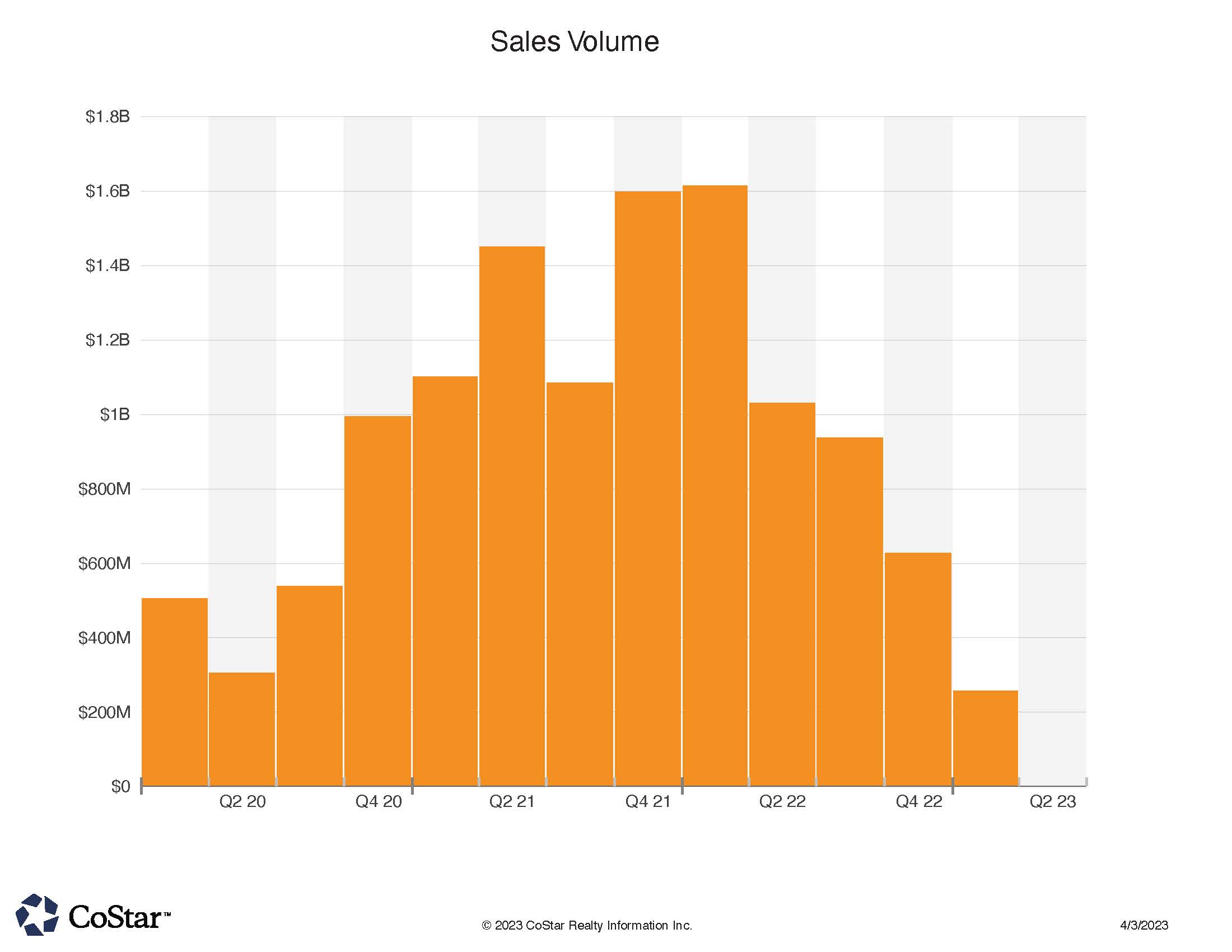

Sales Volume Drops to Covid Era Numbers

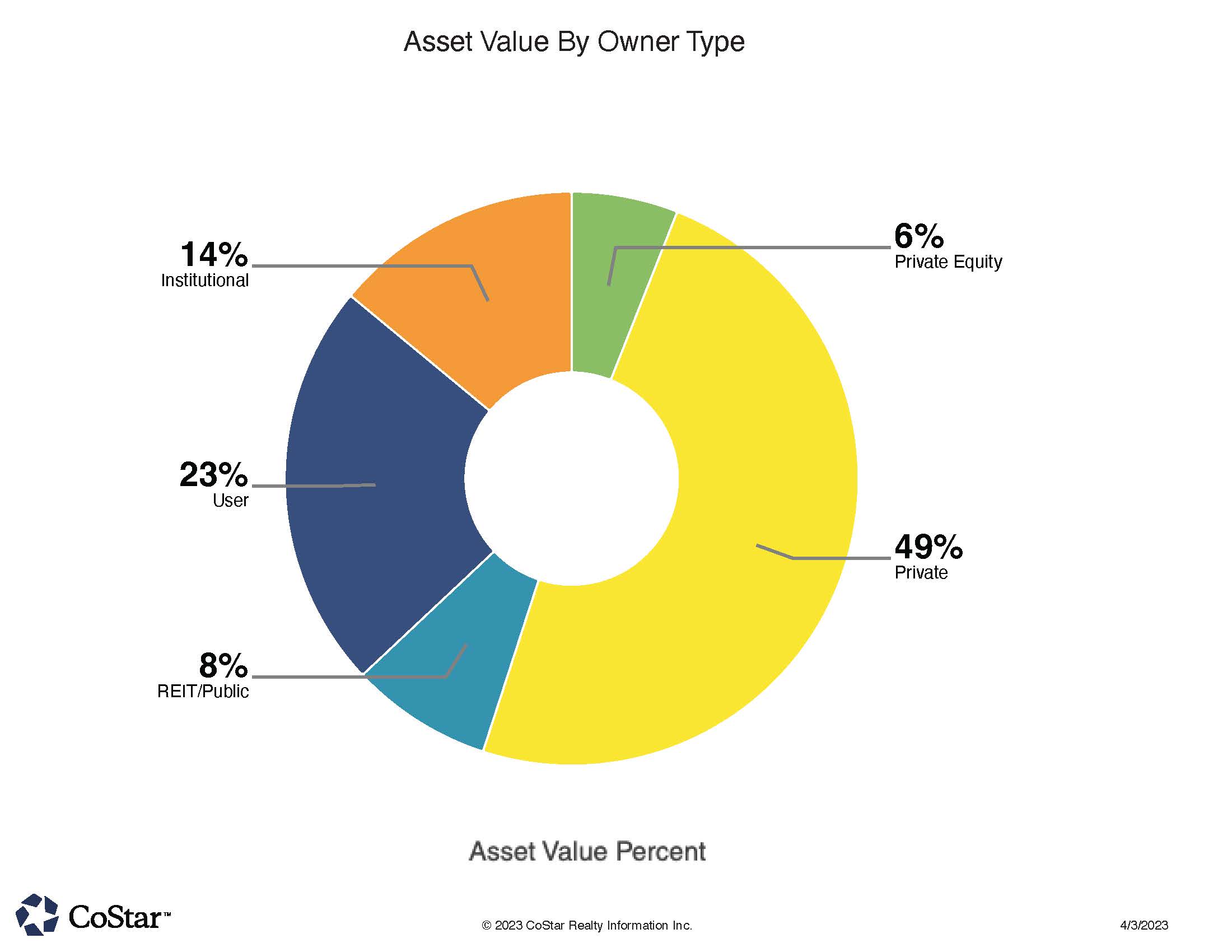

Asset Value Mostly in Private Ownership in Tri-County

While general trading activity was slower than previous years, March still contained $80 million of CRE sales volume, with private parties dominating. Institutional players were very constrained this last month on the buying side.

The top tri-county (Boulder, Larimer, Weld) sale in our region was a $6.85 million trade for a former Heritage Ford dealership in Loveland (and a small additional site). Buyer ClearShift is expanding its presence in Colorado. Both Buyer and Seller are from Colorado. The site includes approximately 25,000 square feet of buildings, and the price calculates to approximately $275 PSF. We have seen a significant number of car dealership site sales in the last couple years in this NoCO region.

A Missouri firm (Staenberg Group) which is mostly involved with retail mall developments bought two development sites in the same 71 acre Firestone CO land parcel on CR 24 1/2, for $6.7 million, or $2 PSF. The second purchase was for $6.65 million, this time for 11 acres within the adjacent Del Camino Business Park. The sites are just northeast of the Del Camino / Hwy 119 exit off I-25. This area has been steadily growing and the site is zoned for commercial purposes. Staenberg is already present right across highway 119 with the 328,000 SF Firestone City Centre development including Home Depot and American Furniture. The retail sector has been more robust than expected since the Covid era, and these purchases reflect developer confidence in the NoCO region in that regard.

