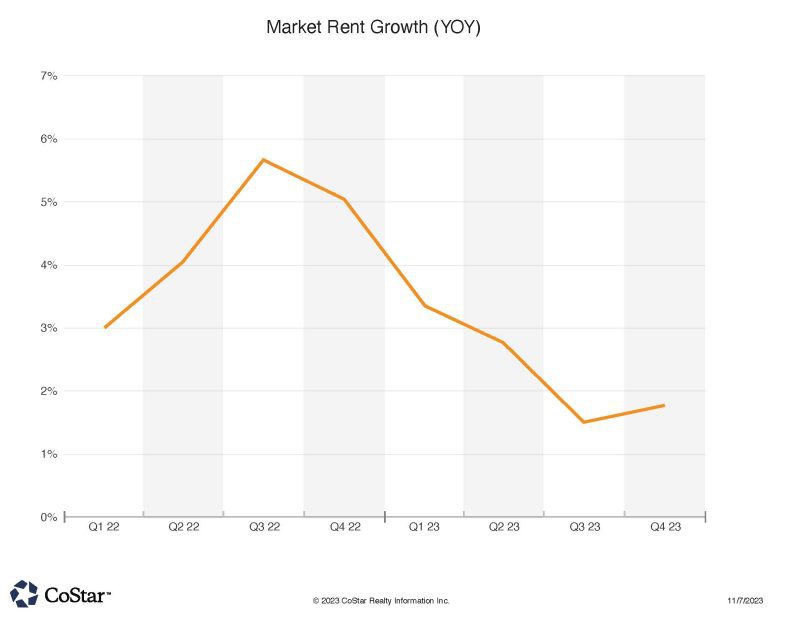

Tri-county rent growth has dropped to a third of where it was last year

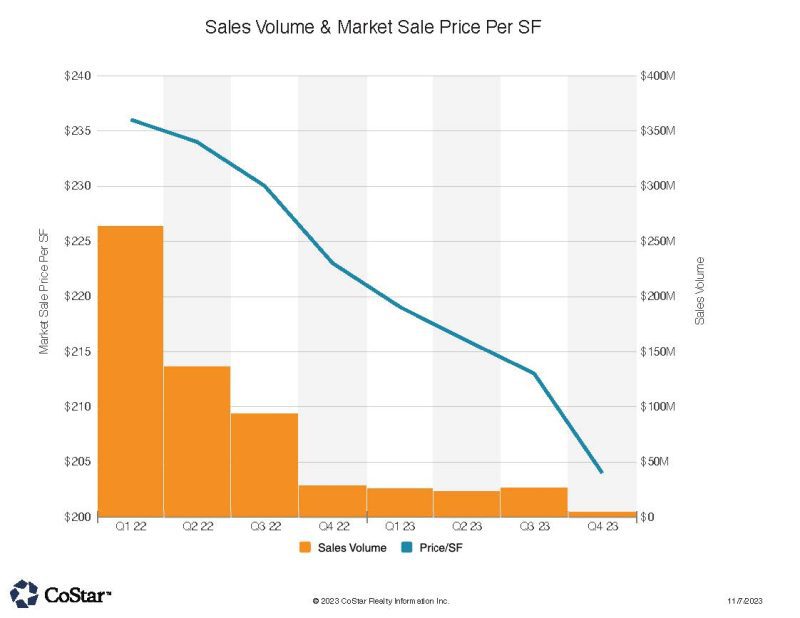

Tri-county sales have been slumping four quarters in a row

In an era where NoCO sales activity is at a very low level as investors wait out the interest rate environment, we look to see what lease activity has occurred. Leasing activities represent “occupiers” versus “investors” in the market. Occupiers have to make moves regardless of the investment market environment. The NoCO region features some interesting leases to companies expanding their operations, where the business value of location is critical to the firm. Over 108 leases were reported to be executed during the month of October across the three Colorado counties of Boulder, Larimer and Weld.

Our region’s top lease last month was the Comunale Properties “Mulberry Connection” industrial project in Fort Collins CO, in which they leased 93,000 square feet to a tenant for the entire building 2 at that site. The new tenant will be involved in pre-fab manufacturing at the facility. The name of the tenant is not yet released.

Heska Corporation, involved in the pet pharmaceutical industry, leased 41,500 square feet at the Axis 25 newly built industrial facility in eastLoveland off of I-25. Another Loveland location, this time on the west side off Boyd Lake road, was the site for Recreational Electrical’s 38,000 square foot lease. An industrial multi-tenant building on 120th in Lafayette CO signed a 17,500. square foot lease during the month, too. This facility features outdoor storage, which is highly coveted by many tenants for industrial properties in the region.

In Boulder office leasing activity last month Beacon Capital announced a new office lease at the Pearl East Innovation Campus, geared to Life Science tenants. In this case, the yet to be named tenant will occupy 41,500 SF. One Boulder Plaza is another regional office building with a lease of note. At this downtown Boulder location, a 36,000 SF three-floor lease was signed in October.

The largest retail lease was an 19,000 square foot deal signed at Foothills Mall in Fort Collins. With the new ownership in place, the center is being transitioned to a mixed-use retail/residential community. The lease demonstrates the continuing NoCO vibrancy in the sector despite inflation cutting into disposable spending capacity of the consumer. This tenant will be the fourth largest at the mall.

The area’s largest sale was the $94.5 million multi-family sale of Lake Vista complex in Loveland. The 303 unit complex was sold by Blackstone to a Minneapolis equity group, at a price calculating to about $312,000 per unit. Reported cap rate at sale is 5.13%. Also of note was the Buyer’s assumption of an existing $53 million loan with a 3.45% interest rate, maturing in 2026. Buyer’s may be strategizing the ability to refinance after 2026 at a lower rate than currently available, which is why they assumed the favorable note in place for the next few years.

Another sale of note was the vacant Apex Storage warehouse facility in Evans for $4.05 million. The price per square foot calculates to $134. Shift Workspaces purchased the facility, likely to imitate their co-working industrial facility in Denver. This entrepreneurial concept offers smaller industrial users the ability to utilize warehouse/shop space.