Rent Growth Still Positive thus far in 2022

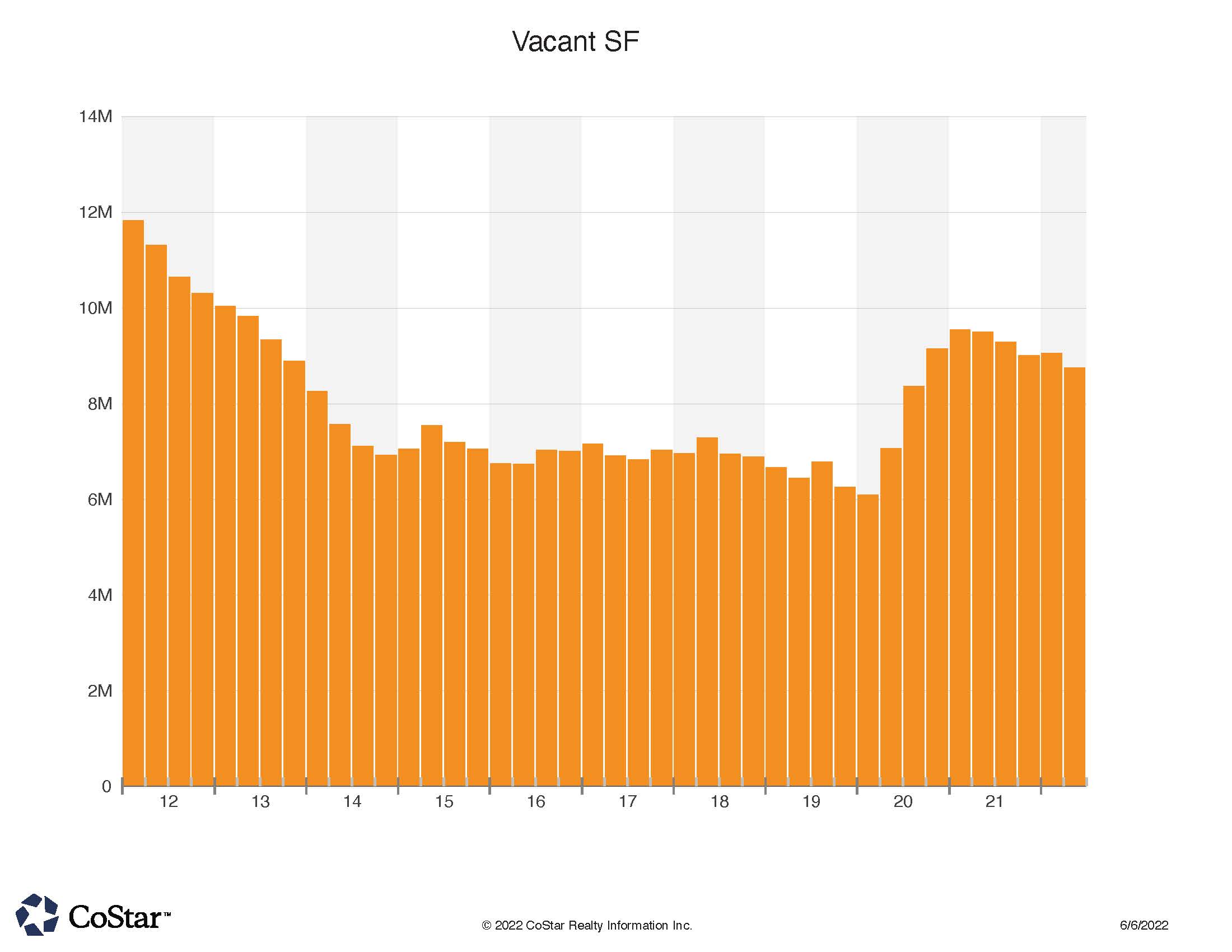

More Vacant Space than We’ve had in a Decade, Though the Overall Vacancy Rate is Still “Healthy” at 5% Rate

Deal size in the NoCO CRE region was higher than normal, as eight $10 million + trades drove a $350 million sales volume month. Both institutional and private investors drove the demand side of the month’s activity. The largest tri-county CRE transaction was part of a large REIT transaction of another REIT’s national portfolio. Blackstone Properties acquired the Verdant Apartment complex in Boulder for $104 million (allocated). That amounts to a per unit price of $486,000 across the 216 units which were about split evenly between one-bedroom and two-bedroom units. The complex had achieved approximately $2.50 PSF in rents prior to acquisition. “Dropping” down to $30 million, the next largest trade was also at the institutional level in Longmont at the Trade Centre. The 78,000 SF two-building portfolio sold for over $435 PSF to Barings, out of Chicago IL. The properties are occupied by a single tenant – Cambrex. Cambrex is a global contract development and manufacturing organization (CDMO) that provides drug substance, drug product and analytical services. Reported CAP rate was 5.25% on the sale. Toll Brothers home builders bought 83 lots in Heron Lakes, west of Berthoud, for $14.35 million, or about $173,000 per lot. The lots were developed and sold to Toll Brothers by longtime NoCO developer Hillside Commercial out of Windsor. Heron Lakes has had steady upper-end home development over several years now. The Pearl Street Mall in Boulder featured another $14 million deal ($14.25 million) that traded in the month of May. The condominium interests were sold at $683 PSF to a local Boulder investor. Seller was also a private Boulder ownership group. The largest tenant is on the second floor, which is occupied by Stantec engineering. A Chicago based investment group purchased a medical office building located on 29th st., next to Loveland’s Orchard Shopping Center for $12.2 million or $293 PSF. UC Health and SummitStone Health are the primary tenants in the 41,500 SF property.. Seller was out of California. Rounding off the $10 million + trades in May, a Denver investment group purchased a 6 property portfolio which contained a Gunbarrel Tech Center office building in the Boulder area. This $10.5 million trade calculates to about $270 PSF on the 38,000 SF Winchester Circle property. Sunrise Medical and Micro Motion have been long term tenants at the property. The Buyer acquired all 6 properties in the Gunbarrel region as a value-add investment. In total 184,000 SF of property traded for approx. $40 million, which calculates to approx. $215 PSF. With other office-flex properties trading well above that in Boulder, the investors hope to backfill the vacant space and increase their value. Another trade of note was another hospitality deal in our region. The 75 room Wingate hotel in Johnstown sold for $8.1 million or $108,000 per key to a Fort Collins hotel operator. Seller was also local, from Loveland. In total, May featured 235 sales transactions, marking it as the most active month yet in 2022.