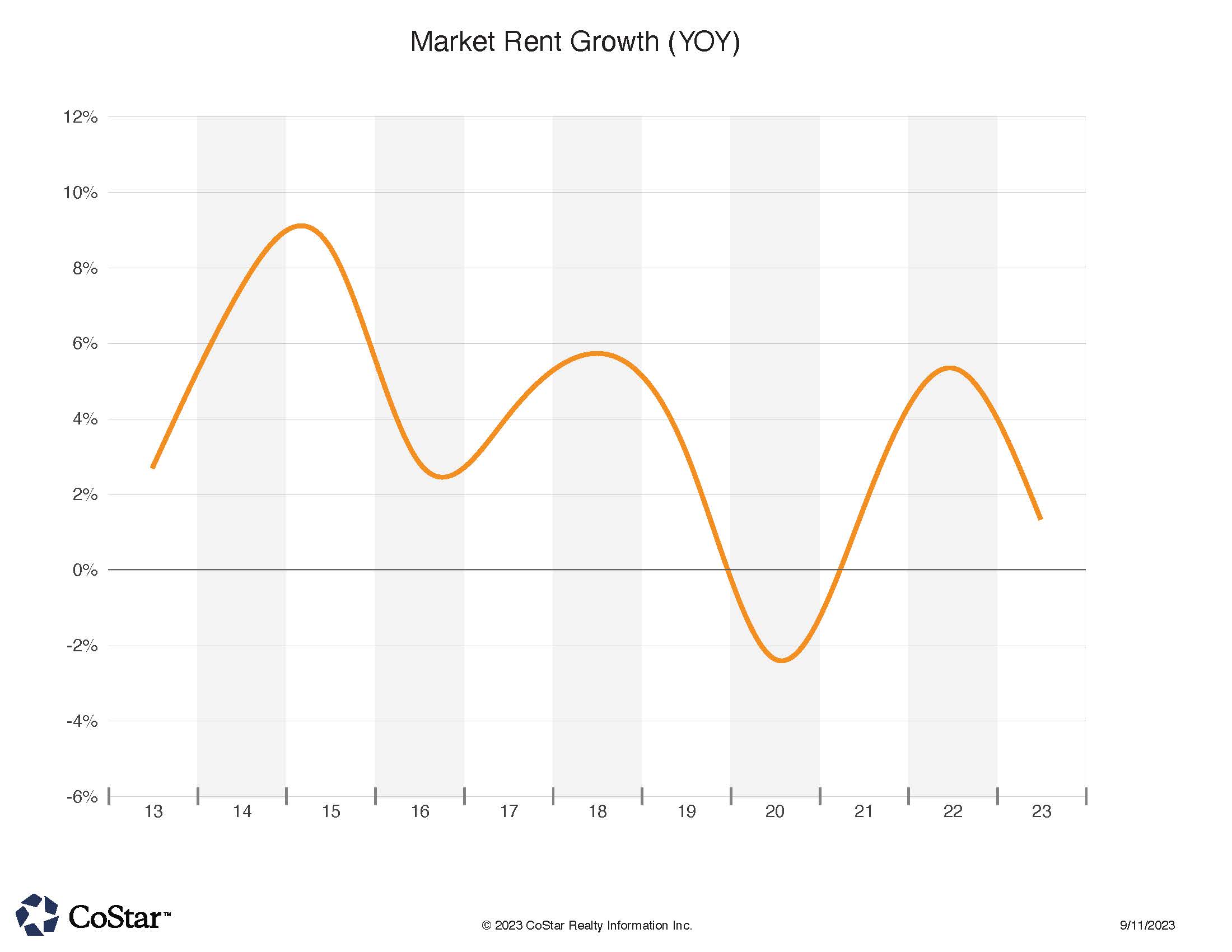

NoCO Rent Growth on Lower End of 10 Year Averages as Office Demand is not Strong Enough to Drive Increases

