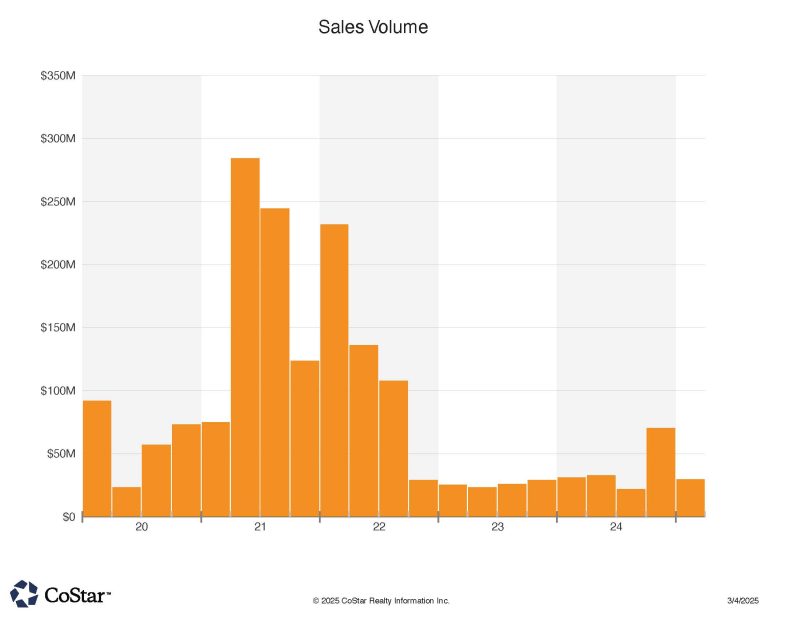

Sales Volume in NoCO CRE Low Compared to Last Five Years

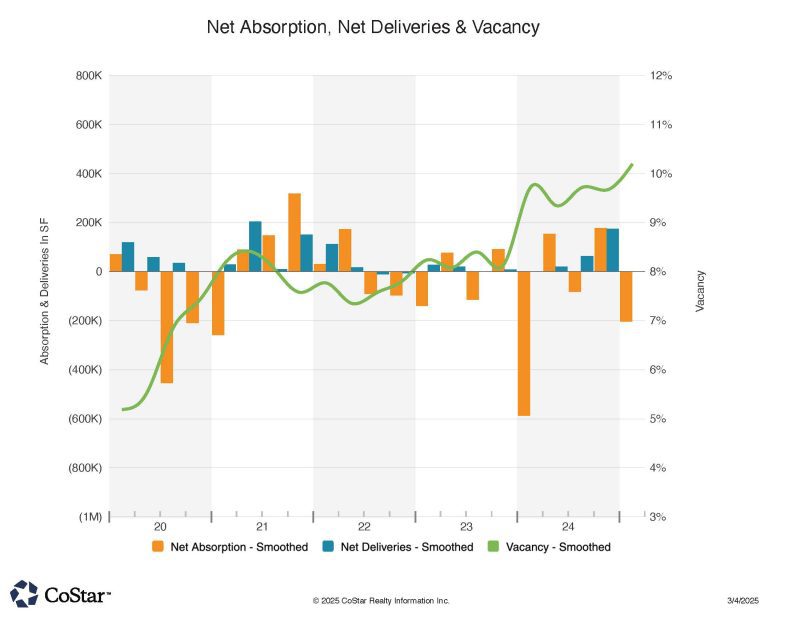

Overall NoCO CRE Vacancies Rise as Absorption of Space Declines

February showed another modest pace for commercial real estate property sales in the tri-county (Larimer, Boulder and Weld) region comprising this NoCoCRE report. 54 transactions took place with only 12 trading above $1 million in price.

Leading the month was a property type (land) category that is usually not the top sale for this region, as Advent Health purchased 153 acres for $34 million. The sale calculates to $4.00 per square foot, and the property is located at Disc Drive in Louisville CO off of Highway 34 and the northwest parkway. The site is within the Redtail Ridge development which has been in various negotiations with the city to re-develop for well over a decade. The acquisition will allow Avista Hospital to expand and provide better access to its facilities. It also may spur surrounding development in Redtail Ridge, such as long rumored life sciences oriented properties.

The second largest sale was also a somewhat rare property type In this trade, the Little Sunshine’s Playhouse & Preschool which just opened in December, was sold for $8 million to a private equity fund out of Austin Texas. The tenant operates similar facilities in 41 other locations nationally. Early childhood education facilities are seen as stable revenue investments for landlords with a high demand. This facility is in the burgeoning Erie CO region, with demographics supporting the tenant’s operations.

Commerce City CO based Jayhawk Trailers purchased the Hallmark Manufacturing warehouse building for $3.4 million or $140 per square foot. The facility features excess yard space for trailer storage and/or future expansion.

“Romantic RiverSong Inn” located in Estes Park and operated as a bed and breakfast hospitality business, sold for $3.15 million for the 10 room property. Seller was out of California, and the Buyer is from Longmont CO. The building dates back originally to 1922 and has been renovated over the years.

Remaining larger sales included one in which DMD Fabrication bought a 16,500 SF facility on “O” street in Greeley for $2.8 million or $171 PSF. The Buyer had been a sub-lessee at the property at time of sale.

A two-story office building on Lookout Rd. in Boulder sold for $2.6 million and most of it was marketed for lease availability at time of sale. Original asking price was $3 million. The property was on the market for over two years, and this reflects hesitancy of investors to purchase in the office sector. At a final sale price of $125 per square foot, the sale is well below replication cost, which is typical again for the office sector market right now.

Another high vacancy office property in Longmont, 204 S. Bowen, sold for $113 PSF. A Boulder investor purchased the office property for $2.43 million. It had been on the market for just more than nine months.

A Burger King restaurant stand-alone facility at the Twin Peaks Mall in Longmont sold for $1.59 million or $538 PSF to an investor located in Aurora CO. Seller was from Greeley CO.

The Stuft Burger Bar in downtown Fort Collins was another restaurant sale in February. This $1.05 million sale to a Greenwood Village CO Buyer calculates to $638 PSF. Stuft has been a tenant at the location since 2010. Seller was a local Fort Collins resident.

February again was dominated by Colorado based purchasers, outside of the top two sales. Owner-users and Investors alike were both active, though the month was rather slow for our region overall.