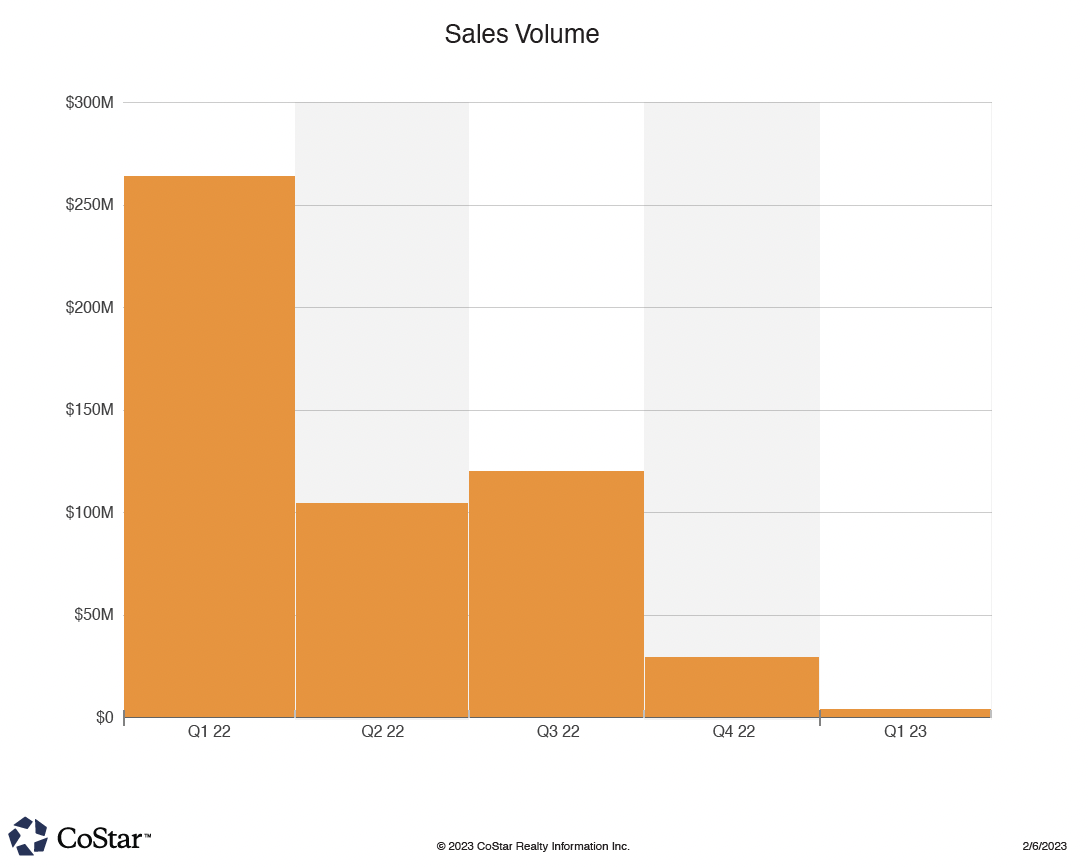

Office sales volume drops quarter to quarter in the NoCO region.

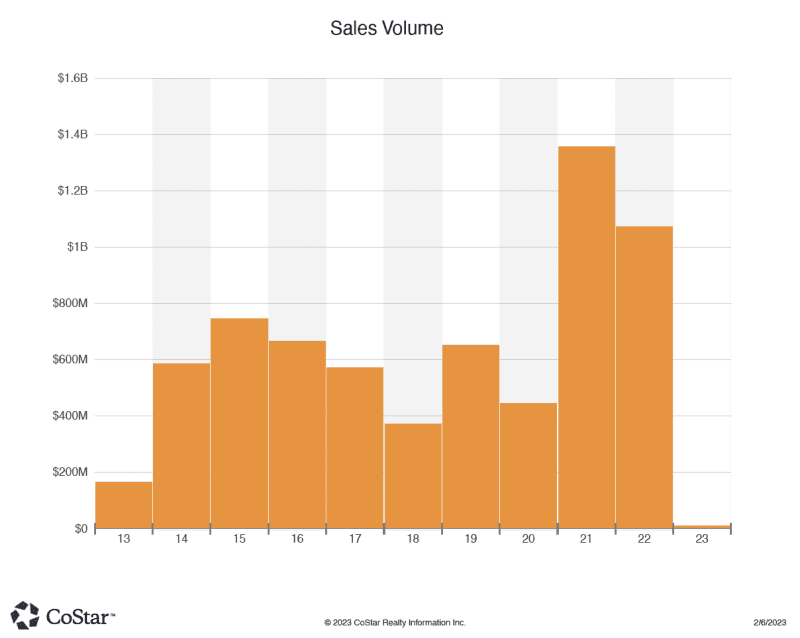

2022 was the highest Multifamily sales volume in NoCO region over the last 10 years.

January was still showing the hangover from the last quarter of 2022 as far as CRE sales stagnation for our region of Boulder, Larimer and Weld counties. Only two deals were in excess of $5 million, (out of the low number of only 47 transactions overall). Some of this inactivity is a market looking for price discovery given the higher interest rates and continuing wariness about recessionary economic forces. For the first time in a while, sale prices were almost 6% lower than ask. We haven’t seen that for a few years in our region.

An Assisted Care facility, the Carillon at Boulder Creek in Boulder led the month’s sales with a $70 million transaction. The seller was Boston based Blue Moon Capital Partners, and Harrison Street Capital of Chicago was the purchaser. The price per square foot calculated to $580. Room rental pricing ranged from approx. $6800 per month for a shared unit, and up to $9000 per month for a private studio. The facility was reported to be 100% occupied at time of sale. This was the only institutional level sale during January in our region. Very different than earlier years.

The 17 room Della Terra Mountain Chalet hotel in Estes Park took the second highest regional sale at $15.1 million, which calculates to a staggering $888,000 per unit price. The luxury boutique hotel and wedding venue sold to a private investor. It is located at the entrance to Rocky Mountain National Park. Seller was located in Estes Park.

An 11 unit apartment at 711 Remington in Fort Collins sold for $3.55 million, or about $323,000 per unit. Housing Catylyst, a Colorado non-profit based in Fort Collins, purchased the property from another Fort Collins private owner. All units were two-bedroom. A 10 unit apartment in Boulder on 9th st. sold for $3 million, or $300,000 per unit. Seller was a private party from Lafayette CA, and Buyer is a private party from Denver.

The Big Lots store (former) in Fort Collins sold as part of a 20 store national portfolio sale of the retailer. Big Lots from Columbus Ohio sold to Red Mountain Retail Group out of Santa Anna CA for $47.5 million for the entire portfolio. Allocated, this comes to $2.39 million or $79 per square foot for the former medium box store.

A single tenant Napa Auto Parts store in Louisville sold for $2.2 million, or $191 per square foot. Cap rate is reported to be 5.49%. Buyer is a private investor from Longmont, and Seller was from Fort Collins, also a private individual. The sale underscores the continued demand from private investors for investment property offerings with triple net leases in good locations. The property was on the market for only 34 days prior to sale.

Weld county had two deals over $2 million. A 1967 built metal warehouse on 1st Ave., which is 16,450 SF , sold for $131 per square foot, or $2.15 million. An engineering firm occupied the property. Both Seller and Buyer are private individuals and local residents. In neighboring Evans CO, an 18 unit apartment building sold for $2.1 million, or $116,667 per unit. Reported cap rate was 5%. This time, Seller was from Laguna Beach, California, and Buyer is out of Aurora CO. Both private individuals. 15 units are two bedroom, and 3 are one bedroom units.