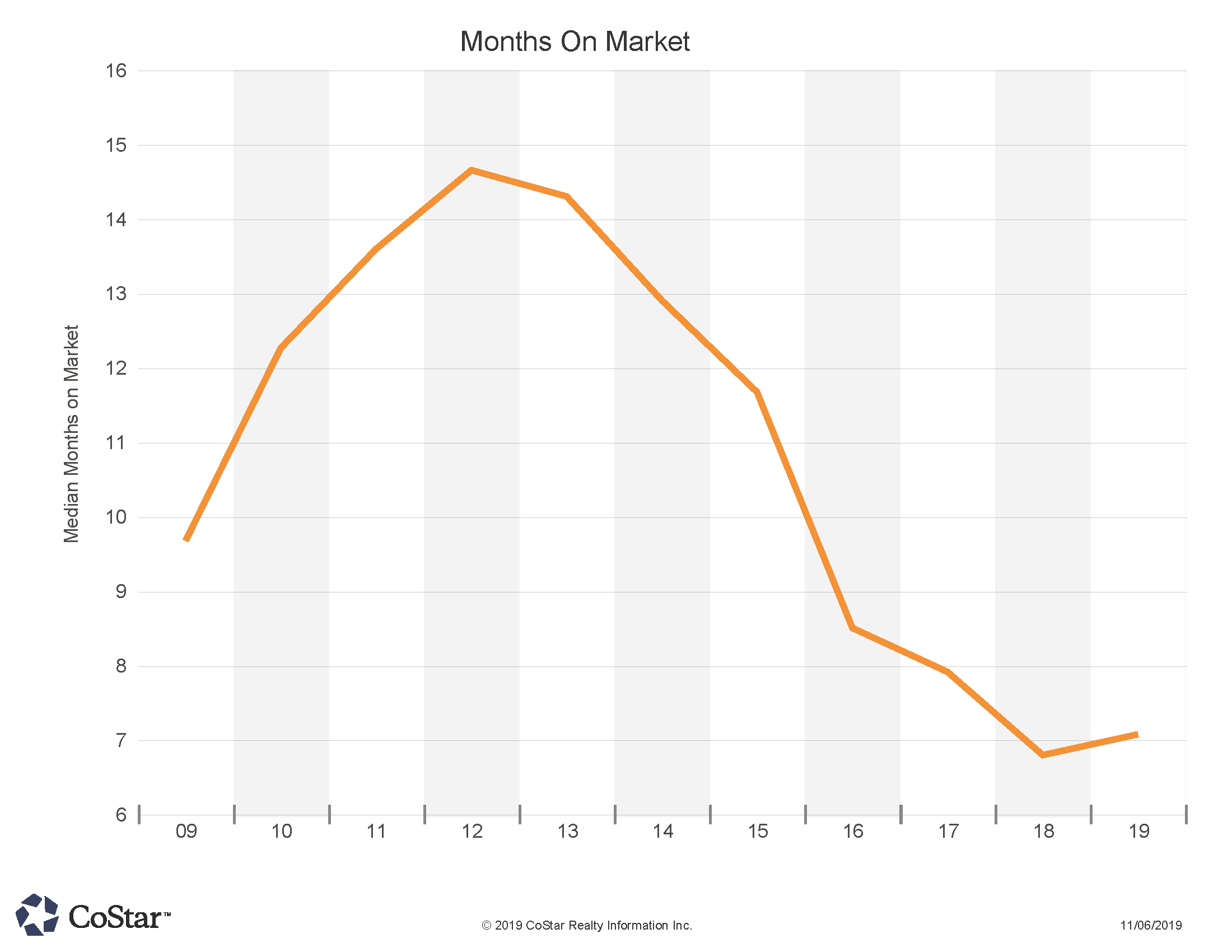

Months on Market

Properties that are put on public market are selling on average within about seven months. Substantially less time than just a few years ago

