New Construction NoCO

Construction starts in NoCO for last two years is below that of 2014-2019

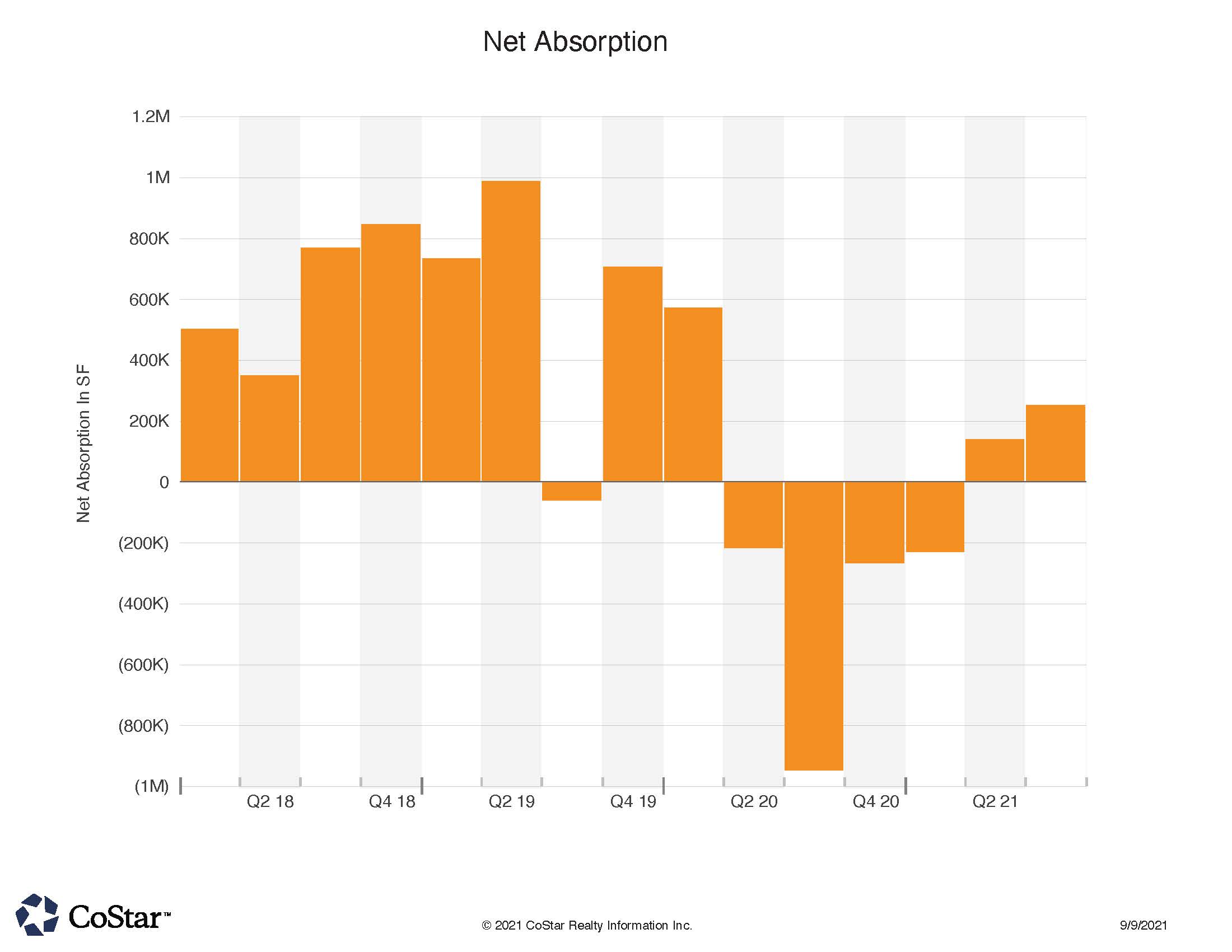

NoCO 3 Year Absorption

NoCO region starting to shake off the 2020 Covid era absorption losses

With almost 50 transactions of over $1 million during the month of August, NoCO CRE was as hot and smoky as the summer weather last month.

Unsurprisingly, multi-family trades represented 3 of the top 5 deals. 218 unit The Preserve at the Meadows in Fort Collins led the way as Inland sold to Chicago based JLL Income Property Trust at almost $300,000 per unit, and a total price of almost $65 million. The reported 3.86% cap rate shows the appetite for investors for NoCO institutional grade multi-family complexes. The Buyer even paid an approximate $4 million pre-payment penalty on the previous existing loan as part of the transaction.

Other regional multi-family sales include an $18 million sale of Gallery Flats in downtown Loveland. This 66 unit urban-style property sold for a reported Loveland record of $273,000 per door to private investors out of Tempe AZ.

Mountain View MHC in Longmont traded for $11 million to an Irvine California investment group. Seller was a private investor in Colorado. The 88 space community is a 55+ manufactured home community. The reported cap rate was 3.4% on this transaction.

Regional developer McWhinney Company sold the Constant Contact office building in Loveland to a Castle Rock Colorado investment group for $12 million. Constant Contact has been the sole tenant in the 50,000 square foot property since original 2009 construction. The sales price calculates to $240 per square foot.

Rounding out the top five sales was a $10.7 million land sale to QuickTrip, a fast growing midwestern gas and convenience center. The Tulsa based firm bought the 80 acre parcel in Mead and intends to develop the land for its own use, and then sell off the remainder. The site is close to Highway 66 and I-25. Price per square foot for the parcel calculates to $3 per square foot.

In the top 10 of August sales were two industrial building sales. A 63,000 multi-tenant property on Diamond Valley Drive in Windsor CO sold at a reported 7% cap rate to a Loveland private investor for $130 per square foot. The building tenants include Bold Renewables and Vestas Wind Energy. A 39,000 SF industrial facility in Louisville sold at $139 per square foot to a Littleton CO private investor. Tenants in this $5.5 million sale include Technology Integration and Third street Inc. Cap rate was not disclosed.

Two retail trades of note included a Loveland Walgreens on Eisenhower St., that traded at a reported 5.1% cap rate. This “Triple Net Investment” property sold to a San Diego CA investment group for $7.6 million, $514 per square foot (14,800 SF overall), and had 13 years remaining on it’s lease. The second sale, also on Eisenhower but unrelated, featured the 23,300 SF Office Max Plaza property. The $4.5 million sale calculates to $193 PSF, Planet Fitness now occupies the property. Buyer was a local Loveland based real estate group.