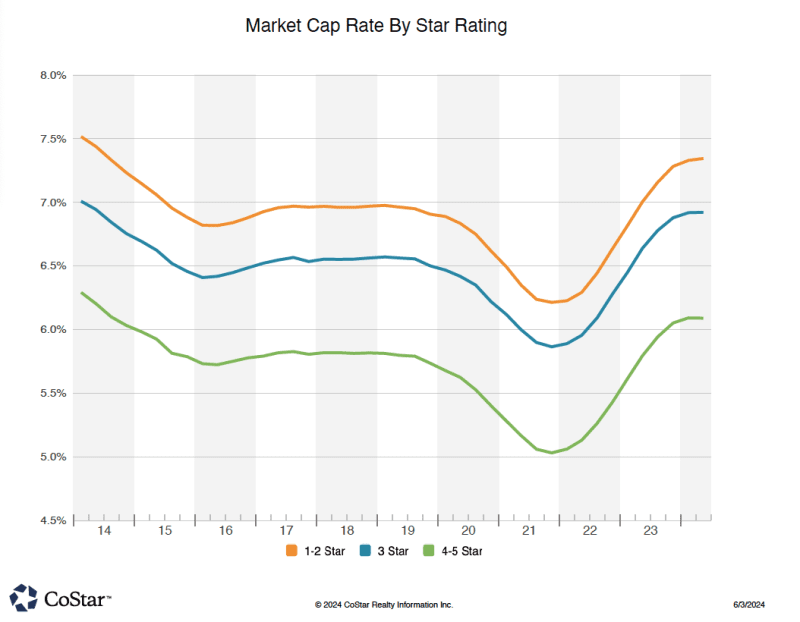

Market cap rates in NoCOCRE have risen to close to a 10 year high

Almost 150 basis point difference in cap rates based on property quality in the NoCO region

Our Boulder, Weld and Larimer county region has been somewhat in the doldrums for almost two years now. We used to chart over 80 commercial real estate sales transactions a month in the region, and we’ve dropped down to maybe 50 as of late. However, we are now tracking 68 properties reported as under contract during the month, so it appears we have a higher level of activity in our near future.

A look at those deals that did transact and close during the month gives us an insight as to what the market is looking for. Out of the $269 million of sales, half of those transactions were under $300 PSF and half over. Also, the majority of the sales were higher-rated properties (4-5 star vs. 1-3 star utilizing Costar’s methodology). 65% of the sales went to private party or owner-occupants. As always, the handful of institutional or private equity fund deals tend to be high-dollar sales which prop up the averages, but are for fewer properties.

Kairoi Properties out of Texas bought the largest deal last month. Grifis 3100 Pearl, a 319 apartment building in Boulder, sold for $159 million, or almost $500,000 per unit. As a case in point from our commentary above, a single transaction like this can skew one’s view of the market without deeper analysis.

We “drop” down to $21.7 million for our second largest sale in May. Another apartment community, View House at 949 Marine St. in Boulder was purchased by an investment group out of Ohio. This transaction amounted to almost $680,000 per unit, and sold at a reported 5% cap rate.

Industrial properties have been attractive to both investors and occupants in NoCOCRE activity as of late, and the third largest sale was a 108,400 SF occupied warehouse in Frederick, which sold for $14. million or $131 PSF. This property was a sale-leaseback arrangement with the Seller (Star Precision) remaining as Tenant. Cap rate reported on this trade is 7.66%. We’ve seen about one-a-month of these sales-leaseback arrangements in our region this year.

The residential development market seems to have restarted in our region and this was supported by a $7.1 million land sale to DR Horton in the Johnstown area. The 20 acre parcel will soon be home to an 80 unit residential tract. Likewise, in the same The Ridge development site, another 20 acres was sold to Journey Homes for the purpose of constructing a 378 unit multifamily complex. This traded for $5.2 million.

Area developer Schuman Companies announced another few sales in their redeveloped Loveland Yards project. This former retail center has been redeveloped for multiple uses, and this latest trade was for $5.85 million, or $230 PSF, to Auto Trends out of Fort Collins. Buyer will likely occupy the 25,000+ SF at the site. The second sale was for about $5 million to a private individual out of Loveland. This building sold for $187 PSF. Use anticipated is not yet announced, but the buyer is associated with a shared services office business in Loveland.

The last sale of interest in May for us to cover is the trade of The McGregor Lodge in Estes Park. Hospitality property sales in Estes Park are one of the leading commercial property types we see. This 19 room lodge sold for $4.3 million at a reported 9.2% cap rate to a local private individual. Hospitality properties include the business aspect of it, so it is hard to analyze the price without knowing the underlying business operation. In this case the sale was at $226,000 per “key” or room.