$1 million was the sweet spot for December Sales, as private parties remained active and national investors took an early holiday in NoCO

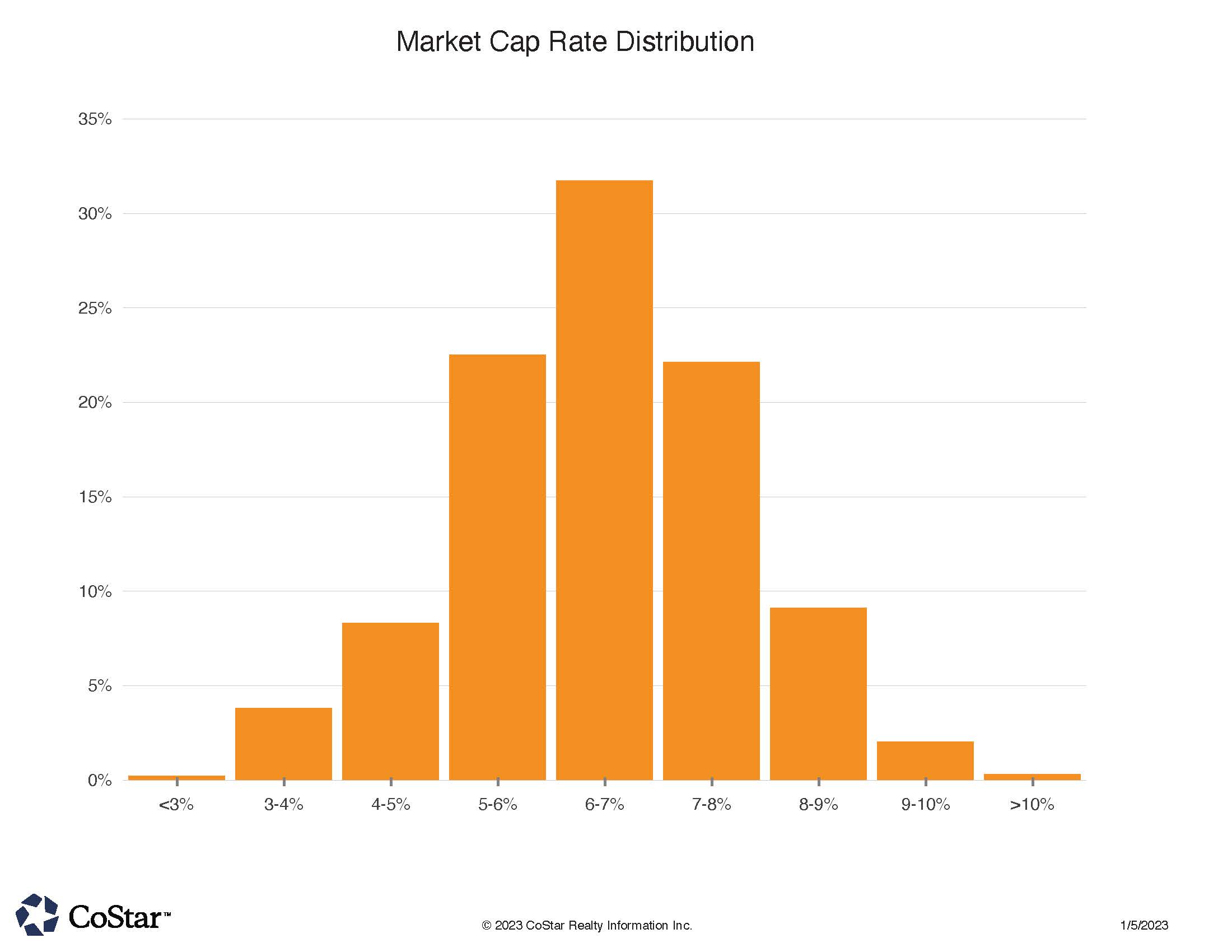

The typical cap rate transaction last year in our region was between 6 to 7%. Institutional-grade properties sold in a lower range, while smaller and localized properties sold higher.

2022 ended in our region with typical deals that marked the three counties covered (Larimer, Boulder & Weld) in NoCO CRE activity. Car dealerships, multifamily, development land and industrial properties transacted regularly in 2022, and December mirrored this trend.

The largest single property deal was the sale of longtime local auto dealer McCaddon Caddilac, Buick, GMC to Michael Maroone dealerships out of Florida. Many of our regions dealerships have been absorbed by national and regional dealerships entering Colorado. The Boulder dealership sold for $16.3 million, or almopst $600 per square foot. Zoning and other regulatory, timing, and economic matters, make opening new vehicle sales operations difficult in Northern Colorado, so the more viable option is to acquire an existing dealership.

In a two property deal, Greystar ( a national operator of multifamily properties out of Charleston, South Carolina) sold the Pura Vida and Carriage House apartment complexes in Fort Collins to Sausalito CA based Shore to Shore Properties, for $13.8 million and $13 million respectively. In total, the student oriented apartments sold for about $138,000 per bed as calculated over the 194 beds in total between the two properties. Student based apartments have been traded actively in our three university region this year.

Land sales have also been dominant in our growing area, and the former Butterball turkey plant land site in Longmont was the site for a 11.79 acre $12 million sale this last month. The pricing worked out to $23 per square foot for the Main st. Longmont property. Houston based Dinerstein Companies purchased the land from San Diego based Pathfinder Properties. This Main and 1st street location is partly redeveloped now, and these lots will fill in the gaps for remaining development.

Longmont was also the city for the next larger sale. In this case, a 64,000 SF manufacturing facility was sold for $6.66 million to Denver Developer Flywheel Capital. The 5.34 acre site could potentially be redeveloped into other residential and commercial uses, and is well located near Ken Pratt Blvd. and the Diagonal Highway (CO 119) on the southern side of town. Animal health industry player Huvepharma occupies the property and sold it to Flywheel at approximately $104 PSF. Medical investment property has been another hot property type for our region as has industrial property, as has land suitable for redevelopment. All factors likely played into this purchase.

Longmont and the I-25 corridor of that city was the location again for an industrial investment sale. A Denver group purchased the Wood Group property on Camelot Dr. east of I-25 for $6 million, or $193 PSF. Texas based Wood Group, involved in the energy industry, had owned and now occupies the 31,000 SF facility in the I-25 Business Park, likely making it an attractive investment for Denver based Good Investment Partners.

Finally, in the hot industrial category again, a CO seller sold another I-25 corridor property to a CO buyer. In this case, a property in the Gateway Industrial Park in Johnstown, was sold for $4.85 million, $195 PSF for the approximately 25,000 SF property occupied by tenant General Electric. Industrial properties with credit-tenants such as General Electric, are in high demand for investors in our region.