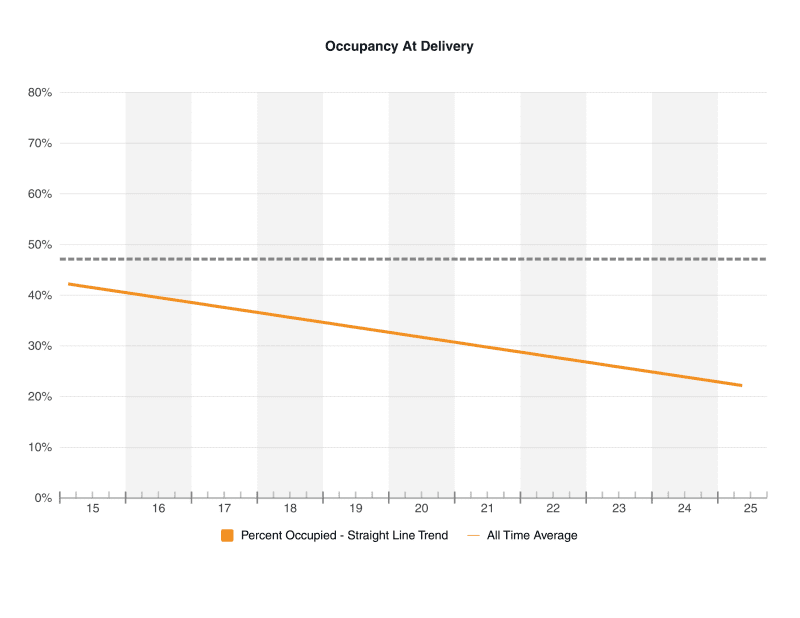

Occupancy at Time of Construction Delivery has steadily Declined over the last 10 years in NoCO tri-county region

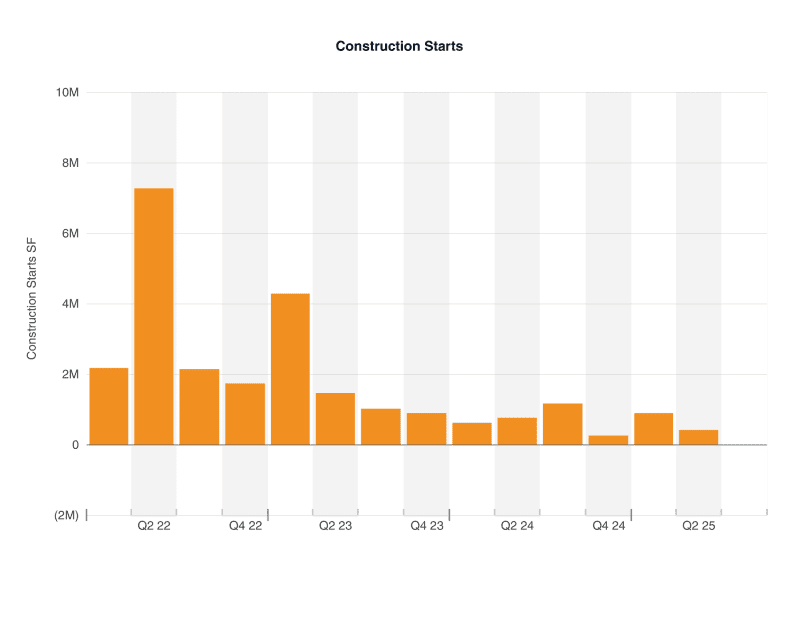

NoCOCRE Construction Starts rate has been declining over the last 3 years, likely due to interest rates and slower lease up rates

With nearly 70 sales closings and 70 other properties reported as “under contract” the tri-county northern Colorado area was almost “back to normal” in terms of transaction activity. The month only featured one blockbuster sale, but other higher value transactions featured across all commercial property types.

Aura Colliers Hill, a 329 unit multifamily project for $111 million. The Seller was a Texas entity, while the Buyer comes from the Denver metro area. The property was delivered in 2023, and sold for $337,000 per unit approximately.

This high ticket sale was followed by a $9.3 million health oriented facility on Fordham street in Longmont. Cascade Capital out of Illinois bought the facility from a Texas investment group. The property is occupied by ACCEL, a senior living facility. Price per square foot calculates to about $120 PSF.

A 41,000 SF warehouse in Hudson sold for $8.8 million or $215 PSF. A private individual from Nebraska purchased the building, currently occupied. by Active Truck Parts and Sales as the tenant. Seller was a private party with a LaSalle CO address.

Resurrection Fellowship out of Loveland sold a 38 acre land parcel to a developer (Schumann Co.s) for $4 PSF or $7.29 million. The developer has been most active in the commercial sector of real estate development in the past and the land parcel is near other commercial developments on Crossroads Blvd. in Loveland.

A Taco Bell / 7-11 store combination building as been sold in Johnstown for $6 million, which is over $1,300 PSF for the convenience store / gas station / restaurant retail property. Buyer is a real estate development company out of Florida, and the Seller is from local Gilcrest CO. Another investment sale in the region featured the All Seasons Luxury Garages on 66th st. in Loveland, which were packaged up as an investment property sale. The 24 unit “luxury” warehouse property sold for $5.5 million, at a reported 4.49% cap rate to the Buyer who is a private party out of Colorado Springs CO. Units are in the 1,000 – 2,400 SF range each. A third investment deal was the sale of the Heartland Dental clinic in Johnstown for $3.2 million or $760 PSF. Buyer in this investment sale is a private local real estate entity, and the Seller was from the Kansas City area.

The second largest strictly multifamily sale in NoCOCRE trades ,during June, was an eight-plex sale in Greeley on 17th st. This property sold at a reported 6.02% cap rate to a local individual investor, and the Seller is also local (out of Windsor CO). This property was built in 2005.

Finally, the Farm Credit Services office building in sold from Ag Credit in Greeley to Ag-professionals in Greeley. The 23,000 SF building sold for $5 million, or $215 PSF.