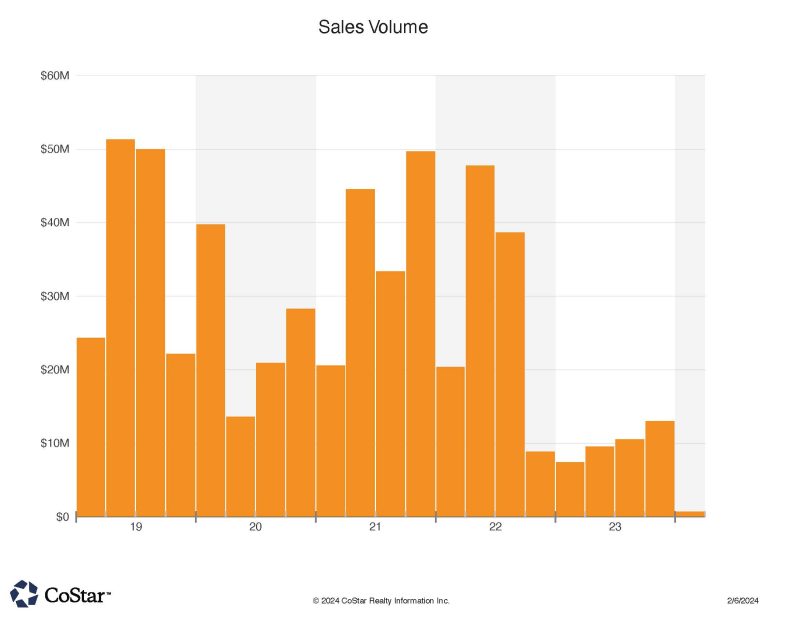

Sales Volume showing modest growth as 2023 ends

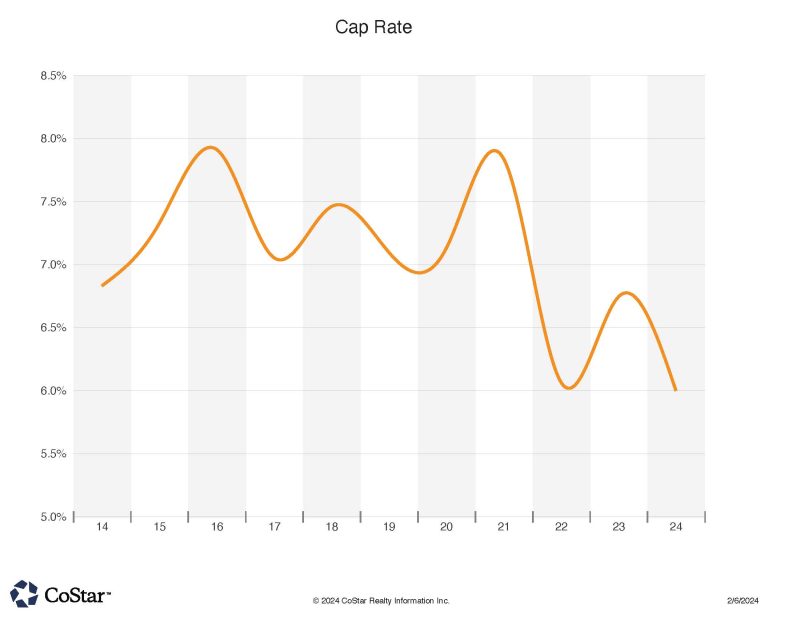

NoCO cap rates have been decreasing

No one city dominated the #NoCOCRE sales trades in the month of January to start the year. Interestingly, many of these sales were for investment purposes. Investors had largely sat on their hands through 2023 due to uncertain interest rate environments. Perhaps these investors feel like interest rates will drop as forecast in 2024 and are ready to get back into the market.

The top sale was a 73,000 SF industrial building in Johnstown, which sold for $12.4 million, or $169 PSF. United Properties sold this property as an investment to a Walnut Creek CA investment group. There are two tenants: Radial Engineering and Superior Pools. Cap rate was not disclosed, but our estimate is that it traded at around a 6% rate.

The next highest trade was also sold for investment value. Walnut Gardens in Boulder traded for $10.8 million, or about $280 PSF. WW Reynolds sold the property to Kroenke Group out of Missouri. Kroenke is well known in CRE circles with ownership of retail centers and has other holdings in the Boulder county market. The center has a myriad of tenants, including the long standing Walnut Cafe restaurant.

A 3.3 outdoor storage lot with an adjoining 38,000 SF industrial building sold for $7.5 million. The two separate (but adjacent) lots are located in an industrial park setting across I-25 in Longmont CO, sold for $7.5 million.

Going up the canyon, the 30 room Wildwood Inn located in Estes Park, sold for $5.4 million. The price “per key” came to about $180,000. Seller had operated the Inn for 33 years prior to the sale.

A 22 acre site at The Ridge in Johnstown, sold to a Build To Rent developer from Scottsdale AZ for about $5 PSF, or $5.22 million. The BTR model has become increasingly popular as an alternative to multi-story multifamily rentals.

Another investment sale featured retail in Windsor CO. In this case, the Fuzzy’s Taco restaurant site sold to a private investor out of Greeley for $4.05 million, or $772 PSF. Reported cap rate was 5.55%.

A 15,400 SF food distribution center (former Schwann’s Fine Foods site), sold for $4 million to a Buyer who intends to occupy the property. The Loveland (Crossroads) property sale calculated to $260 PSF.

Another warehouse sale occured in Greeley, where a 15,000 SF building traded for $2.75 million or $185 PSF on H street. Buyer is an equity group out of California, and the property was sold by the occupant, Schilling Graphics, which is headquartered in Ohio. This sale is another example of a sales-leaseback model to help put capital into the occupants hands for business operations rather than be concentrated in the real estate.

Agfinity co-op bought 12 acres in Eaton for a likely development of their retail and gas service stations. The sale was at $5 PSF, or $2.4 million for commercial land on Collins ave.

The final sale we feature is also an investment sale. The Ent Credit Union property on 10th st. in Greeley traded as an investment for $2.18 million, at a reported 5.5% cap rate. The unique aspect of this sale is that Ent is on a ground lease at that location, so technically the investor is getting land rent from them at the site.