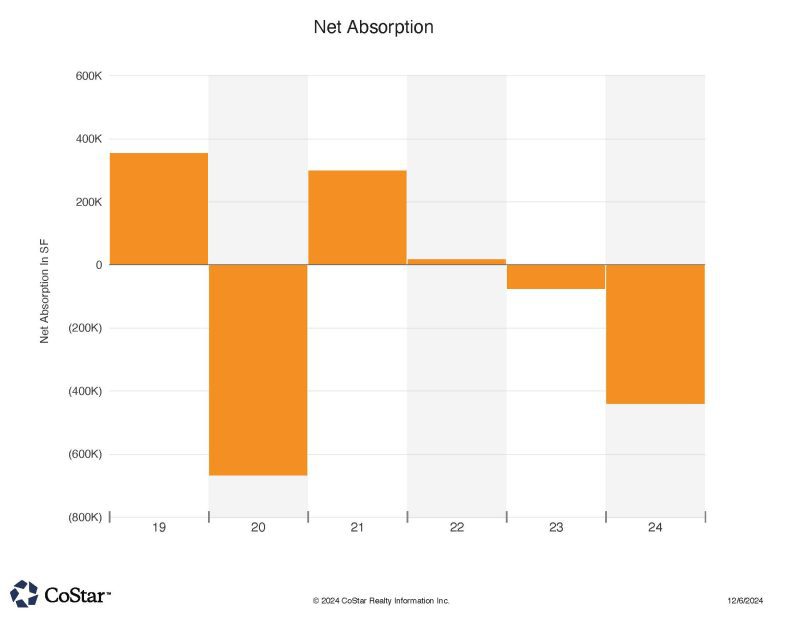

NoCOCRE net absorption is struggling this year, but not as bad as it was in 2020.

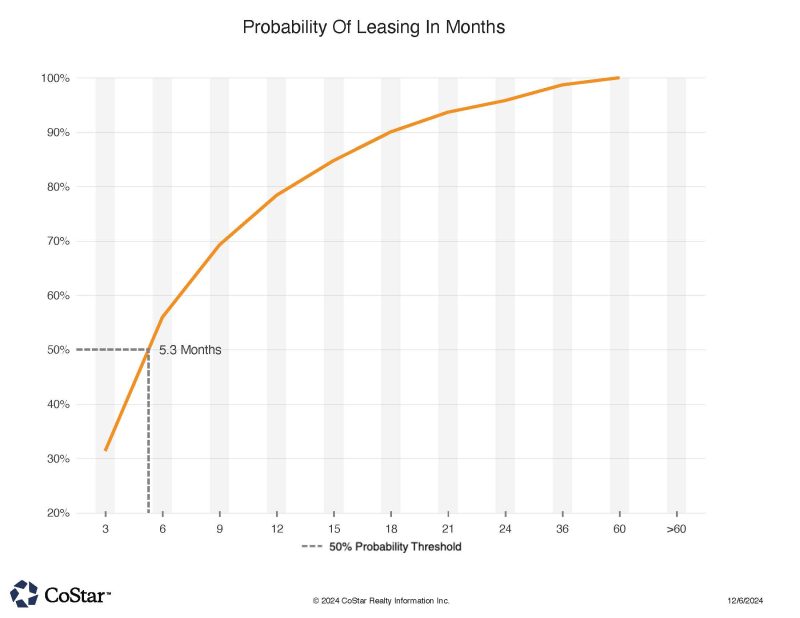

NoCOCRE landlords have about a 50-50 chance of leasing their vacancies in about the first 5 months of marketing.

After some promise of an upward moving market in October, the tri-county (Larimer, Weld & Boulder) NoCOCRE market slowed back down to the pace seen earlier this year. 54 sales deals were recorded during November. No large institutional, nor any portfolio deal of any size traded during the month. However, the local user/owner-occupant activity was reasonably strong on its own, particularly in the industrial property type.

A Weld county buyer purchased the highest dollar deal in the town of Ault. The trade featured four developed lots in the Highland Business Park, and one 5,300 SF warehouse. Total value of the transaction was $7.6 million, with likely the land value driving that pricing.

A Boulder private investment syndicate paid $4.7 mil. ($173 PSF) for a 27,000 SF glass recycling center in Broomfield CO. Seller is out of Salt Lake City. The calculated capitalization rate on the sale based on the tenant’s lease was approximately 7%.

An owner-user purchased a vacant 27,000 SF warehouse on 7 1/2 acres in Platteville. The Seller was from Denver, Purchase price calculated to $83 PSF, and the price was $2.25 million. Buyer is involved in the oil and gas industry.

Investors out of San Mateo CA purchased a 9,800 SF daycare center in Loveland CO for $369 PSF, or $4 million total. The Childrens Workshop daycare is a tenant. Cap rate was reported to be 7% on this 1031 exchange sale.

Another daycare center property was involved in a sale in Fort Collins. In this latter case, the 2004 constructed Bright Horizons center, measuring about 11,500 SF sold for $2.77 million ($318 PSF) to a private trust.

Boulder CO was the location for the region’s top office property sale. An 11,370 SF building sold for $2.2 million, or $193 PSF to a private individual out of Boulder. Seller was out of Longmont CO. The building houses over 15 smaller tenants including the Community Acupuncture business.

Contractors are often in the list of purchasers for industrial properties, and the region featured two such transactions. A 9,600 SF metal warehouse in LaSalle CO traded for $1.9 million or $193 PSF to a builder out of Utah for owner occupancy. Another user sale was a 7600 SF distribution warehouse in north Fort Collins which traded for $1.65 million ($218 PSF). The purchaser for this property was locally based Sage Homes out of Fort Collins.

Finally, there were multiple smaller multifamily building sales in NoCO. The highest sales price of these was a 12 unit building that sold for $1.6 million or $133,000 per unit. The trade was an approximate 4.5% cap rate deal, though pro-forma rents could increase that up to 8.5% reportedly.