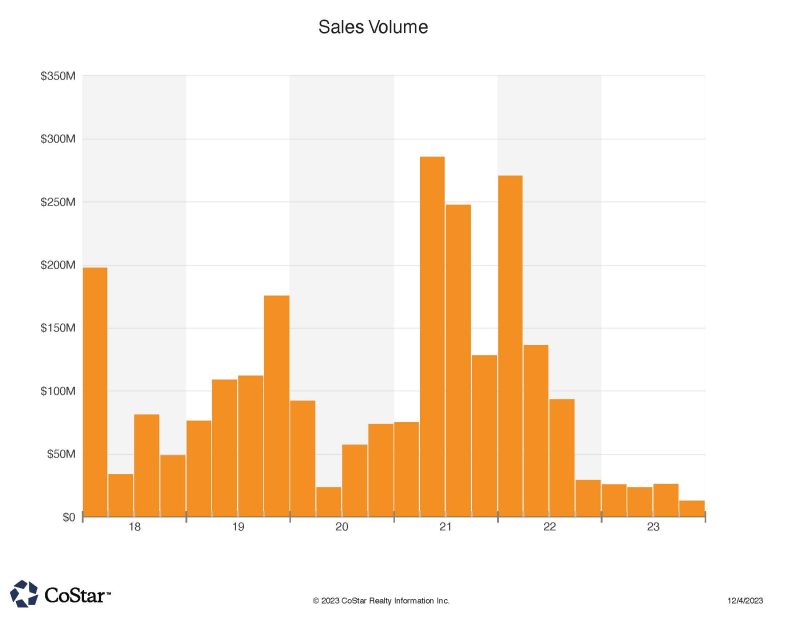

NoCOCRE Sales Volume stays at 5 year lows

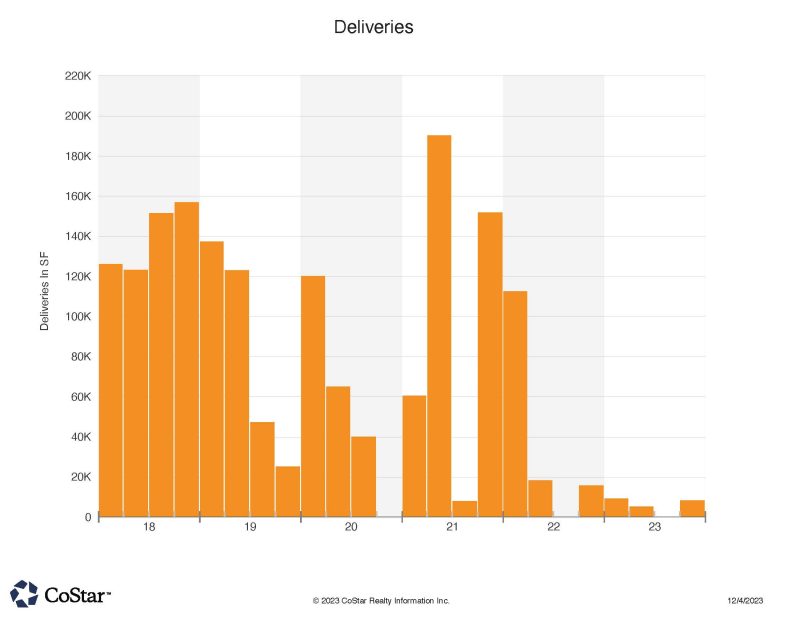

NOCOCRE Deliveries at 5 year lows, showing caution in Development

With an average sales price of $1.3 million, and only 53 sales transactions for NoCOCRE during November, it was clearly a locally traded market that fed the statistics this time around. Boulder, Weld and Larimer counties -used to- transact 80+ properties per month before the interest rate surge of the last year and a half drove that down almost 40%. Plus, the region routinely features multiple deals trading in the tens of million dollar ranges. Not this November, however. Nevertheless, the right properties with the right location were still moving.

Top sale was an industrial building purchased by the Town of Erie. This 1996 metal warehouse of almost 18,000 SF sold for $6.7 million. In other industrial CRE regional news, Fort Collins was the site for a $3.5 sale. This was a 15,000 SF distribution center on Automation Way that was purchased by an electrical parts distributor with Texas headquarters. The third largest industrial deal was a 12,000 SF metal warehouse in Windsor, for $1.45 million, or $120 PSF.

Also somewhat active as a property type nowadays is the multi-family sector, and in particular the privately owned smaller complexes not requiring high loan-to-value financing. Our tri-county region featured a couple of these smaller multi-family property trades. A newer 14 unit complex in Longmont on Baker st. traded for $6.5 million, or $467,000 per unit (3 bedroom units). The reported cap rate of the trade was around 4.7%. Buyer is out of Niwot CO and no loan was immediately recorded as part of the sale. A 13 unit downtown Boulder property sold for $3.5 million, or $269,000 per unit. This 13th St. building featured all one-bedroom units. The property dates back to 1894. No loan recording was apparent as part of the sale.

A third smaller multi-family sale was also transacted in Boulder, where a student-oriented fourplex sold for $1.6 million, or $400,000 per four bedroom unit. Reported cap rate for this sale was 6.05%.

An 8,300 SF retail storefront property sold in Longmont, off Sherman St. for $3.5 million, or $423 PSF. The Buyer was also from Longmont. The site is occupied by the Habitat for Humanity “Restore” operation, featuring sales of used goods. The Buyer purchased the property (aka ShermanStation), for investment purposes. A Milliken, Colorado buyer purchased 512 Main St. in Windsor, which has a retail main floor and office on second floor. The $1.5 million purchase calculates to about $150 PSF for the property. Financing was utilized for this purchase. Property is occupied by a mortgage company and a home builder. The last retail sale of note was a downtown Louisville service station on Pine St. This $1.3 million trade was bought by another Colorado service station operator and financing was involved. The property sold for just over $660 PSF.

A development land sale of note occured at a 7.5 acre commercial site in the Crossroads area of Windsor CO. It traded for about $5 PSF. The property was partially entitled for a 78,550 SF self storage facility.