Still a ways to go to catch up to the 5 year Sales Average in NoCOCRE

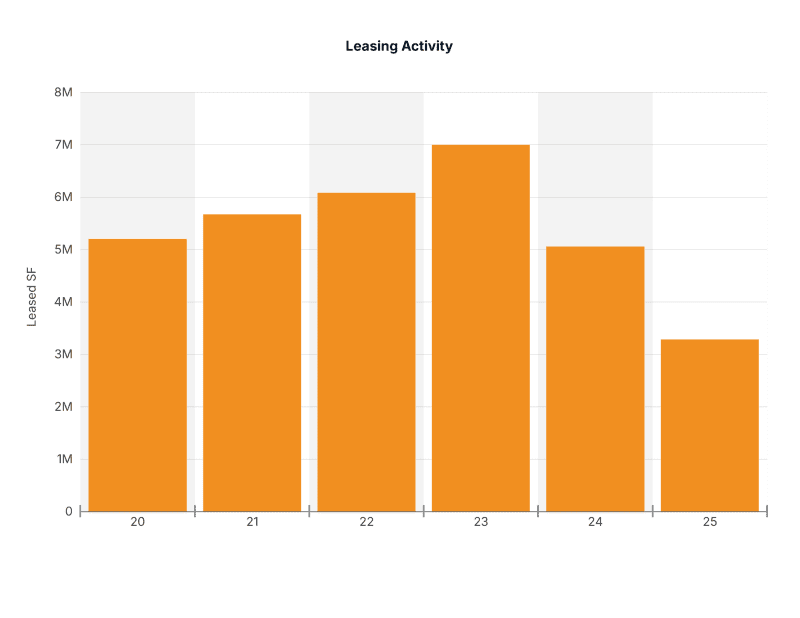

Still a ways to go to catch up to the 5 year Leasing Activity Average in NoCOCRE

Contact our advisors to see how they can help you with your property

Returning to a more “normal” monthly statistic, the tri-county NoCOCRE region had 78 sales transactions in August. A few portfolio deals featured within these sales numbers, helping drive the transaction numbers up. Well located properties with strong tenants or demand drivers continue to sell in the region at higher prices, while other sales are opportunistic or bets on the future viability of the locations.

On the retail side, the 15 building Promenade Shopping Center on the east side of Centerra in Loveland CO, sold for $55 million or $111 PSF, to the Galway Companies out of Wisconsin. Seller was KeyBank, and the property was a REO sale. Cap rate was reported as 10.6% with Dick’s Sporting Goods, Express, Best Buy, MetroLux Theaters, and Barnes and Noble amongst the tenants in place. The Promenade has had a volatile history, and this purchase is at a price below previous sales.

The next largest trade was for $27.8 million as the Copperleaf Place apartment complex sold to a Walnut Creek CA investment entity at a reported 4.74% cap rate. The 94 unit complex priced out at about $296,000.00 per unit. Located on S. Shields 72 of those units are one bedroom apartments. Seller was from Boulder.

Kodak Alaris out of Los Angeles CA sold off a large piece of the former Kodak industrial park to MAG Capital Partners out of Dallas TX for $23 million, or about $30 PSF. The properties were constructed in 1971. The 770,000 SF manufacturing facilities had been occupied by the Eastman Kodak Co. from onset.

A flex property in Fort Collins on Automation Way sold for $8.9 million, or $205 PSF. Buyer is the Axis International Academy, a non-profit school organization. Seller was CBW Automation out of Fort Collins. The property featured an additional 2 acres of yard space that may be utilized for outdoor sporting and recreation space by the school.

The 12 room boutique Bradley Hotel in downtown Boulder was acquired by a property group out of Ann Arbor Michigan for $8.1 million. The price translates to $675,000 per room or “key”. Seller was an individual from Boulder.

A two property industrial portfolio on Conestoga st. in Boulder, sold to JW Advance out of Boca Raton FL. The $9.56 million trade was at a reported 3.83% cap rate, and about $215 PSF. Golden CO based The Bailey Company was the Seller. BAE Systems is the tenant in both properties. With replacement costs prohibitive in Boulder, industrial properties continue to sell at high prices and thus low cap rates.

Local individuals in Fort Collins purchased the multi-tenant retail property at 2700 S. College for $4.75 million or about $157 PSF. Tenants include Fig Leaf Furniture, Core Power and Konica Minolta Business Solutions. Seller was also local to Fort Collins.

The distinctive Red Barn Liquors building in Berthoud sold for $3.57 million or $425 PSF to a Buyer out of Tucker GA. Seller was out of Lenexa Kansas. The property is across the street from the Buc-ee’s retail and gas tation center off I-25.

Finally, in a 25 acre industrial zoned land deal, the Windmill Ventures site in Brighton, just east of the UPRR Rail site and Vestas Wind location, sold for $2 PSF, or $2.2 million. Buyer is a private trust out of Castle Rock, and Seller was Castle RV in Brighton.