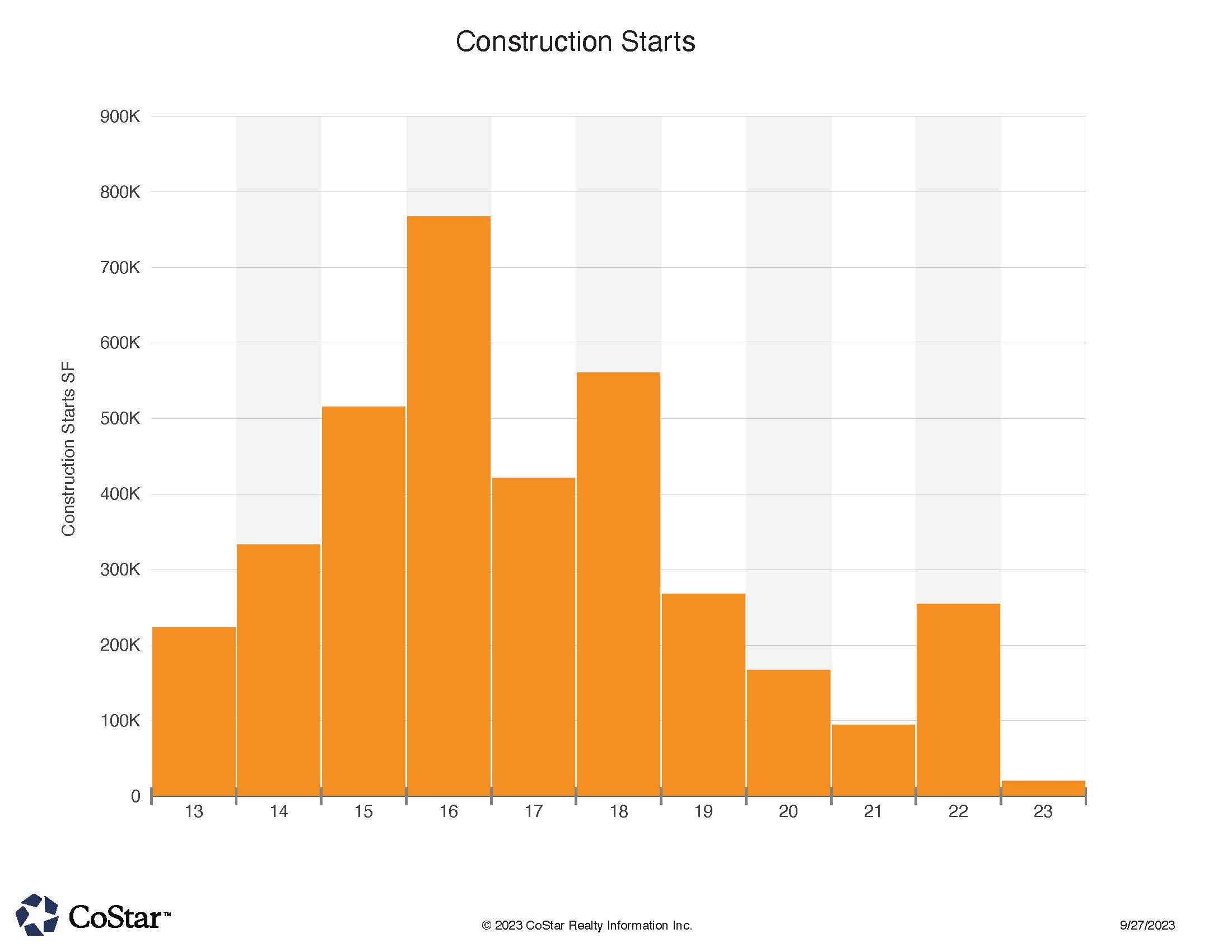

NoCO Construction Starts virtually at Stand-Still in NoCO compared to 10 year Averages, as Developers stay Cautious

Economic vitality lies with sectors not as greatly impacted by the current interest rate environment. In the tri-counties of Boulder, Larimer and Weld in Colorado, that was reflected in commercial real estate trades in August. Medical, government, and general industrial sectors were the most active Buyers and Sellers last month.

Boulder county is the one location in NoCO which often features portfolio sales closings, and August presented us with the newly constructed two building Medtronic campus in Lafayette, trading at $188 million. Real Capital Solutions, based in nearby Louisville, purchased the property from Ryan Companies in Minnesota with a new 20 year lease in place. The medical industry single-tenant occupied campus sold for $532 per square foot.

Three industrial property trades made the top 10 in the region last month. An Englewood CO investment group purchased a 68,000 SF light-industrial property in Johnstown CO for $14.6 million or $422 PSF. Kimbel Mechanical Systems occupies half of the property. The property lies within the Ironstone Business Park off highway 34 in Johnstown CO. Secondly, a 36,000 SF vacant newly constructed light-industrial property in Loveland CO sold for $8,528,000 or $239 PSF. This property will be occupied by the buyer: Colorado Flooring company. Then, an occupied 32,000 SF Erie CO property was purchased for $5.52 million, or $175 PSF, and at a reported 6.1% cap rate by an Englewood CO private investor. The current tenant is Magnum Plastics.

NoCOCRE often features I-25 interchange gas service station sales in top 10 trade activity and the $6.7 million sale of the 7-11 station in Firestone adds to the list. In this case an investment group out of Atlanta GA purchased the property at a reported 4.95% cap rate. Price per square foot slightly exceeded $1,200 for the property.

Land sales in a growing region are also active. In August, a 40 acre commercial tract in Greeley CO sold for $2 PSF, or $3.31 million. Weld county itself bought the property which is near the Greeley-Weld county airport. Another airport adjacent property sold, this time 60 acres at $1 PSF to the Housing Authority of Weld County. A 3.82 acre farm with commercial development option sold in Longmont for $13 PSF. The Peacock Farm included residential and farm structures. The property had been run as a nursery, and now sits in an area that the town of Lyons is reportedly interested in annexing if there is a commercial development.

Office properties have not traded during the economic interest rate environment and uncertainty about future occupancies of office properties. Nevertheless, a Louisville Main St. property, 7,346 SF, sold for $2,025,000 to an Arvada CO buyer. Tenants in the property are primarily medical industry oriented, and the purchaser utilized a 1031 tax-exchange strategy in the sale.

Finally, on the self-storage sector front, August featured the $1.3 million sale of a Keenesburg CO storage complex. The 14 acre property has the ability to double it’s current capacity of 56,000 SF. Reported cap rate is just above 7%.