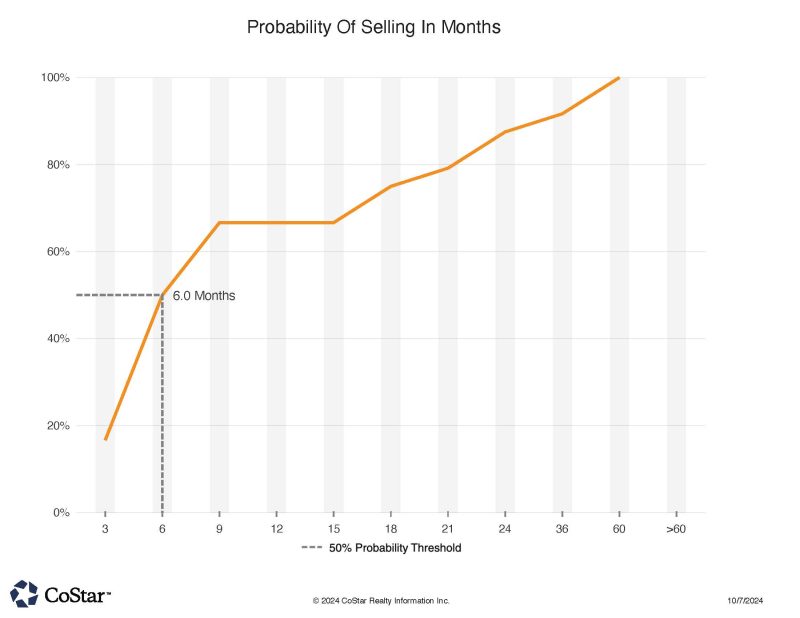

One half of the sales occured within 6 months of original listing. The other half were on the market as much as five years.

The most popular price range of properties sold last month was between $1.8 million and $3.6 million. The majority though were under that amount.

September continued the rather sluggish summer activity in the NoCO CRE market of Boulder, Larimer and Weld counties. Only 51 deals were executed last month, and sales prices were 10% below ask prices. Perhaps the fourth quarter will be more active than the 51 closings pace we had in September.

The multi-family sector had a couple notable transactions to lead the region. The Roundhouse group out of Boise ID bought CO based McWhinney’s “Clovis Point” apartment complex in Longmont for $75 million. Of note, the trade as at a low cap rate, reported at 4.5%. The 208 unit property sold for just over $360,000 per unit and was originally developed in 2020. Critically, a debt assumption was part of the deal, no doubt having a much lower interest rate than what is available today otherwise.

The second multifamily deal was a $42 million sale of the Louisville CO “Delo” apartment complex. Buyer was Hudson and Grove out of Lakewood CO. Seller was from Boulder CO. The trade price per unit was about $323,000.00. Cap rate was not available. The property was built in 2017 and has 130 units.

A two-property trade involved another retail sector sale with the trade of the South College Shops in Fort Collins. Total price for the two buildings was $5.1 million or $252 PSF. Both Buyer and Seller are out of Colorado. Buyer utilized $6.3 million in bank financing, indicating plans for remodel of the existing buildings which date to the 1970s.

Next in pricing order was a $3.5 million retail sector building sale. The Mash Lab Brewing building in Windsor sold to a Colorado based individual. Price per square foot was $350 for the 2021 constructed facility. A second tenant is also at that location. Seller was out of Windsor CO.

The Boulder CO Twin Lakes Inn, a 32 room hotel in the Gunbarrel region of Boulder, sold for $3.38 million. Price per key is about $105,500.00. Both Seller and Buyer are out of Texas for this hospitality industry property.

Industrial buildings are still popular in the region, and one on Western Ave. in Boulder traded for $3.13 million, or $182 PSF. The property was purchased by a neighbor in that area. Seller was also out of Colorado. A significant amount of space in the building is dedicated to lab and R&D setup, typical of Boulder area industrial buildings in the near vicinity.

Boulder was the location for an office building sale at 16th and Pearl Street near the Pearl St. Mall. The property traded at $3.06 million or about $395 PSF. About half the building was vacant at time of sale, positioning the property for owner-user and investment opportunity.

Finally, a Windsor CO Buyer and a Windsor CO Seller collaborated on a $2.95 million trade of a flex/industrial/retail property along the Mulberry corridor of Fort Collins CO. Cap rate was reported to be 7.17% for the building, and price per square foot was $162 approximately. The largest tenants are Front Range Pool Table and Signarama.