Private Investors Dominated the NoCO CRE Transactions during September 2023

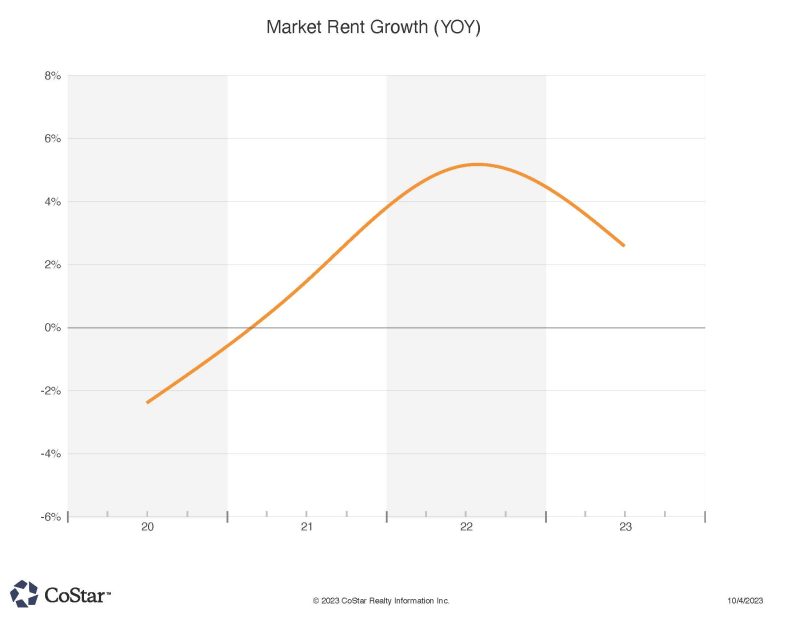

Market Rent Growth in NoCO CRE has Ground Down to almost Zero

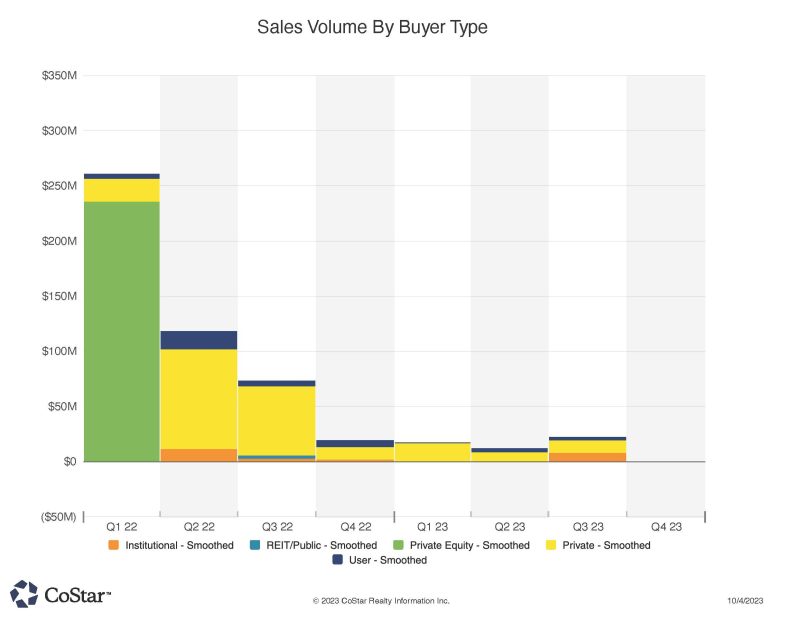

September commercial real estate transactions were quite light in historical terms. Only 45 trades occurred. However, a substantial portion of those were sales to investors. Investment real estate has certainly slowed due to higher borrowing costs to the investors. Still, NoCO offers patient investors a realistic hope of upside as population and rents grow over time. It also appears that locally based Colorado investors still have an appetite for income producing properties under $10 million.

The top sale was a 197 unit apartment complex recently built in Fort Collins. 281 Willow, presented as a luxury apartment project, sold for $65 million to a California investment group. The price calculates to about $330,000 per unit. Seller was a Chicago based entity.

The next sale was also residential property. DR Horton sold its 86 single family home project in Firestone, called Cottonwood Hollow, to a Scottsdale AZ group. This project sold for $40.55 million or about $470,000 per house. The homes were built in 2022.

An investor out of Boulder purchased 112 acres of development land in Dacono. This site is located on the Highway 52 and I-25 interchange. Seller was out of Florida and had been marketing the site for about two years.

A Fort Collins private investor bought the La-Z-Boy furniture store property on Harmony road for $6.33 million. The fully leased property was sold by another Fort Collins party, and the sale calculates to $431 PSF. Another Fort Collins private investor bought the Harmony School Shops for $2.65 million from a separate Fort Collins based Seller. This property traded at a reported 6.7% cap rate, and included Spine Correction Center Of The Rockies amongst its tenant list. The building is 5700 SF with multiple tenants.

A 13,400 SF Longmont industrial building, fully leased to the Toro Company and Gear Alliance, sold for $2.18 million. The property sold for $162 PSF, and at a reported 7.15% cap rate to a local investor. Seller was out of Niwot CO. Another 13,100 SF industrial property, this one in Fort Collins, sold as an investment for $2.03 million to a local investor. The trade calculated to $155 PSF and the property is fully leased to Injectech.

A 15 unit apartment in Longmont on St. Vrain Street, traded for $2.03 million, or $135,000 per unit. The property was built originally in 1939. Buyer was out of Estes Park CO. A 10 unit property on Baker St., also in Longmont, traded for $1.73 million or $173,000 per unit. The Seller had held the property since 1981.

Rounding out the top 10 regional sales, an office building on Mountain St. in downtown Fort Collins sold for $1.6 million or $143 PSF. The property was fully leased, headlined by RB&B Architects. The Buyer resides in nearby Red Feather Lakes CO.