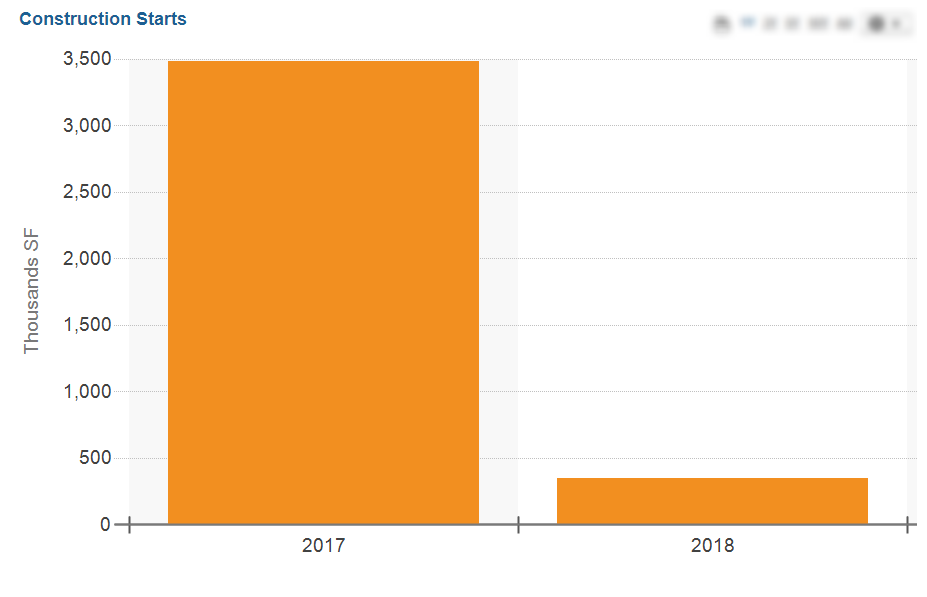

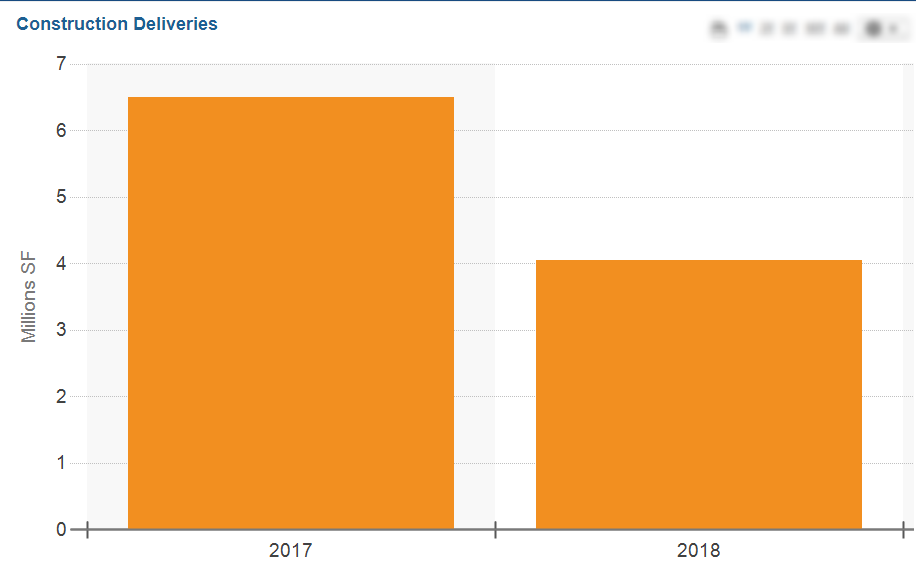

2018 is shaping up to be rather sleepy in terms of new construction compared to the pace in 2017. While over 6 million square feet of new building space has been delivered to the market over the last twelve months, that pace is sure to slow down as construction starts slowed considerably in 2018 thus far. 6 million square feet represents slightly higher than 2% of the total inventory in Boulder, Larimer and Weld counties.

2018 is shaping up to be rather sleepy in terms of new construction compared to the pace in 2017. While over 6 million square feet of new building space has been delivered to the market over the last twelve months, that pace is sure to slow down as construction starts slowed considerably in 2018 thus far. 6 million square feet represents slightly higher than 2% of the total inventory in Boulder, Larimer and Weld counties.

Meanwhile, investors still were active in the market with existing buildings. A contrast in age and location shows the broad based investor interest in the region. Case in point was the highlight sale of the month. The Boulder-located Wonderland Creek Townhome project sold for $21 million, or about $512,000 per unit. It was just one year past its delivery date. On the other end of the spectrum, the 59 unit University Tower apartment property in Greeley sold for just $84,000 per unit. University Tower is 44 years old. The Wonderland Creek Townhome buyer was an equity group out of San Francisco, while the University Tower buyer was from Denver.

A specialty building, WashWorx, in Fort Collins, sold for $5.6 mil which calculated to over $1,300 PSF. This 3 year old property sold to a local Fort Collins buyer.

The Harmony Commons two building retail center in Fort Collins sold for $13.1 million, at a reported 6.9% cap rate, to a Denver based buyer. This property was on a few years old and features multiple restaurant tenants.

Top leasing activity came from Evans CO, where an industrial property on 31st St. had a 25,600 SF lease signed. Boulder then came in with the next largest lease as an office tenant took 18,000 SF at 3107 Iris Ave. Loveland grabbed the third largest lease in October as an industrial tenant took 15,000 SF in the airpark center near I-25. The HighPointe office in Boulder featured a 12,000 SF office lease to round out the top leases in the region. The industrial properties were asking $10 PSF plus triple net expenses, while the office buildings were asking $26 and $18 PSF triple net respectively.

As deliveries slow, one might anticipate space to remain tight in the tri-county region.