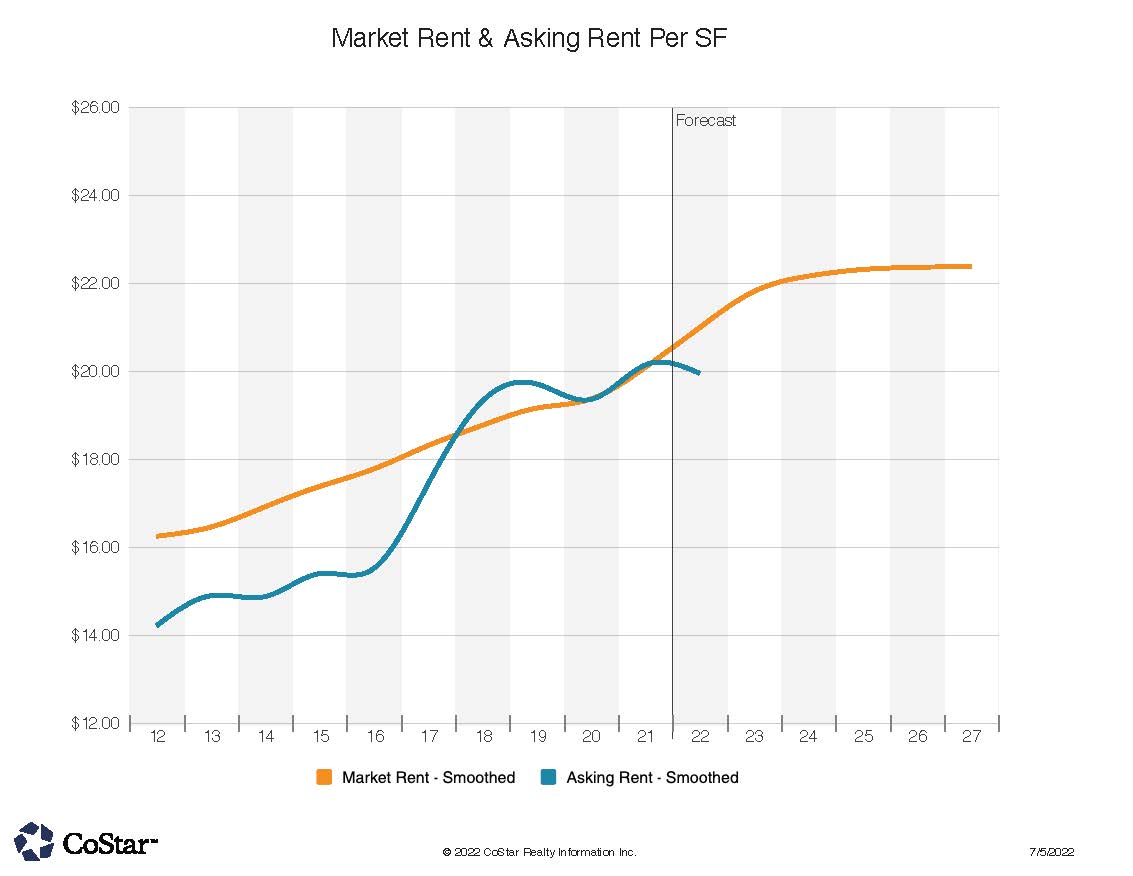

Retail Market Rents Holding on to the $20 PSF (triple net) Lease Rates in NoCO

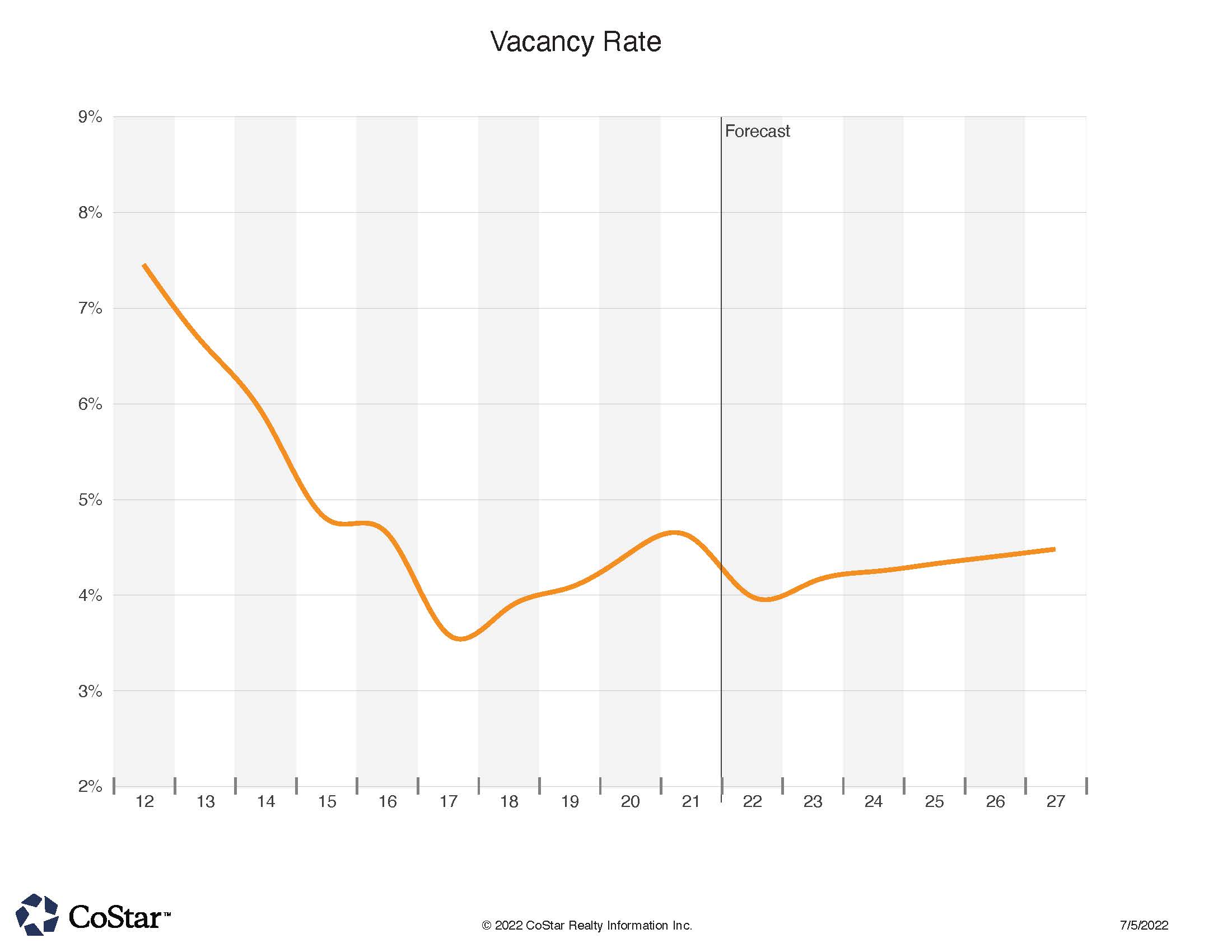

NoCO Retail Vacancy Healthy and Holding at Under 5% Rate

June was a relatively quiet month for our tri-county region in terms of commercial real estate sales. Perhaps there was a pause for summer, or watchful eyes following Fed interest rates and recession concerns heard on all the new channels? We did have just over 50 sales to look at, though. This month, the majority of Buyers of the significant deals came from Colorado, and Sellers were mostly Colorado based. The 300 unit Lago Vista Mobile Home Park in Loveland topped the deal list with a $45.5 million trade to an investment group out of Phoenix AZ. In 2016 the Seller, a local private investor, put about $12 million in financing on the property at time of a related party sale. In 2010, the property sold out of foreclosure. Now, these type of properties are in high demand for investors. Another property type of interest in our region has been the hotel sector. The La Quinta Inn in Loveland. A Colorado based buyer out of Erie purchased the 69 unit hotel for $7 million, or about $102,000 per key. Seller was a private party out of Loveland. A San Diego CA investor purchased a self-storage facility in Johnstown CO from a Colorado private party for $5.95 million, or about $116 per square foot. Self-storage is a popular investment property type, as occupancy is high and onsite turnover is low. The properties usually have low ongoing maintenance costs and space rents have been growing. The fractured ownership at Diagonal Plaza in Boulder has been limiting to sale of a high visibility mostly retail aggregation of properties off 28th st. and the Diagonal Highway. However, one of the buildings did trade in June at $180 per square foot, or $5 million prox. It features