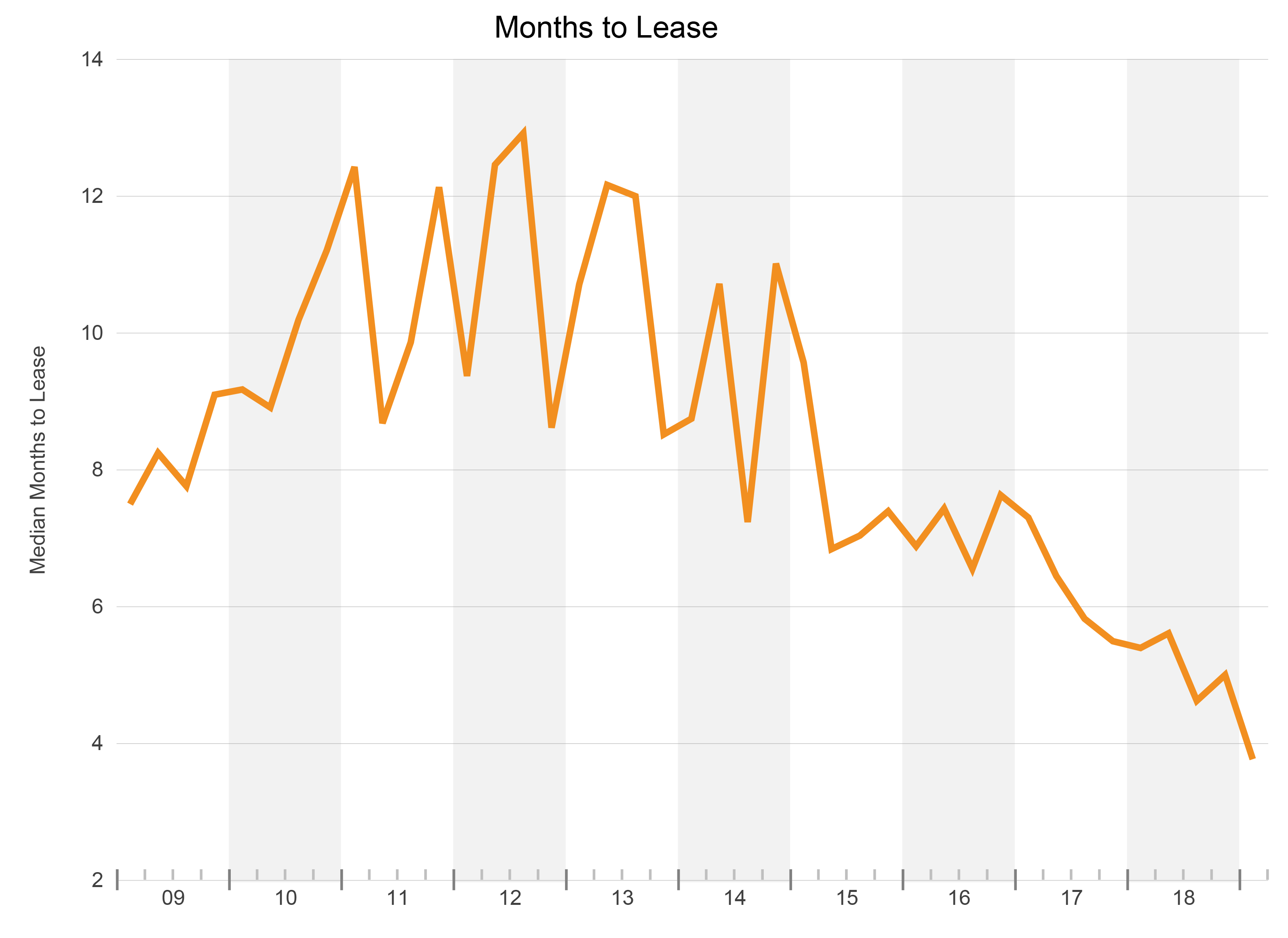

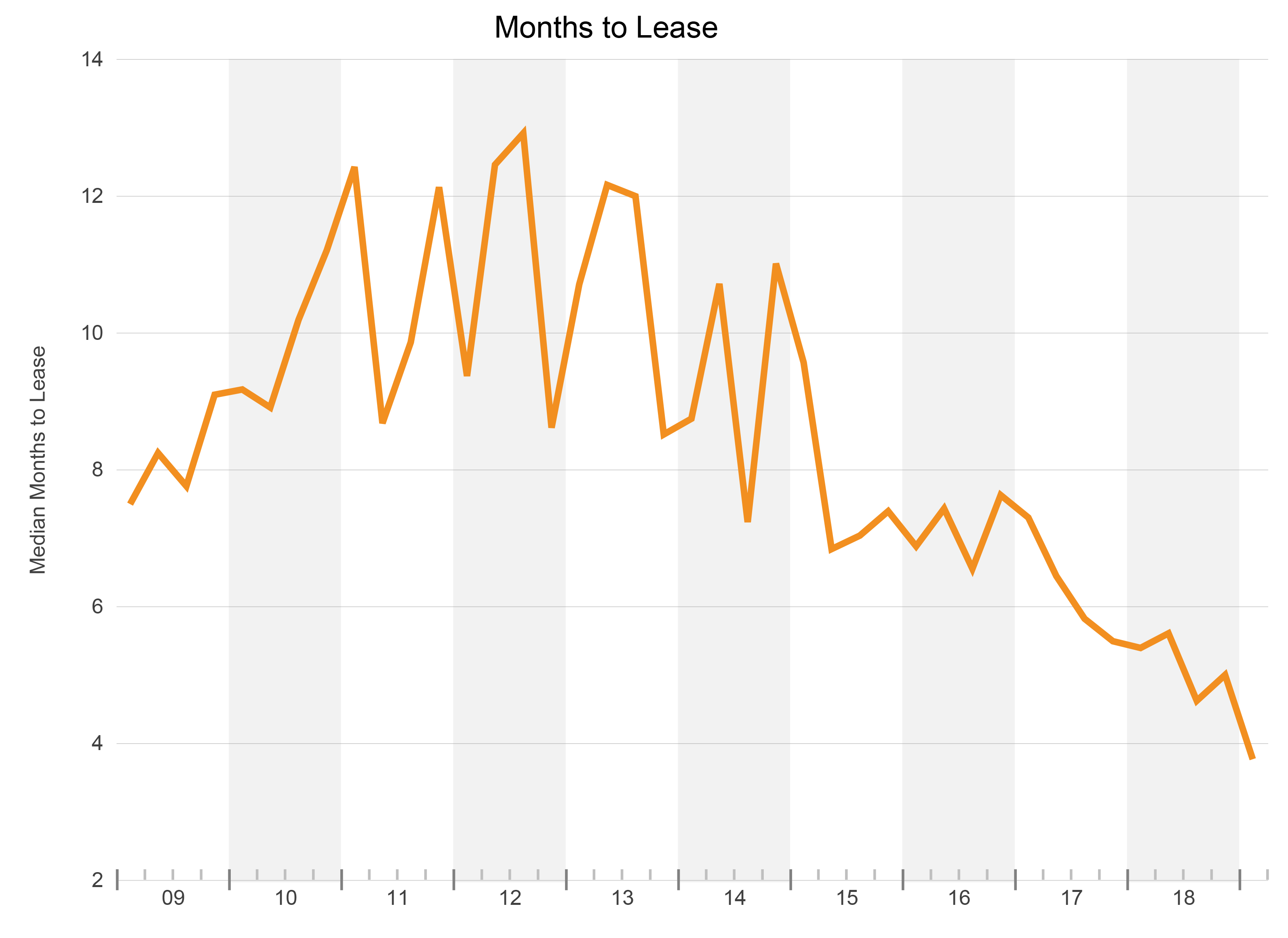

Months to Lease

“Landlords steadily lowering the time to backfill vacant space over a 10 year period”

