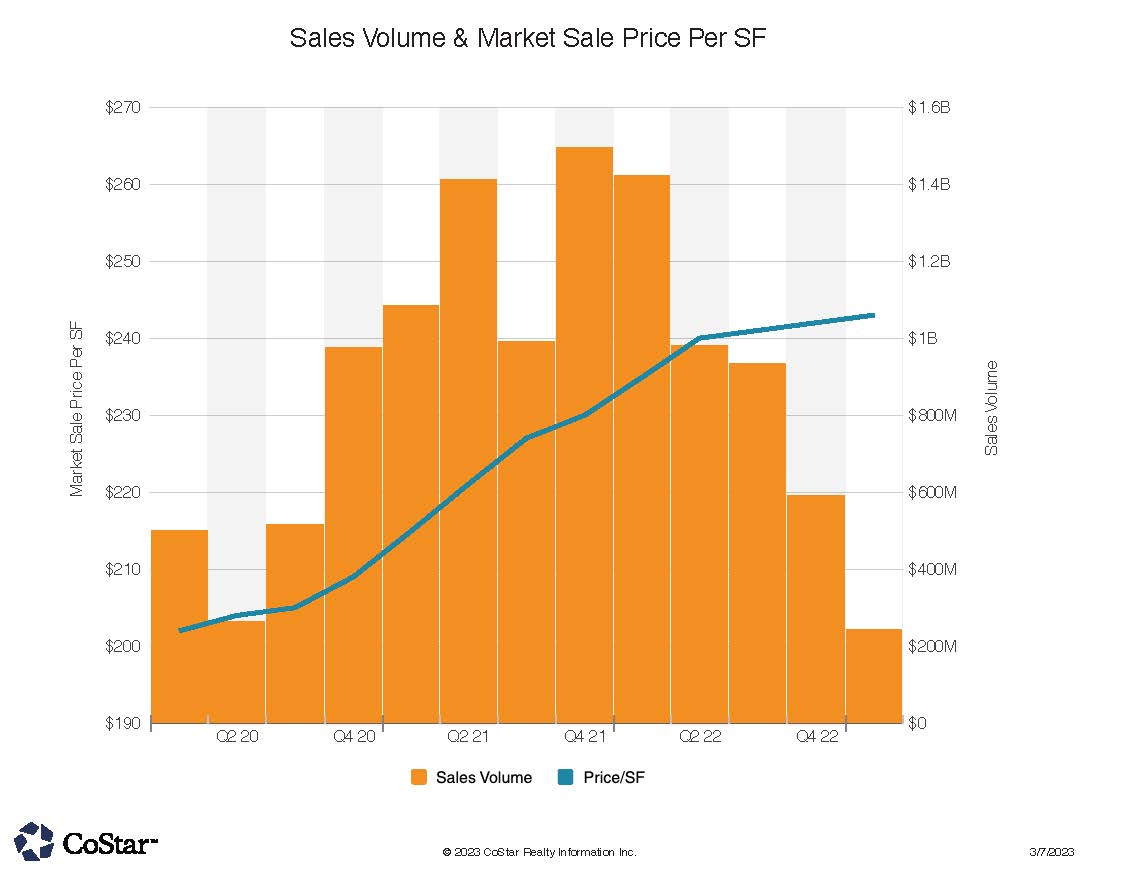

The NoCO CRE Sales volume looks similar to 2020 (pandemic year), with reduced sales volume

