 room Comfort Suites in Loveland for $11.5 million. Buyer in this case is a group also out of Utah. The Comfort Suites sale calculates to approximately $125,000 per key for the 2017-built property.

Industrial properties have continued to be of prime interest to investors and users alike in NoCO. Microvast out of Texas purchased the vacated former Hexcel industrial building in Windsor for $11 million for their own future occupancy. The building is approximately 99,000 SF, and the sale calculates just above $110 PSF. Hexcel corporation had purchased the property for its own use in 2011 for $9.8 million from the Great Western companies which operate the industrial park where it is located. In another area region deal, a 71,000 SF light industrial building in Loveland off Medford St. sold to an investment group out of Wisconsin for $7.8 million, or $110 PSF. In this case, the Sellers financed 80% of the purchase price at 7.5% interest for a 3 year term. At time of sale, Amerimax Windows and Doors is the sole tenant. Seller financing is another strategy for Sellers who are in position to offer it, which can ease financing challenges for a Buyer.

NoCO’s tight restrictions for auto repair facilities restricts supply and supports pricing value for sellers of these properties. A case in point is the $5.64 million sale of a 10,500 SF repair facility at Spruce and Folsom Street in central Boulder. The purchase deal also included a single family home that was separately purchased for $500,000. The selling price for the auto repair facility calculates to approx. $537 PSF. Buyer is out of Denver. Same Buyer also purchased another facility, this time on Spruce St. in Boulder for $2.44 mil. or $529 PSF. The two properties were part of a portfolio deal. In this same property class, a private individual purchased an 11,100 SF auto repair facility in Loveland for $2.5 million or $225 PSF. Tenant at time of sale is Gerber Collision and Glass.

On the retail side, County Line Wine and Spirit’s Erie CO location sold for $2.8 million. The 7,700 SF facility brought $362 PSF at time of sale. A private buyer purchased the property from a Brighton CO seller.

Though the office category has been constrained, specific owner-use needs are still present in the market. The historically landmarked “Arbor House’ in Boulder sold to a Denver based counseling group for $1.7 million or about $771 PSF. The property was salvaged, rebuilt and restored in 1996 by a mental health counseling group and featured off-street parking along the highly coveted Pearl Street corridor in Boulder.