Download .pdf version

Contact our advisors to see how they can help you with your property

Northern Colorado:

970.207.0700

2032 Lowe St. Suite 101

Fort Collins, CO 80525

Denver Metro

303.632.8784

414 14th St. Suite 100

Denver, CO 80202

Contact our advisors to see how they can help you with your property

Northern Colorado:

970.207.0700

2032 Lowe St. Suite 101

Fort Collins, CO 80525

Denver Metro

303.632.8784

414 14th St. Suite 100

Denver, CO 80202

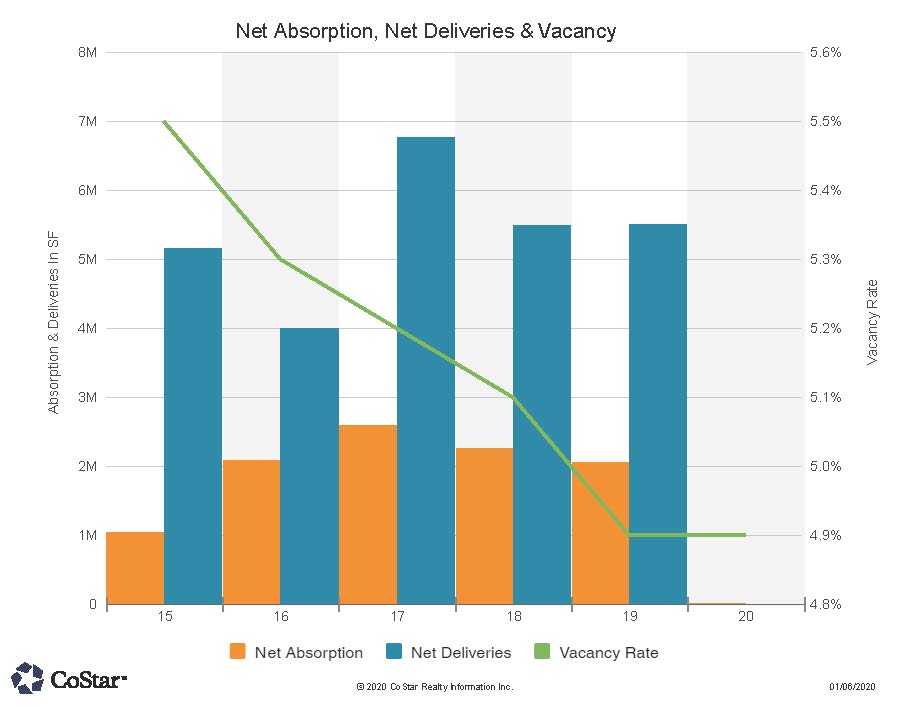

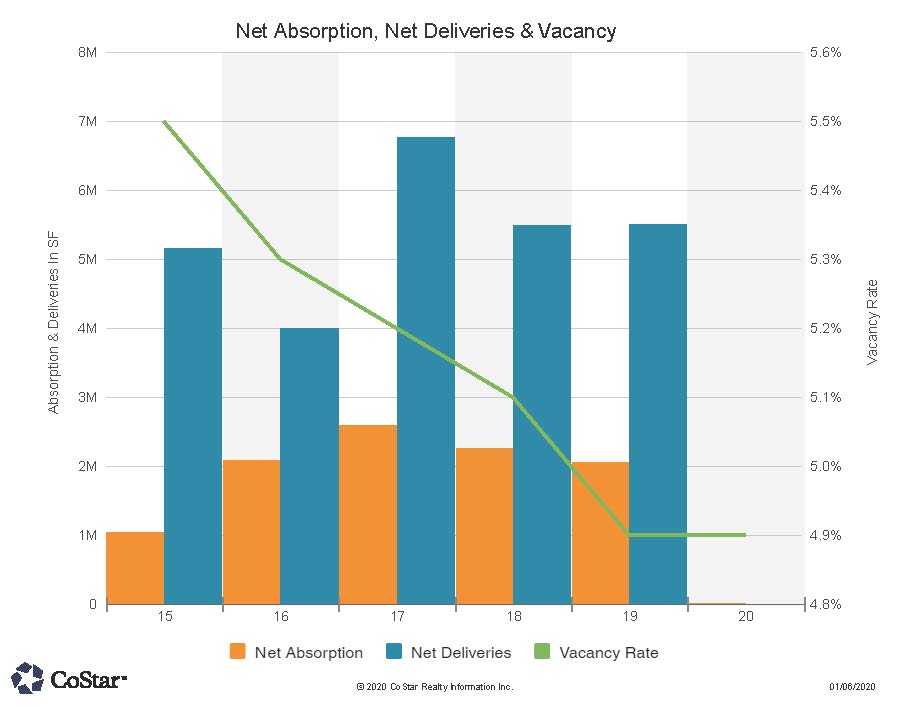

Market Not Overbuilt

Despite delivering over 5 million square feet a year on average to the tri-county market over the past 5 years, vacancy rates fell about 50 basis points (5.5% down to 5%).

