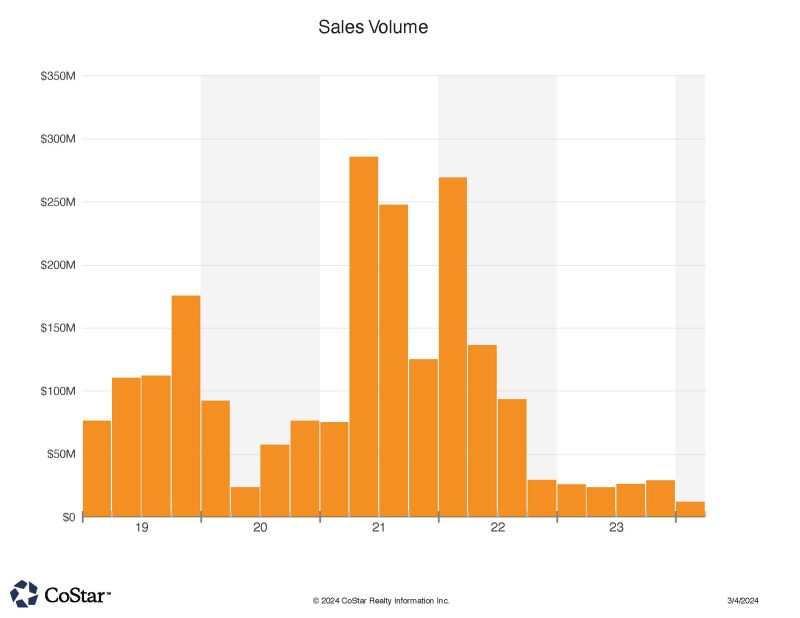

NoCOCRE Sales Volume Staying Low since end of 2022

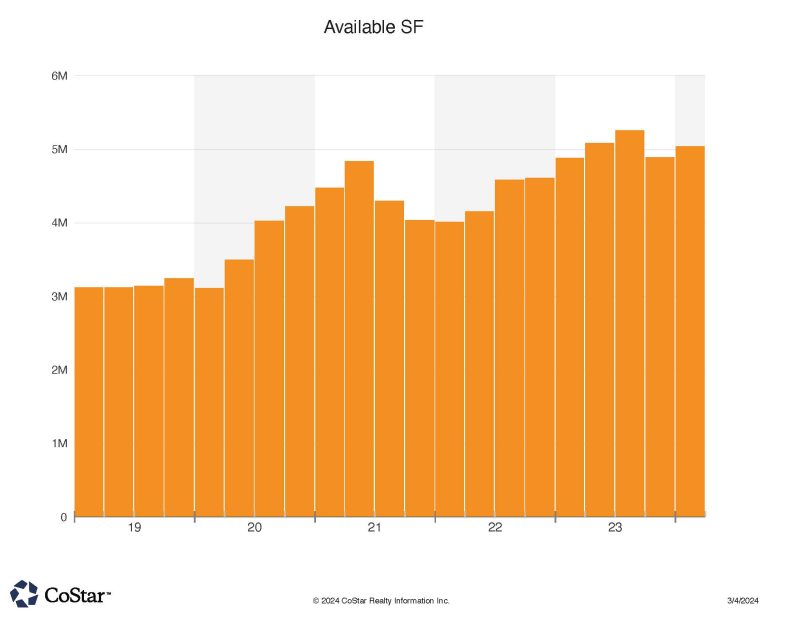

NoCOCRE Space Availability has reached 5 Million Square Feet

The month of February 2024 did not show a pickup in commercial real estate transactions in NoCOCRE territory, even with the extra Leap Year day. We usually expect about 80-100 transactions throughout the tri-county region of Larimer, Weld and Boulder, yet we only had about half that number. Nevertheless, we can see some trends worth noting. Longmont, on both its west and east sides, experienced the most notable activity.

The largest sale was a two property apartment complex portfolio sale in Longmont, totalling $112.5 million. Fairfield Residential equity group out of San Diego purchased the 570 unit portfolio at about $197,000 per unit. With vacancy rates near 10%, Fairfield was willing to pay a price that calculates to a cap rate of 5.55%. The Buyer believes there is an opportunity to add value to the property through improved rents and occupancy. The complexes are located on the west side of Longmont and carry the names “Rock Creek” and “Sky Rocky” apartments.

A private buyer out of Breckinridge CO purchased a warehouse occupied by Tesla, in Longmont, as an investment sale. The 41,000 SF property sold for $13.23 million, which calculates to about $323 per square foot. Seller was out of Nashville TN.

Meanwhile, another warehouse sold in Longmont for $207 PSF, or $6 million, to an private party owner occupant out of Longmont as well. The 29,000 SF metal constructed industrial property is located in the Vista Commons development, near I-25.

With the next sale in the Top 5 for our region also being in Longmont, that city grabbed all the February highlights. In this case, an office building sold for owner-occupancy right off the I-25 and Hwy 119 interchange. An energy firm out of The Woodlands TX purchased this building for $121 psf or right at $5 million for the 41,000 SF property.

With the remaining sales being at or below $2 million, we’ll highlight some that were of interest and in other cities than Longmont!

An office building in Loveland sold to a private party (out of Longmont) for a reported 8.39% cap rate for the 17,000 SF multi-tenant Creekside Plaza project. Three of the five tenants were medical providers which is always of interest to investors. The price was $2.1 million, or $120 PSF. Greeley featured an auto-repair building sale for $1.95 million or almost $800 PSF to an Englewood CO buyer. The property was not being utilized for auto repair, so one must consider that the buyer intends to open such a business. Locating auto repair properties is difficult as there are zoning and property covenant restrictions at many locations to such use.

ARC maintained a donation site at the subject at time of sale, and it is located on 10th st.

A five-plex near downtown Fort Collins and Colorado State university sold for a little over $1 million to a Fort Collins buyer as part of a Section 1031 IRS deferred tax strategy. Buyer was local as well. The sale calculates to about $207,000 per unit. Student apartments are also attractive to investors as they are rarely vacant. This sale was likely related to several other small multi-family sales in the same area. Two other nearby fourplexes sold for $1 million each or $250,000 per unit. Seller was the same throughout and the Buyer was Fort Collins based.

Finally, a stand-alone restaurant building in St. Michael’s Town Square in Greeley sold for $943,000 to a private party Loveland buyer. The former “Hobnobber Tavern” property sold for $210 PSF, and is currently occupied by “The Tavern” restaurant and an Aveda hair salon. Reported cap rate is in the mid-6% range.

Looking at all 40 February sales in the region, the Sale to Ask price difference was just over 11%, showing that Buyers were able to negotiate better pricing for the transactions.