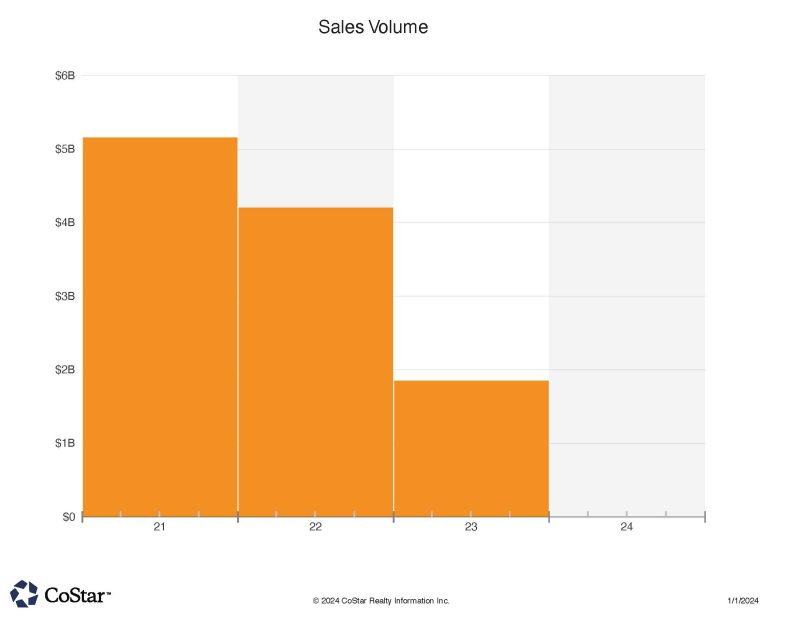

2023 NoCOCRE sales pale in comparison with two previous years

85% of 2023 NoCOCRE sales were under $3 million

With another mild transaction month, private investors dominated the higher end sales in our tri-county (Larimer, Weld and Boulder) region. December in NoCO featured only 62 sales transactions which is well below previous years activities. The vast majority of these deals were under $3 million, which is where private investors and owner-occupants usually land in.

The largest deal was an auto dealership trade, where the Longmont CO GMC dealer sold to a Florida automotive group for $8.7 million. King Automotive on Vista View street, sold at almost $290 PSF for the real estate (prox. 30,000 SF of building on a 6.4 acre lot).

The second largest deal was the sale of a land parcel in Longmont. This lot at 75th and Nelson road sold for $38 PSF on the 2.44 acre site. The lot is near the Clover Basin Business center and the West Grange housing development. Future use is not yet known.

The Kum ‘n Go service station in Loveland onClydesdale Parkway was sold as an investment to a Nebraska group for $4 million. This price calculates to just over $700 PSF and is bolstered by a long term lease to Kum ‘n Go. Loveland was also the location for an investment sale of an industrial condominium on 67th ave., which sold to a Wisconsin investor for $3.8 million. The condo is 23,358 SF, and the price was calculated at just over $160 PSF. A Beverly Hills CA investor bought the Spring Country Day School in Fort Collins for $2.94 million, or $236 PSF. Same Buyer and Seller also traded the Children’s Workshop daycare facility in Loveland for $2.39 million, or $242 PSF. Day Care properties are in high demand for both operators and investors as the economics for the pre-school operators has been improving recently.

Three other investment sales of note during December included the $2.5 million sale of 10,450 SF office building at 501 Main in Windsor CO. Buyer was an occupant at the property, and paid $234 PSF for the property. A 9,800 SF warehouse in Frederick sold for $2.34 million to a Denver investor. In this case, the flex/industrial property was sold under a Sale-Leaseback arrangement providing the Buyer a reported 7.5% capitalization rate on the investment. Occupant (former owner) is an engineering firm which signed a lease for 5 years. The site also has a highly desirable storage yard, which is a popular asset in NoCO industrial business. Finally, Greely featured a $1.53 million eight-plex multifamily property sale at a reported 5.5% “cap” rate. The buyer was an investor out of Aurora CO in this case. The price calculates to about $190,000 per unit.

An interesting sale occured at the Loveland/Fort Collins airport, where a hangar sold for $1.15 million. The 4,650 SF property was actually sold as a ground lease, but the price calculates to about $250 PSF if allocated to the building itself. The improvement was constructed in 2022 and included gate access directly to the airport.

We will all look forward to a (more) active 2024 for NoCOCRE. Hope all readers have a great year ahead!