multiple small tenants, though occupancy was only at 65% at time of sale. Most notable tenant is the Colorado Dept. of Revenue, which operates a drivers license bureau at the site. Seller was from Boulder, while Buyer was a private party from Erie. Southern Weld county has been the location for many energy industry facility locations, and a 20,000 SF industrial property in Fort Lupton, with an additional 4 acres adjacent to it, sold as a portfolio for $4.5 million to a Fort Lupton addressed buyer. The Seller was a private party out of Parker CO. Single Tenant Net Lease properties are always attractive to private investors. The Aspen Dental building at Centerplace shopping center in Greeley sold to a group out of Reno Nevada for $3.6 million prox. The Seller was from Fort Collins, the reported cap rate on the deal was 4.9%. The sale price calculates to almost $960 PSF, which is also a phenomenon of these type of investment sales. Pricing is derived from expected cash flows over the lease term. Pricing will be higher on these types of deals based on the strength of the tenant. Dental offices are seen as very stable, and Aspen Dental operates nationally. Similar to the above, a multi-tenant property on 29th st. in Loveland sold from a Fort Collins based Seller to a Fort Collins based Buyer. This time, the property was largely occupied by restaurants (Krazy Karl’s pizza and Noodles. Selling price was $3.45 million, or $485 PSF. If Estes Park is mentioned in these posts, it is likely because of a resort sale. The 28 room Amberwood traded for $3.2 million, or $114,000 per key to a Buyer from Broomfield CO. Seller was from Estes Park. Finally, a medical building in Johnstown sold for $3 million, or $220 PSF. Seller was from Windsor CO and Buyer from Golden CO. The property featured a vacant main floor surgical facility, and a neurological medical clinic on the second floor.