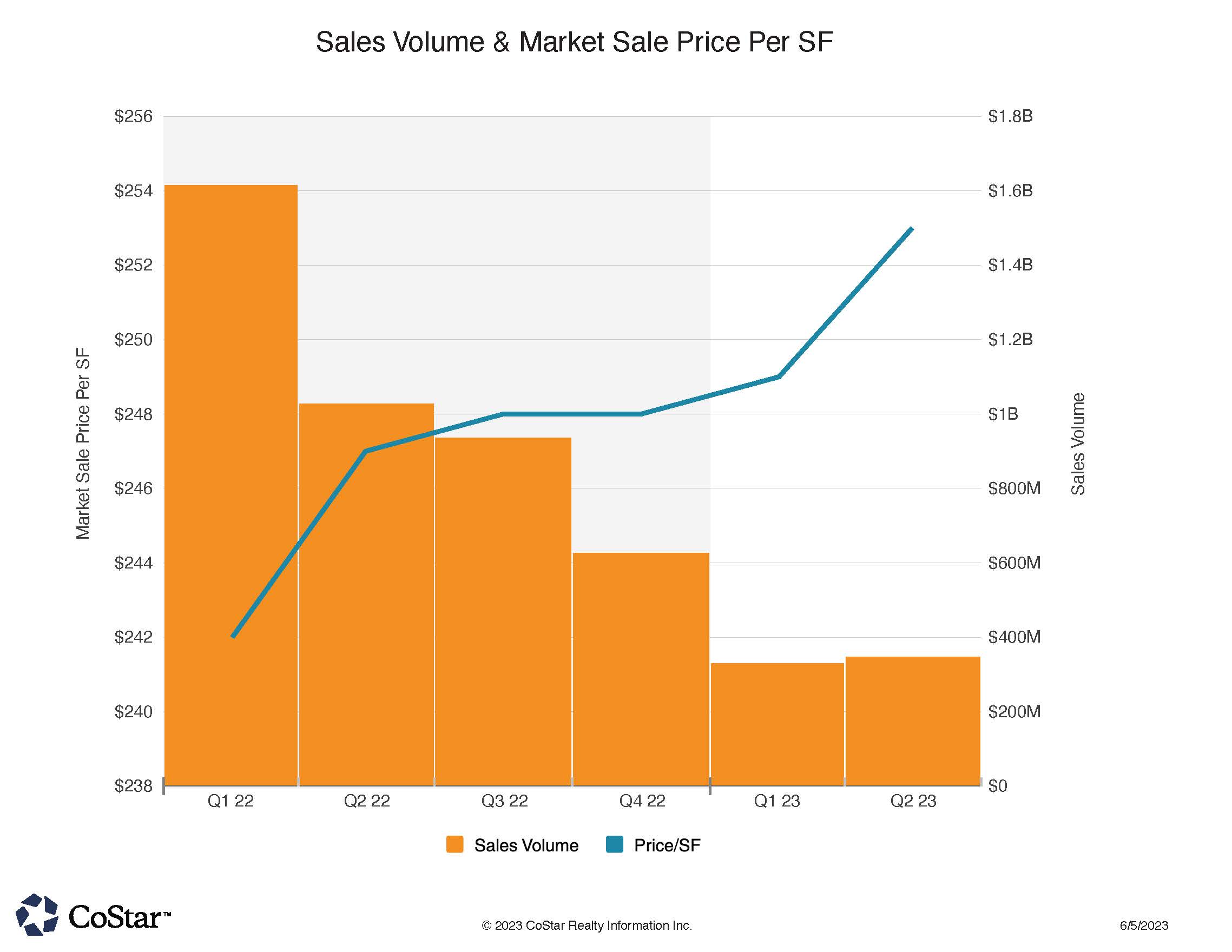

Q2 Sales Already Ahead of Q1, 2023 in NoCOCRE

Q2 2023 Pricing Shows Definitive Rise on Recent Sales

The #NoCOCRE market in the tri-county area of Boulder, Larimer and Weld counties of Colorado rebounded somewhat with 166 sales deals trading over the two month period. 80+ trades a month are a rebound from Q1’s lackluster start to this year. Of note is that almost half the sales were classified as investment sales, as opposed to owner-occupancy sales. Investment sales had been suppressed for most of this year due to relatively high interest rates.

Those investment sales happened to also be the larger deals of that two month prior period. The largest deal was the $108 million Savannah Nine Mile apartment complex sale in Lafayette CO. A Chicago IL based equity company bought the 287 units for $367,000 per unit. The unit mix was mostly 1 or 2 bedroom units. Seller was a Phoenix development group who built the property just within the last two years.

We then jump down to a $37.5 million transaction of the Plaza on Broadway student apartments in Boulder. This 39 unit property traded at $961,000 per unit. The ultra-high price was obtained with the Buyer out of Athens GA. Seller was a Californian private equity fund. The property was constructed in 2012.

A roughly 10 acre east Boulder industrial land site was acquired by a joint venture of local developers Brue-Baukhol and Schnitzer West who has been active both in Denver metro and Seattle metro areas with specialized office properties. The property sold for $19 million or $46 psf. The duo plans a 216,000 R&D campus. Pricing per planned “buildable square foot” is approximately $88.

Dellenbach Motors in Fort Collins bought a 52,000 free-standing retail property close to mid-town College Ave. for $9.25 million or about $177 per square foot. Current primary tenant is Shamrock Distributing (food service). Dellenbach is likely planning on expansion into the property upon the sunsetting of the existing leases. They already occupy about one-quarter of the property which abuts its other properties in the area.

Longmont was the location for the next two largest deals. A 27 acre land parcel near Amgen and the Longmont airport sold for $7 psf, or $8.34 million to Modern West land development which is active in the area. In an April trade, Walmart sold some excess land it had at 2514 Main St. to a local developer. Price of this transaction was $7.58 million.

Journey Homes purchased 62 acres of residential land in Windsor for $7.44 million or $3 PSF. Journey is one of Northern Colorado’s largest homebuilders and the purchase demonstrates that homebuilding is still active despite the rise in interest rates. It could also be a positioning awaiting a drop in interest rates and an inventory hold in the meantime.

Greeley has had a continuing high interest in industrial space, and a sale on “F” Street on the city’s north side illustrated that again. In this case, a $5.55 million sale of an oilfield services company’s regional facility was sold to a Greeley based investment group which largely holds properties in Great Britain. The 8,000 SF subject property traded at over $660 PSF.

Finally, not to be forgotten, Estes Park in Larimer County featured in a sale over $5 million ($5.2 million in this case). The 21 unit Streamside on Fall River lodging facility sold to Estes Hospitality in Fort Collins. Seller was out of California. The recently remodeled property sold for $245,000 “per key”.