Over 3 million SF of Planned Industrial Development for Weld County Could Change the Industrial Market over the Next Several Years

That assumes all planned projects will actually be built!

Almost $175 million of commercial real estate traded hands over the last two months in the NoCO region of Boulder, Larimer, and Weld counties. 85 market transactions occurred during this period, with Industrial properties ($65 million) and Multifamily properties ($40 million) accounting for the majority of the larger deals.

The largest sale was a $32 million apartment complex in Boulder. The 82 unit Henley & Remy property was sold by the San Diego seller to a Denver based private company for what was reported to be a record price per unit for a pre 1980’s complex ($394,000).

Industrial properties made up 24 of the 85 sales. This category has remained strong during the Covid era, and the sale of the former HP complex in Loveland is testimony to that confidence in the product type. Local Loveland investors picked up the Rocky Mountain Center for Innovation and Technology for $15.5 million. With a total square footage of 811,000 SF approx., this property complex sold for a price of only about $19 PSF. Since HP left the complex, it has historically had high vacancy and was difficult to demise into multiple smaller spaces. With other industrial properties selling well above $100 PSF, the Buyers will have room to spend additional funds to reconfigure the spaces and still be at or below market pricing.

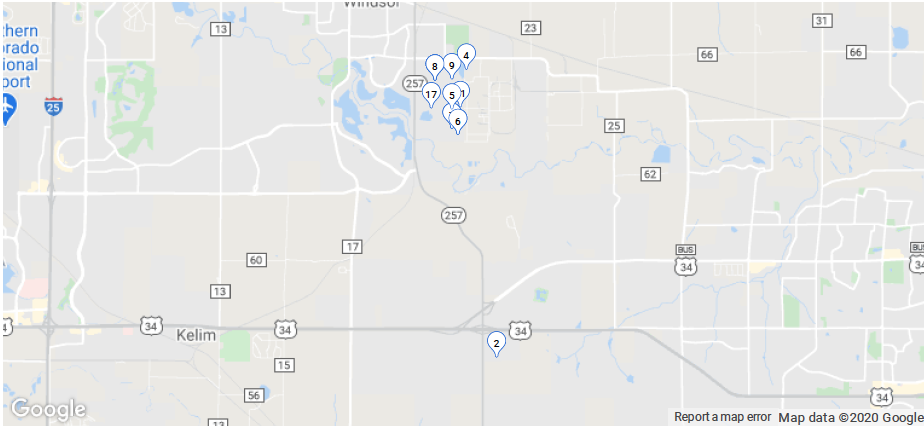

Additional Industrial sales were noteworthy as well. A 69,000 SF Flex Industrial property on Boeing Dr. in the Fort Collins-Loveland Airpark development area sold for $6.9 million, or about $100 PSF. The Wisconsin seller sold the property to a Golden CO investor. Rubadue Wire Co. is the long term tenant in place at that building. A 30,000 SF Industrial property on SW Frontage Rd. in Fort Collins sold for $4.75 million. The fully occupied three tenant building included Pro-Coat/Beacon Roofing Supply, which is a NASDAQ listed firm. Buyer was from Henderson CO. Another investment deal in the Industrial property type was a $4.4 million sale of 19,500 SF in Platteville CO. That property sold at a reported 9.55% cap rate, which is significantly higher than other market transactions. The cap rate reflected the exposure of the property to the energy industry which is under heavy regulatory pressure in Colorado and many firms are reducing their Colorado based operations in that industry.

In the office sector a former medical office building on Kendall Dr. in the Loveland Crossroads area sold as a foreclosure to a local Loveland based group. The former 70 bed rehabilitation clinic sold for $13 million, or almost $200,000 per bed. Such pricing reflects the high cost of a skilled nursing facility buildout compared to standard office properties. The facility was never occupied after it was built, and is in new condition.

In the land sector, a Florida home builder purchased a 34 acre single family development site comprising 205 homesites, for $23.6 million from a local developer in Fort Collins. This rate of almost $100,000.00 per finished lot reflects the selling prices of finished homes in the area which exceed $500,000 per home. Typical land component of a finished home is approximately 15-20% of the final selling price of the home.

Boulder continues to draw interest from firms seeking to capitalize on a highly educated workforce and the ability to recruit the same from across the nation. Accordingly, the Railyards at S’Park announced a 65,000 SF office lease to Twitter to lead all categories as the largest single lease during the 60 days covered herein. Only slightly behind that significant lease was a 60,000 SF industrial lease to PetDine in Greeley.