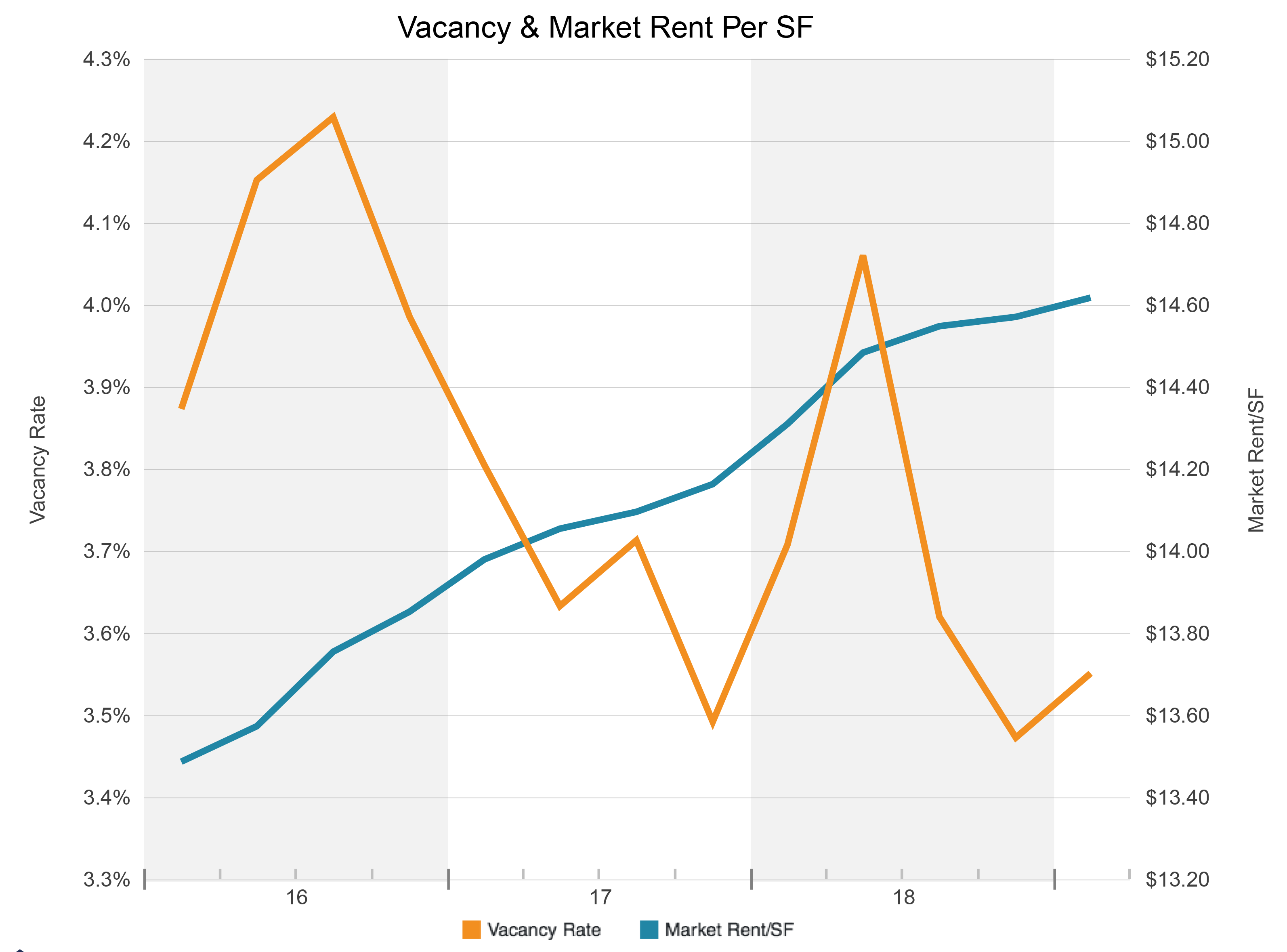

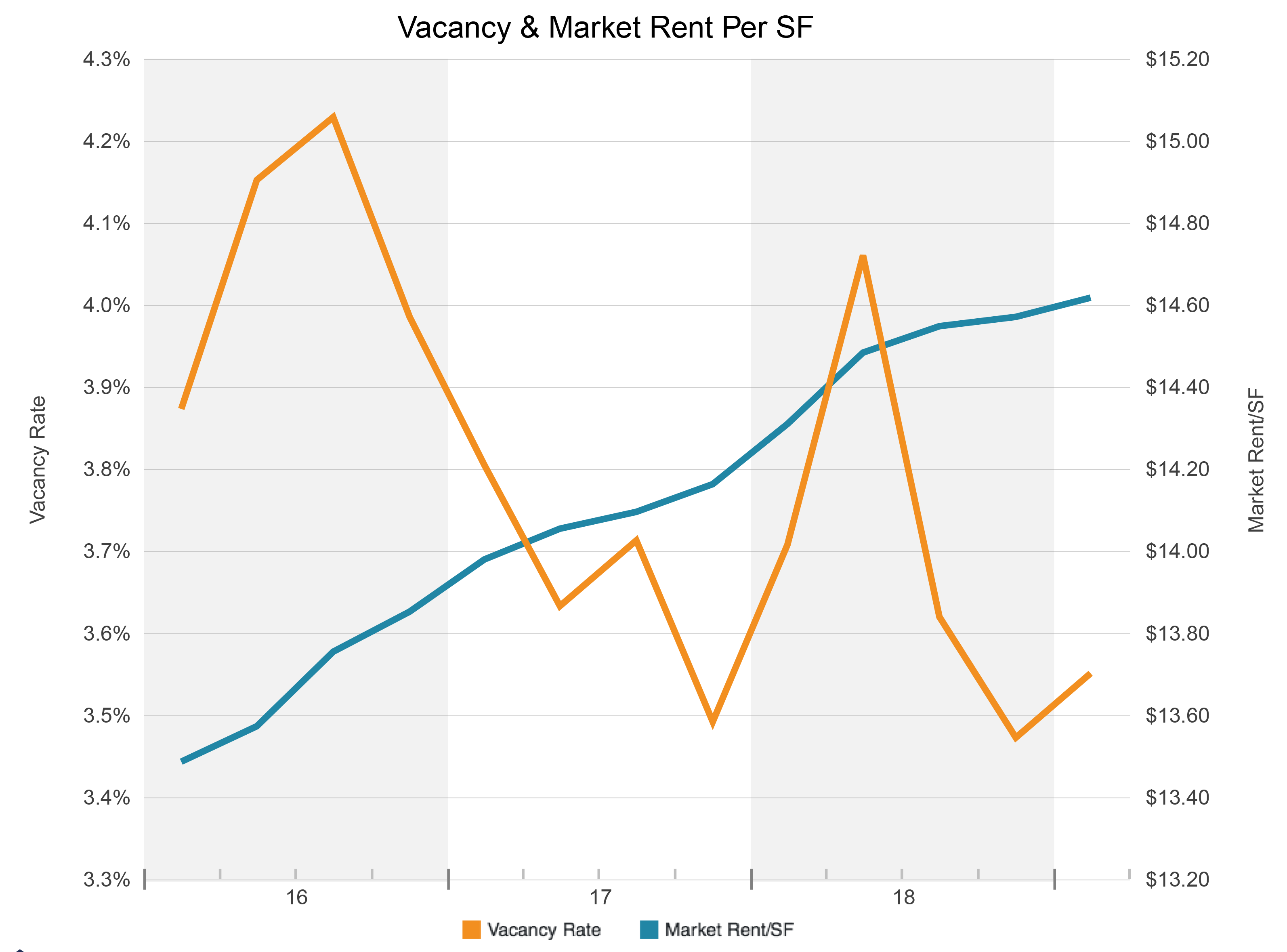

Vacancy & Market Rent Per SF

“Average rents have risen $1.00 PSF over the last three years as vacancy stays below 5%”

Contact our advisors to see how they can help you with your property

Northern Colorado:

970.207.0700

2032 Lowe St. Suite 101

Fort Collins, CO 80525

Denver Metro:

303.632.8784

414 14th St. Suite 100

Denver, CO 80202

In all there were over 100 sales deals and over 100 lease deals in the Boulder/Weld/Larimer county region in northern Colorado commercial real estate activity. Additional sales included the trade of The Ardenne Apartments in Lafayette which sold for $38 million to a Boston MA entity. The complex sold for $237,500 per unit, or $38 million. A 41,000 SF multi-tenant office building on McCaslin blvd. in Louisville sold for $7.5 million to local developer and property owner Tebo Properties. This property houses shared workplace Office Evolution as one of its primary tenants. The sale calculated to $185 PSF, which compares favorably when compared to the Pearl East sale noted above.

