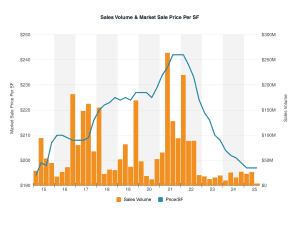

NoCO OFFICE property sales dip to a 10 year low (price and volume)

NoCO OFFICE property rents show a general growth over the last 10 years despite the troubles on the sales side

Despite the hot weather in July, NoCOCRE deals slowed a bit, with 60 trades in total. We typically saw 80 or more prior to slowdowns for Covid, and then further with the high interest rate environment of the past 2-3 years. In our tri-county region, the Buyer market continues in the commercial real estate market in the Boulder, Larimer and Weld county area. This was evidenced by an average 13.3% reduced sales price from the original ask price for the month’s transactions ,(from those which had preset asking prices when they went to market). Public REITs featured in several of the larger sales last month.

The largest sale was a whopper. $132.2 million was the price that the Railway Flats in the Loveland area just sold for. Seller was the McWhinney company with its longtime development presence in NoCO, and the Buyer was Centerplace, a public REIT, out of Minot, North Dakota. The property contains 420 units in all, and it traded at an average of about $315,000 per unit in the sale. The reported cap rate at sale was 4.71%, This cap rate indicates that the Buyer is optimistic about the northern CO economy and potential to raise rents in the future. 60% of the units are 1 bedroom or studios in these 6 year old garden apartment buildings.

The second largest investment sale carried a $18 million price tag. In this Johnstown area sale, the Franklin TN based Summit Behavioral Health Center sold its property to Ohio based Communicare Family of Companies. The property has about 63,000 SF and historically operated as an acute psychiatric hospital.

A Chick Fil a store sold as an investment for $17.75 million during July. Shopping Center owner NewMark Merrill Companies sold it’s Fort Collins site to Arileus Capital out of Los Angeles. The high-visibility College Ave. and Horsetooth corner location has always performed at a high volume for the tenant. In 2001, the property sold for $10+ million less than this recent sale.

The Extra Space Storage facility on Nelson Rd. in Longmont traded for $13 million, as it was part of a 16 property national self storage property portfolio sale to Public Storage. The public REIT acquired the self storage property at $155 PSF. Seller was Merit Hill Capital out of Brooklyn NY.

A Denver buyer picked up the industrial property at 4160 Busch St. in Frederick, which was fully occupied by Toro Equipment and Owl Vans. Price was $11.43 million and it traded at a reported 6.11% cap rate. The trade calculates to just over $400 PSF for the 2023 built property.

The Fort Collins Urban Renewal Authority bought the Country Club Corners vacant former grocery property on North College in Fort Collins for $6.75 million, or $132 PSF. The property is about 51,000 SF and had sat vacant for many years. The Seller was a public REIT out of San Diego CA.

St. John Paul II school bought the former St. Vrain School District Elementary School near highway 287 & 34 intersection for $5 million. The Loveland location was built in 1996 and is reported to be planned for used for school use. The price calculates to about $94 PSF. Typical for these types of properties, it had been on the market for over 400 days. Original asking price was $6.3 million.

Boulder appears on the list of top July sales, as a six-plex on University Avenue traded for $2.1 million with a local Buyer and Seller. The property dates back to 1907. This price calculates to $350,000 per unit.

Finally, a 1.37 acre parcel in Hover Crossing subdivision of Longmont was purchased by an entity called the “Inn Between of Longmont, Inc.” for $1.6 million, or $38 PSF. Planned use is not yet public, but the name of the buyer might give a clue.