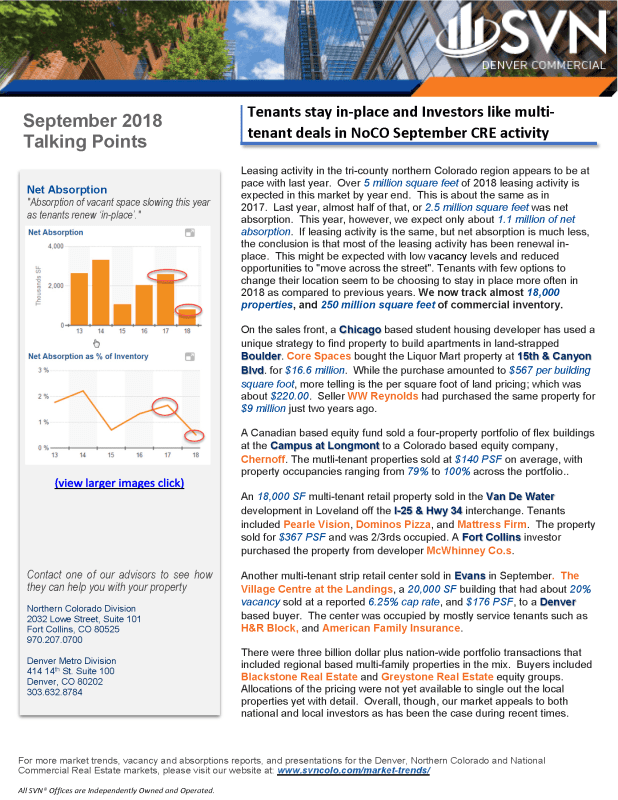

Leasing activity in the tri-county northern Colorado region appears to be at pace with last year. Over 5 million square feet of 2018 leasing activity is expected in this market by year end. This is about the same as in 2017. Last year, almost half of that, or 2.5 million square feet was net absorption. This year, however, we expect only about 1.1 million of net absorption. If leasing activity is the same, but net absorption is much less, the conclusion is that most of the leasing activity has been renewal in-place. This might be expected with low vacancy levels and reduced opportunities to “move across the street”. Tenants with few options to change their location seem to be choosing to stay in place more often in 2018 as compared to previous years. We now track almost 18,000 properties, and 250 million square feet of commercial inventory.

Leasing activity in the tri-county northern Colorado region appears to be at pace with last year. Over 5 million square feet of 2018 leasing activity is expected in this market by year end. This is about the same as in 2017. Last year, almost half of that, or 2.5 million square feet was net absorption. This year, however, we expect only about 1.1 million of net absorption. If leasing activity is the same, but net absorption is much less, the conclusion is that most of the leasing activity has been renewal in-place. This might be expected with low vacancy levels and reduced opportunities to “move across the street”. Tenants with few options to change their location seem to be choosing to stay in place more often in 2018 as compared to previous years. We now track almost 18,000 properties, and 250 million square feet of commercial inventory.

On the sales front, a Chicago based student housing developer has used a unique strategy to find property to build apartments in land-strapped Boulder. Core Spaces bought the Liquor Mart property at 15th & Canyon Blvd. for $16.6 million. While the purchase amounted to $567 per building square foot, more telling is the per square foot of land pricing; which was about $220.00. Seller WW Reynolds had purchased the same property for $9 million just two years ago.

A Canadian based equity fund sold a four-property portfolio of flex buildings at the Campus at Longmont to a Colorado based equity company, Chernoff. The mutli-tenant properties sold at $140 PSF on average, with property occupancies ranging from 79% to 100% across the portfolio..

An 18,000 SF multi-tenant retail property sold in the Van De Water development in Loveland off the I-25 & Hwy 34 interchange. Tenants included Pearle Vision, Dominos Pizza, and Mattress Firm. The property sold for $367 PSF and was 2/3rds occupied. A Fort Collins investor purchased the property from developer McWhinney Co.s.

Another multi-tenant strip retail center sold in Evans in September. The Village Centre at the Landings, a 20,000 SF building that had about 20% vacancy sold at a reported 6.25% cap rate, and $176 PSF, to a Denver based buyer. The center was occupied by mostly service tenants such as H&R Block, and American Family Insurance.

There were three billion dollar plus nation-wide portfolio transactions that included regional based multi-family properties in the mix. Buyers included Blackstone Real Estate and Greystone Real Estate equity groups. Allocations of the pricing were not yet available to single out the local properties yet with detail. Overall, though, our market appeals to both national and local investors as has been the case during recent times.