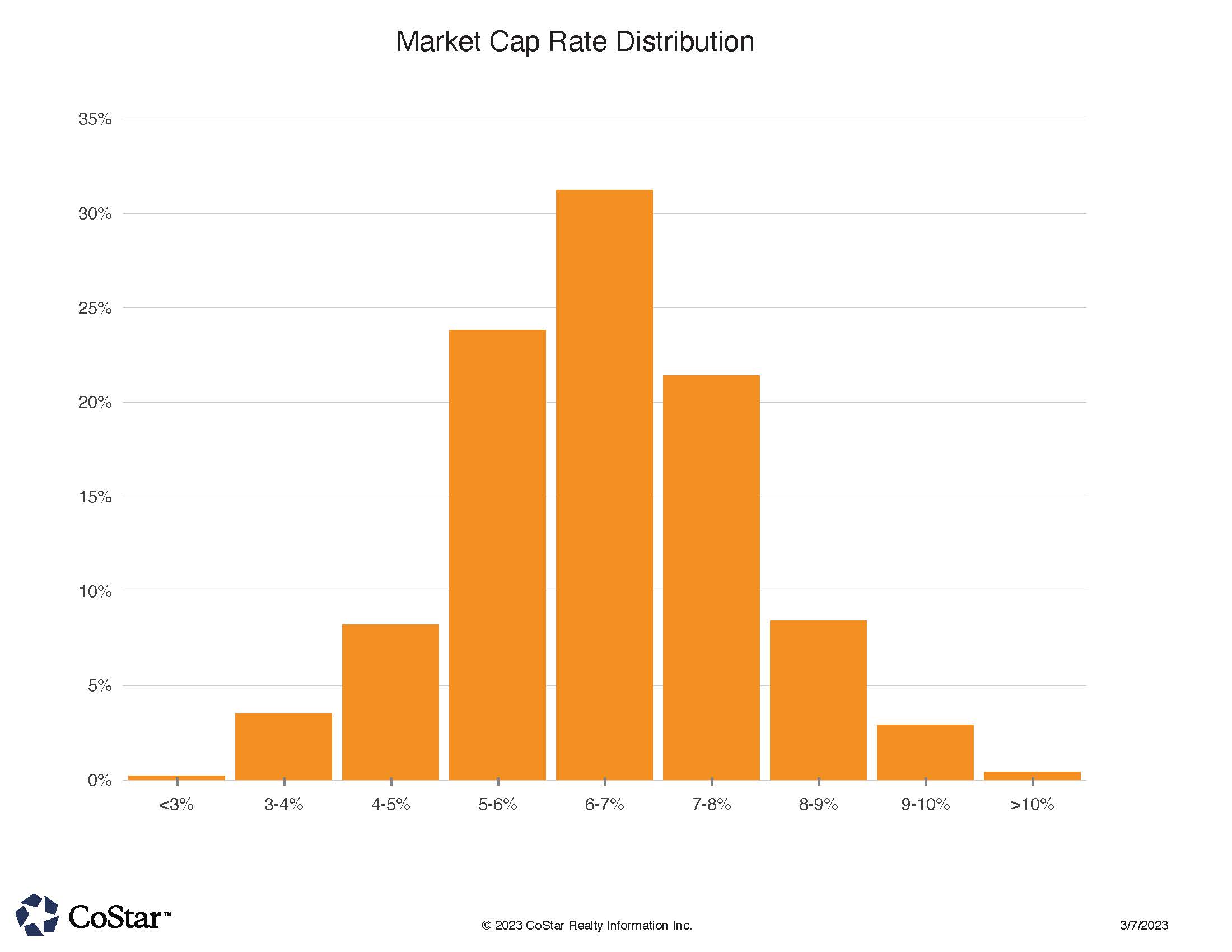

NoCO CRE cap rate distributions shows that most deals are in the 6% to 7% range.

With a CRE market trying to figure out pricing in this new financing environment, sales are already somewhat muted. Add in a short 28 day month, and they were further abbreviated to just less than 50 transactions. Nevertheless, multi-family, hospitality and retail deals topped the charts in our Boulder/Larimer/Weld NoCO CRE market.

Topping the charts was the 138 unit Fox Meadows apartments in Fort Collins which traded for $36.8 million. The sale was from a Colorado firm to a Denver CO investment group as buyer. The price per room was almost $267,000. for the property which featured an attractive HUD loan for the partial LIHTC affordable project. Assumption of a 2020 originated loan was the strategy for the buyer so as to forego new financing at rates which have raised significantly in the past year.

The 124 unit Parkwood Place apartments in Greeley also traded in February for a price of $15.25 million, or $123,000 per unit. In this case, a Denver area buyer reportedly will initiate a value-add strategy to upgrade the 50 year old complex. This age and building condition accounts for the pricing discrepancy per unit between the aforementioned Fox Meadows deal.

On the hospitality product side, the Best Western Plus in Loveland, with 89 rooms, traded for $7.5 million ($84,000 per “key”). A Santa Clara CA operator bought the property from the Fort Collins based Seller. The property is located along the I-25 & Highway 34 exchange in Loveland.

An interesting hotel trade was the $4.2 million sale of the Alps Inn, located up Boulder Canyon.

This former 12 room bed and breakfast will be repurposed to an adolescent mental health residential property operated by a Denver based health provider. Purchaser is a capital group out of Texas who entered into a long term lease with the health care group.

Retail type sales showcased during February in our region. An Arizona investor purchased the UC Health building in Erie for $5.65 million, utilizing a 1031 tax exchange strategy. The 14,800 medical clinic sold for $382 PSF.

A Dollar General store was sold for $2.7 million at a reported 5.09% cap rate. Seller is from Louisiana, and Buyer is a trust from Santa Barbara CA. Price per square foot calculates to $280.

A former restaurant in the Fort Collins Old Town shopping district area sold for $4.83 million to a Boulder restaurateur. The two story property (formerly Main Line restaurant), traded at $389 PSF, and had been on market for over a year. The property originally dates back to 1904, and has been renovated most recently in 1992. The Boulder operator has a restaurant in a similar downtown location in Boulder which features a Japanese menu.

A Conoco gas station on Highway 287 in Lafayette traded twice in Lafayette. First for $1.7 million, and then for $1.9 million a week later. The first Buyer who then became the Seller a week later, is from Brighton CO, and the second Buyer is from Lafayette. The property was constructed in 1997, and the final sale was at $519 PSF.