A Denver based owner of a 24 unit apartment building (“FoCO Flats”), north of Fort Collins’ downtown area, sold to a Brooklyn NY group. Sales price was $5.6 million, or $233,000 per unit approx. The 1971 building has mostly 3 bedroom units.

An 88,000 SF flex building in Loveland (“Waterford Center”) with 10 tenants, sold to a private investor for $60 PSF. Seller and Buyer are both local. The reported cap rate was 6.34%, which reflected the rents on the property. Price per square foot was lower than other flex properties for the property which is near Highway 402 and 287 on the south side of Loveland.

Another flex property, this time in Windsor, sold for $3.4 million, or $235 PSF. The Eastman Park Dr. property had multiple vacant units and was likely purchased for occupancy by the Buyer. Buyer and Seller were local.

On the retail side, the Dollar General in Wellington CO sold for $2.7 million, or $298 PSF. Buyer was a private investor from Cheyenne WY. Reported cap rate was 4.85% for the newly built 9100 SF facility on a longer term triple-net lease with the Dollar General store.

Another free standing retail triple-net investment sale was the $2.5 million trade of the newly built Starbucks facility in Berthoud off Grand Market Dr near the Herons Lakes developments. This property was sold for $1,120 PSF, with a reported 5% cap rate. Seller is a Denver based developer. Buyer is a Denver investment group.

Following this stand alone single tenant triple net investment trend was the $1.9 million sale of a Greeley Taco Johns building. This one sold for over $800 PSF, at a reported 6.32% cap rate. Buyer is Denver based.

A specialty building sale of note closes out this month’s report. In this case, Rock Creek Church sold their Louisville area church to another local church. The 6400 SF facility on 5 acres sold for $2.1 million or about $328 PSF. Calvary Boulder Valley out of Boulder is the purchaser.