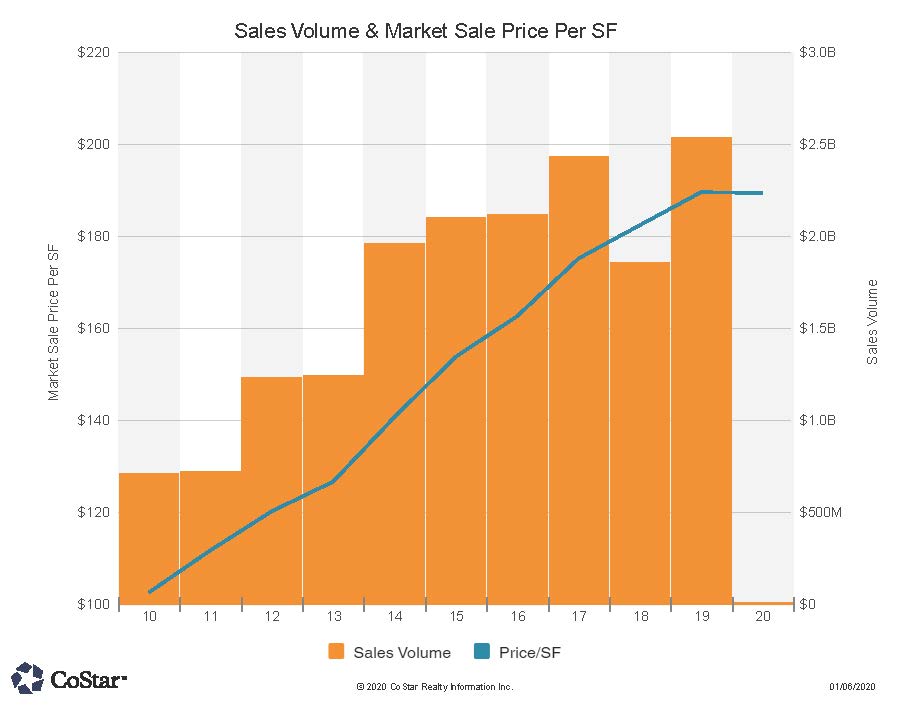

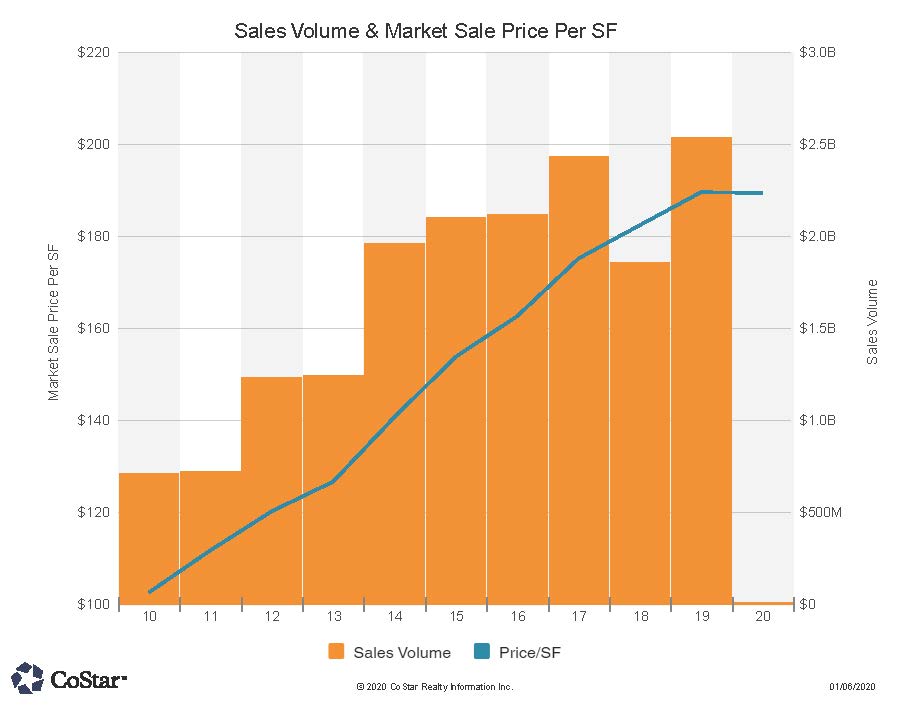

Record CRE Sales Volume for Region

For the first time, Boulder, Larimer and Weld county commercial real estate annual sales topped $2.5 billion. Contact our advisors to see how they can help you with your property

Northern Colorado:

970.207.0700

2032 Lowe St. Suite 101

Fort Collins, CO 80525

Denver Metro

303.632.8784

414 14th St. Suite 100

Denver, CO 80202

Contact our advisors to see how they can help you with your property

Northern Colorado:

970.207.0700

2032 Lowe St. Suite 101

Fort Collins, CO 80525

Denver Metro

303.632.8784

414 14th St. Suite 100

Denver, CO 80202

Not surprisingly, December was a month of larger institutional grade sales as investment managers finalized their 2019 asset management plans.

The largest sale, also not surprising, was a multi-family complex. Country Club Gardens in Greeley sold for $52.8 million. The complex has 288 units, so the per unit price was about $187,000.00 each. Inland Capital sold the property to Peak Capital out of Provo, Utah. Inland’s press release said they had completed a “full cycle transaction”, and they had held the property for four years and brought their investors a 155% total return over that time frame.

Clarion Partners out of New York purchased the 59 unit apartment building at 2121 Canyon in Boulder for $17.2 million from local developer Element Properties. Boulder being Boulder from a price perspective, this calculates to about $291,000.00 per unit. Another Boulder multi-family property, Goss 22, sold for $6.8 million, or $271,000.00 per unit. In this case, the Buyer was from Colorado for the 25 unit building.

Bryman Manufactured Home Park in Loveland sold at a reported 4% cap rate for $12 million to Prudential Financial out of Newark, New Jersey. This facility had 108 units and sold for about $111,000 per unit.

STAG Industrial out of Boston, MA purchased a distribution warehouse in Johnstown for almost $16 million. This 131,000 SF warehouse sold at $122 PSF. Sellers were out of Minneapolis, MN. US Autoforce is the tenant in the newly built property.

Carlson Land Development sold a 585 acre residential land parcel to Front Range Development in Denver. High Point in Mead, CO sold for about $14 million, or 32 cents per square foot, as undeveloped raw land.

On the other end of the land pricing spectrum, the Boulder City Housing Division sold a redevelopment parcel on 30th and Pearl street for $5.5 million for the 5.63 acres. This works out to almost $22 per square foot for dirt value. The project anticipated will need to incorporate affordable housing components. The Buyer (Morgan Creek Ventures) in this case already has a presence in the Boulder market and is adding to their portfolio of projects.

The largest retail deal was a $4.66 million sale of a Bonefish Grill restaurant in Johnstown. A Loveland, CO entity bought the property. Price per square foot worked out to about $821.

In all, almost 150 properties traded, or went under contract, during the month of December. 2019 went out with a bang!