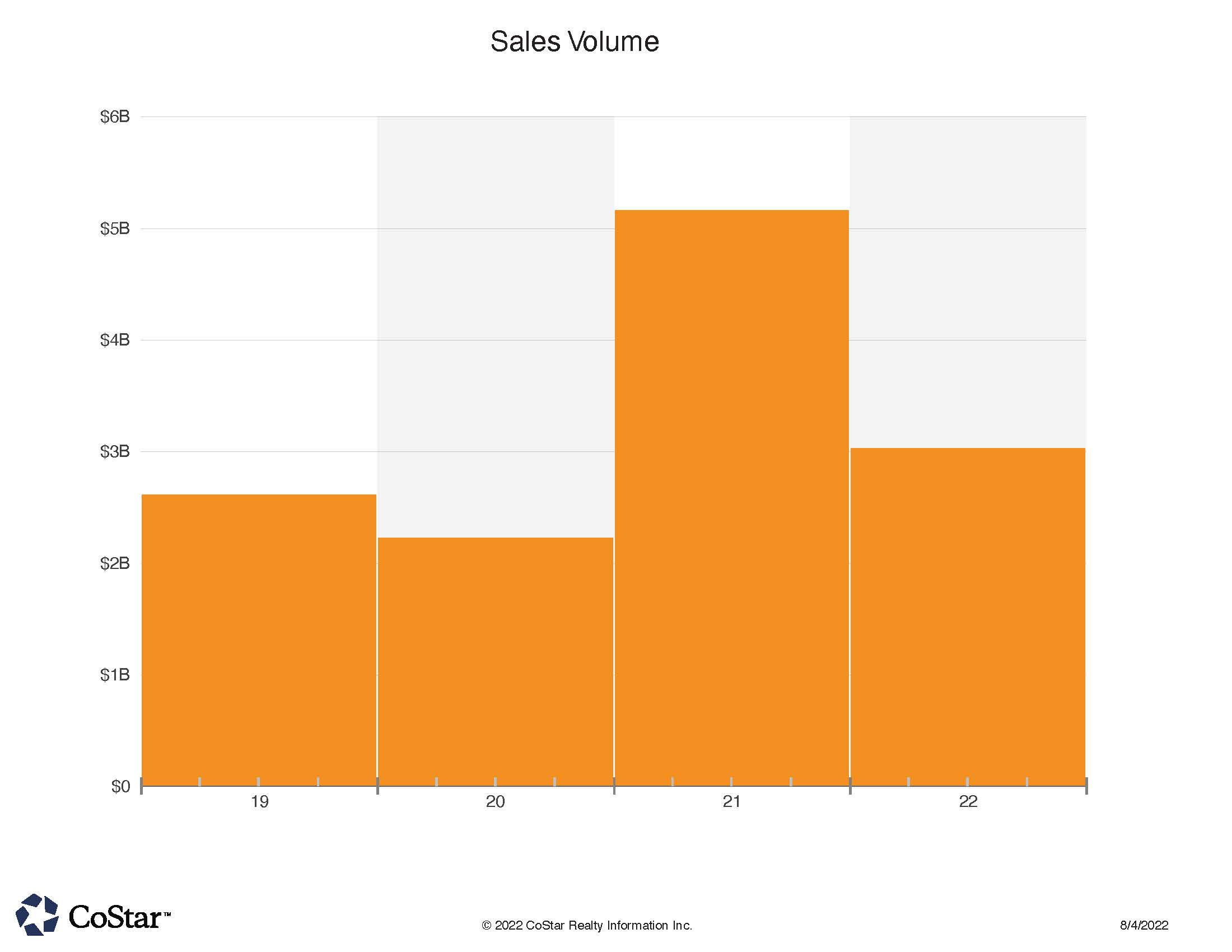

2022 on Track to Top 2021 Levels in NoCO Regional CRE Sales

5 Year Annual Sales Volume

Sweet Spot for Most NoCO Buyers is around $400,000 to $5 million, but plenty of activity over $10 million as well

NoCO Sales Price Distribution

Contact our advisors to see how they can help you with your property

For the last few months, private investors and owner-occupants made most of the purchases in the Larimer/Weld/Boulder county region. This last month, however, the institutional and entity buyers came roaring back. They also displayed their confidence in the regional demographics and economic conditions as several sales featured “cap-rates” in the 3.8% range. That is only about 1% above the 10-year treasury bond rate currently. Typically, one might expect that spread to be 2 or 3% for good assets. Several industrial deals in the 5% cap rate range also express area confidence when lending rates are in the same range. Investors are betting on rising rents during their anticipated hold period. The Arbors at Sweetgrass complex in Fort Collins sold for $74.5 million, at a reported 3.81% cap rate, and about $287,000 per unit for the 159 unit apartment property. An Indianapolis investment firm bought the property from its California sellers. Loveland developer McWhinney Co. sold its 166 unit Pinyon Pointe apartments in Loveland for $55.75 million to a Colorado investor who just sold the Sterling Heights apartments in Greeley and traded into Pinyon Pointe. The sale logged in at about $336,000 per unit, and the class A property’s cap rate was reported at 3.86%. Next we “drop” down to a $19.08 & additional $12.1 million and $6.34 million sale (three adjacent properties) of a 152,000 SF retail center in Greeley. Centerpoint of Greeley sold to a Canadian REIT out of Toronto. It is anchored by a Safeway grocery store and Ross clothing store. Bellmore Farms of Nunn CO sold 53.5 acres of land in Pierce CO, with gravel resources, to a private buyer in Ault. While the land prices out at $17.5 million, or $8 per square foot on the sale, it is uncertain what value the gravel resources brought to the sale. The sale of the Hampton Inn in Lafayette for $12.5 million continues our continuing streak of hospitality property sales in the NoCO region. This one sold for about $149,000 per key to a regional hotelier desiring to be close to Exempla Hospital and new office and residential development in that side of Lafayette. Industrial investment property is highly sought after, and a local developer (Schuman Companies) sold a Windsor multi-tenant property at just over $300 per square foot, or $9.8 million. The reported cap rate of 5.5% was paid by the private buyer out of Fort Collins. Major tenant at the building is Limagreen Cereal Seed company. Other Industrial / Flex properties trading included: $8.7 million sale of a warehouse in Lafayette on 120th st., and who’s major tenant is Colorado Timberframe, at a reported 5.65% cap rate. Oakridge Business Park building 3 in Fort Collins traded for an even $7 million, or $184 per square foot. Tenant is NITROcrete. 7755 Miller in Frederick traded at a reported 7.7% cap rate, $148 per square foot, and $6.5 million. Precision Manufacturing has been the long time tenant at the I-25-centric property. Frederick was also the site of an office sale. This $5.4 million trade at a reported 6.5% cap rate went from a local owner to a California investor. The property is known as the Lafarge building, and has many tenants. The sale calculated to approximately $240 psf. Next door neighbor to Frederick is the town of Firestone. It featured the last regional sale over $5 million in July. A 25,000 square foot industrial building there in the Raspberry Business Park sold to an owner-occupant for $5.63 million, $225 per square foot. Buyer is the Asbury Automobile group out of Duluth GA who has been active buying dealerships in the area lately.