Tri-county Market Rents Climb up again in 2021 as Covid impact lessens

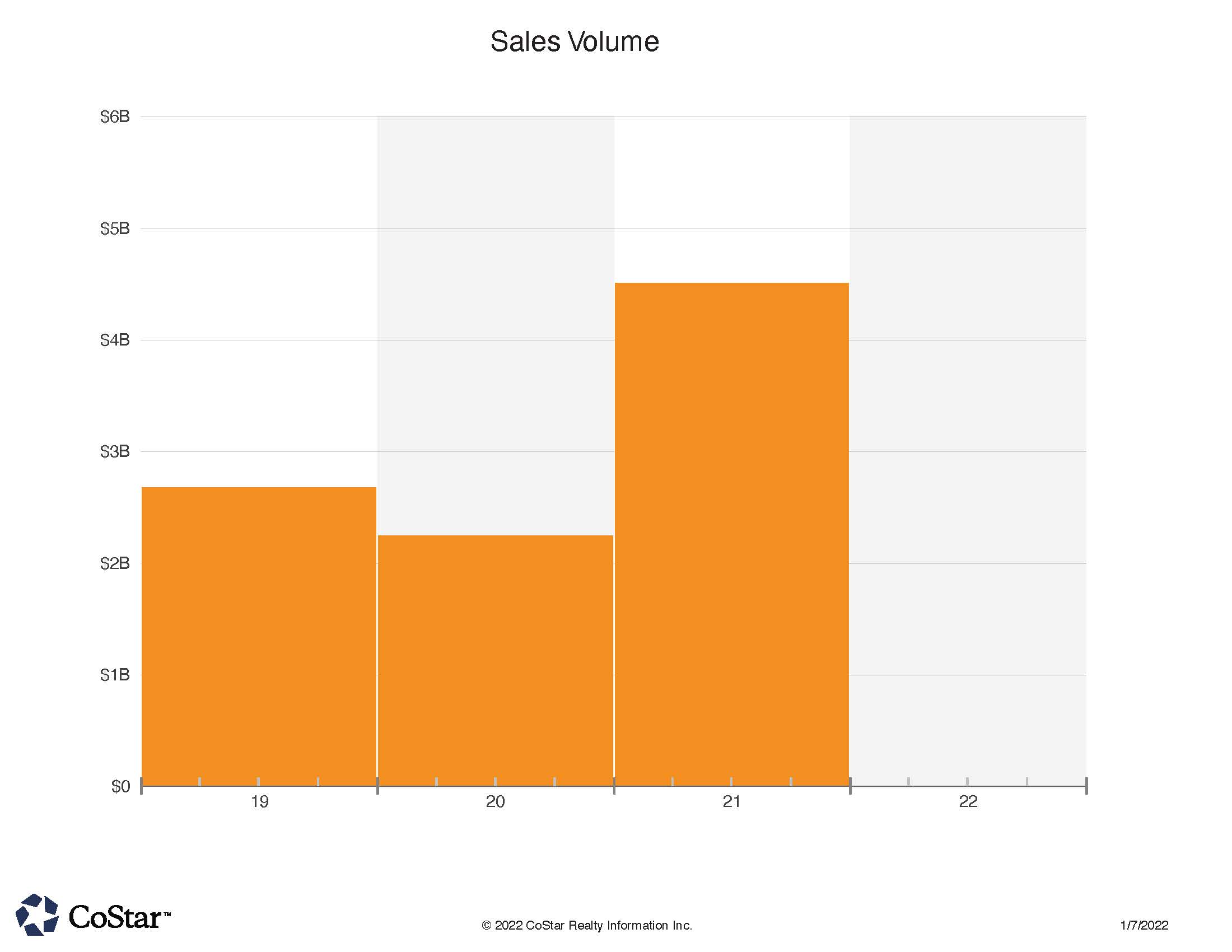

Tri-county Sales Volume roars back in 2021 to Record Levels

Region featured over 100 sales per month, with over 7% of all properties selling during the year

December often closes out with a bang for CRE sales, and 2021 proved to follow this form. The Tri-county Boulder, Larimer and Weld area topped $4 billion in CRE sales for the first time in history. 129 sales overall closed in the month, and the Top 10 herein were all $10 million or higher trades.

Leading the charge was a multifamily sale, as has been typical through the last few years as investors bet on regional demand growth, and rent growth.

The Ten West complex in Greeley sold to Summit Investments out of Ohio for $80 million, or just over $303,000.00 per unit. The complex was just built and occupied within about one year of this sale. Local developers from Denver built the 264 unit project and it had 168 1-bedroom units in their mix. Summit has increased their holdings significantly in northern Colorado over the past decade.

The 20 building Prospect Innovation Campus in Fort Collins was the largest office deal in the region last month, as it traded for $53.5 million to a Denver based investment group. The mixed use complex included R&D, distribution/flex, and office properties with 45 different tenancies, including technology, life sciences, and general business occupants. The sale calculates to $146 PSF.

A RV dealership was a sale of interest in the top 10. LazyDays RV Sales at the I-25 & Johnstown exit sold for $19.8 million The individual Colorado based Seller, traded the property to another Colorado based investor at a reported 5.5% cap rate. LazyDays will still occupy and lease the property. Seller aquired the property only 15 months prior at $11.4 million, and made over $8 million profit from the relatively short holding time.

Another auto dealership, Stevenson Lexus, sold in Longmont at $15.8 million / $267 PSF, to a Georgia dealership group as part of a 5 property portfolio sale. Stevenson was reportedly the largest privately held auto dealership in Colorado prior to the sale.

Self-storage is a highly sought after asset type and has large institutional interest. Extra Space Storage in Loveland was part of a two property sale to Life Storage out of New York. The Loveland property was valued at $12.7 million, which is $126 PSF. Life Storage is a public REIT with over $3 billion in self storage assets. Another large self storage sale occured on Midway st. in Fort Collins as Stor-Mor Storage sold for $16.8 million to Atlanta GA based Invesco. This price calculates to $258 PSF.

Signaling confirmation of the recovery in the hotel business being forecast, two regional hotels sold in December. The 109 room Home2 Suites by Hilton in Longmont traded for $15.8 million, or $145,000 per key, to a large hotel operator out of Irving Texas. The Holiday Inn Express in Loveland traded for $13 million, or $158,000 per key (82 rooms), to a smaller hotel operator out of Wichita KS. In this case, the Seller was also from Wichita.

As our region continues to grow, residential development land is in high demand. Entitlement and infrastructure takes several years, and regulatory hurdles are high before homes can be built on raw land. A 45 acre parcel on Harmony road in Fort Collins sold for $10.7 million to Toll Brothers, (a major homebuilder out of Pennsylvania). The land anticipates 97 homesites, so the price per lot is just over $110,000 each.

The range of higher end sales ended up pushing the region to record annual sales in the commercial real estate property industry.