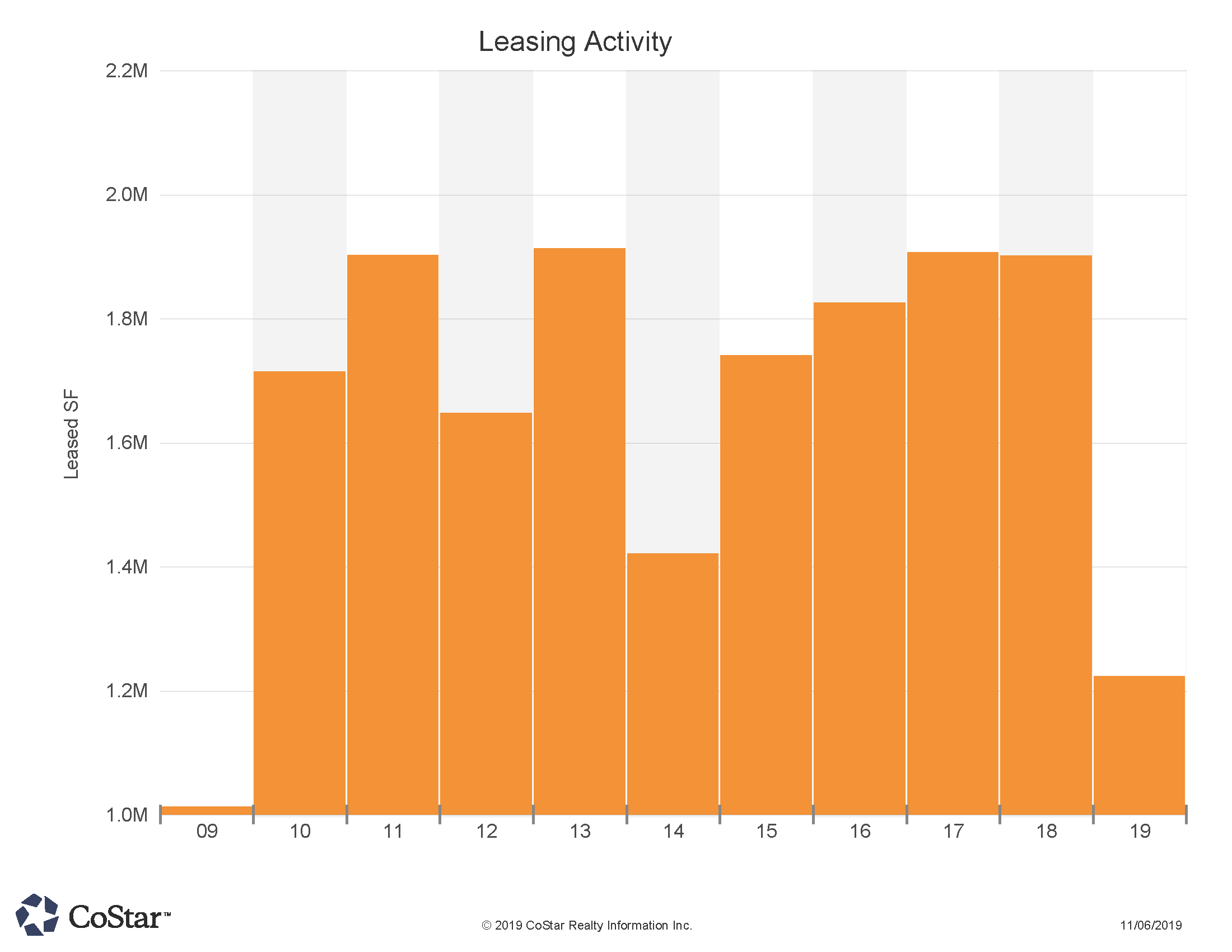

Lease Absorption Slowing

Leasing absorption has slowed considerably in 2019 and compares back to almost 2009 in this regard

Contact our advisors to see how they can help you with your property

Northern Colorado:

970.207.0700

2032 Lowe St. Suite 101

Fort Collins, CO 80525

Denver Metro

303.632.8784

414 14th St. Suite 100

Denver, CO 80202

A couple of auto dealerships sold in the region last month. The former president of AutoNation bought the Longmont Ford auto dealership in Longmont CO for $9 million, which calculates to $189 PSF. The property is about 6.4 acres and has over 500 parking spaces in addition to the 47,500 SF building. In Fort Collins, the Nissan dealership sold for $4.2 million or $233 psf. This one is on 2.7 acres. Buyer is out of Longmont.

In other regional sales action, Kroenke Group out of Columbia MO purchased a retail complex in Fort Collins, CO in which the tenants were Whole Foods and Wilbur's Beverage. The $23.8 million price tag calculated out to $348 PSF for University Plaza. The selling price represented a profit of about $1 million to the previous owners out of Phoenix AZ who purchased the property in 2014.

A REIT out of Los Angeles purchased the Leed Fabrication manufacturing facility on Boyd Ave.,north of Loveland CO for $10.3 million, or $118 psf. The tenant was the previous owner and sold the building to the investors on a sale-leaseback structure, so as to free up capital for other business needs.

A Denver based investment group bought a property in the Prospect East Business Park in Fort Collins from Cress Capital. The 26,000 SF building sold for $6.3 million, or $263 PSF. Tenants include Larimer County. The largest Boulder county deal was a retail sale in Lafayette CO. Summit Marketplace sold for $4.5 million or $313 psf. Tenants include Sally Beauty Supply and Advance America. The Broomfield CO investment group was adding to their portfolio. Reported cap rate was 7.41% on the sale.

Tracking almost 36 million square feet of commercial property across the tri-county (Boulder Larimer and Weld) area, leasing activity has been particularly sluggish this year. Some of this is explained by the pre-leasing of the new construction, which has largely been purpose-built for specific tenants and not adding speculative space to the market. With a tight overall market, there aren't a lot of good choices to move to, or spaces that meet certain criteria. Therefore the stagnation may be due, in part, to lack of viable option.