Private investors always make up most of our sales transactions in the tri-county northern Colorado commercial real estate market. The soon to open Everbrook Academy, an early childhood pre-school, was sold after a build-to-suit placement of the La Petite Academy affiliate was made on the strong Harmony Corridor area of Fort Collins. The sale was approximately $6.2 million. The tenant had signed a long term lease prior to the sale of the new building.

King Soopers grocery (Dillon Companies) bought out a leasehold interest on their CSU-centric store on Taft Street in Fort Collins. The 101,000 SF center (of which King Soopers is the major occupant) leasehold interest sold for $5.3 million. Six years remain on the ground lease at the center, which helps explain the low $53 PSF purchase price.

Longmont featured two larger deals. A 13 acre commercial site on Ken Pratt Blvd. and 3rd sold for $5.15 million or $9.20 PSF of land. In a separate deal, a $7.2 million sale of a flex office campus on Kansas Ave. sold to a private investment group out of Boulder. The four building 57,600 SF campus includes multiple tenants including Complete Home Health Care, CivilArts Engineering, and Frontier Communications. The sale was reported at slightly above a 7% cap rate, and calculated to $125 PSF.

Louisville’s Colorado Technology Center (CTC) always features big deals and January was no exception as the Allen Company leased 165,000 SF of high-bay class A flex and warehouse space. Rents were reported at $11.95 PSF plus triple nets which are about $1.00 PSF higher than the surrounding market averages.

Firestone CO featured a 23,500 SF lease by Wadsworth Construction in a new warehouse facility. Rates there were reported at $12.00 PSF plus triple nets.

2019 appears to be off in a strong manner in NoCO CRE terms!

In all there were over 100 sales deals and over 100 lease deals in the Boulder/Weld/Larimer county region in northern Colorado commercial real estate activity. Additional sales included the trade of The Ardenne Apartments in Lafayette which sold for $38 million to a Boston MA entity. The complex sold for $237,500 per unit, or $38 million. A 41,000 SF multi-tenant office building on McCaslin blvd. in Louisville sold for $7.5 million to local developer and property owner Tebo Properties. This property houses shared workplace Office Evolution as one of its primary tenants. The sale calculated to $185 PSF, which compares favorably when compared to the Pearl East sale noted above.

Private investors always make up most of our sales transactions in the tri-county northern Colorado commercial real estate market. The soon to open Everbrook Academy, an early childhood pre-school, was sold after a build-to-suit placement of the La Petite Academy affiliate was made on the strong Harmony Corridor area of Fort Collins. The sale was approximately $6.2 million. The tenant had signed a long term lease prior to the sale of the new building.

King Soopers grocery (Dillon Companies) bought out a leasehold interest on their CSU-centric store on Taft Street in Fort Collins. The 101,000 SF center (of which King Soopers is the major occupant) leasehold interest sold for $5.3 million. Six years remain on the ground lease at the center, which helps explain the low $53 PSF purchase price.

Longmont featured two larger deals. A 13 acre commercial site on Ken Pratt Blvd. and 3rd sold for $5.15 million or $9.20 PSF of land. In a separate deal, a $7.2 million sale of a flex office campus on Kansas Ave. sold to a private investment group out of Boulder. The four building 57,600 SF campus includes multiple tenants including Complete Home Health Care, CivilArts Engineering, and Frontier Communications. The sale was reported at slightly above a 7% cap rate, and calculated to $125 PSF.

Louisville’s Colorado Technology Center (CTC) always features big deals and January was no exception as the Allen Company leased 165,000 SF of high-bay class A flex and warehouse space. Rents were reported at $11.95 PSF plus triple nets which are about $1.00 PSF higher than the surrounding market averages.

Firestone CO featured a 23,500 SF lease by Wadsworth Construction in a new warehouse facility. Rates there were reported at $12.00 PSF plus triple nets.

2019 appears to be off in a strong manner in NoCO CRE terms!